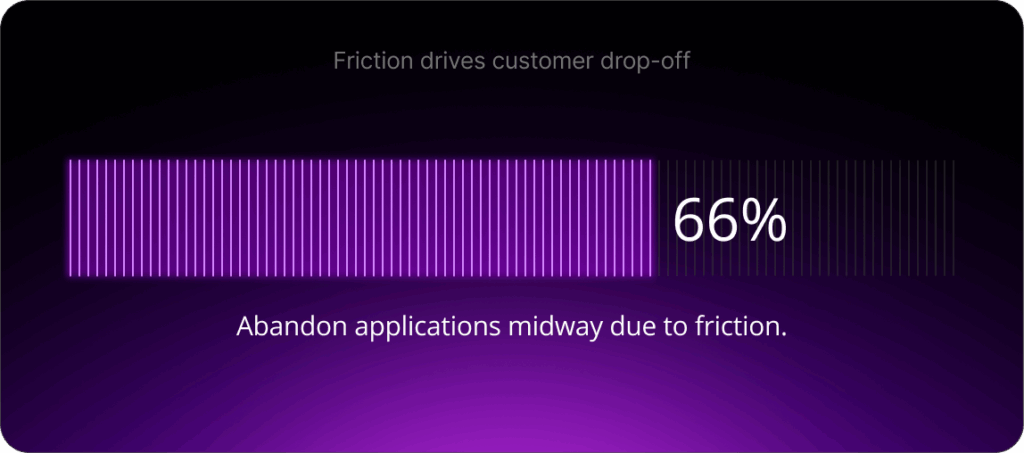

The modern banking customer expects seamless, intuitive interactions every time they engage with their bank. Yet for most traditional banks, these interactions are slow, fragmented and frustrating. Two-thirds of consumers abandon applications midway, reflecting the high cost of friction not just for customers, but for banks in lost revenue and missed opportunities. Legacy systems, manual Know Your Customer (KYC) checks, disconnected workflows and siloed business units exacerbate the problem, forcing redundant requests for customer information, repeated integrations and inefficient processes across accounts, loans, cards and bundled products. Coupled with tightening regulations like the EU Anti-Money Laundering (AML) Package and evolving AML/KYC compliance frameworks across Africa, banks face a stark choice: move fast and risk non-compliance, or move slowly and lose customers to digital-first competitors.

There is, however, a solution that transforms these challenges into a platform-driven growth engine. Origination-as-Engagement unifies onboarding, origination and KYC compliance into a continuous, data-driven journey, turning every customer interaction into an opportunity.

The fragmented origination lifecycle and its costs

Historically, the origination lifecycle, whenever a customer applies for a new product or modifies an existing relationship, has operated as a series of disconnected, one-off transactions. Each interaction often forces customers to resubmit documents, repeat verification steps and navigate multiple systems, even when the bank already holds most of the necessary information.

This dysfunction arises from several structural issues. Banks’ legacy systems often do not communicate across departments, creating silos that prevent a unified view of the customer. Business units maintain separate integrations for onboarding, loans, cards and bundled products, multiplying complexity and maintenance costs. And manual KYC reviews and periodic verification processes further slow approvals.

The operational consequences are substantial. Fragmented workflows lead to slower decision-making, higher costs and repeated touchpoints that frustrate customers and reduce satisfaction. They also hinder growth: product launches are delayed, cross-selling opportunities are missed, conversions drop, and retention suffers. In fact, banks commonly allocate 10–15% of their full-time staff to KYC and AML compliance, tying up capacity that could otherwise drive product innovation and growth.

By breaking down the silos and addressing these root causes, banks can begin to consolidate the origination lifecycle into a seamless, continuous journey that supports efficiency, compliance and growth.

Unlocking growth through a unified platform

Origination-as-Engagement tackles the inefficiencies of the fragmented origination lifecycle by consolidating onboarding, product origination and KYC into a single, continuous platform. This unified approach transforms every customer interaction into a seamless, data-driven journey that pushes growth.

Centralizing data and workflows allows banks to deliver faster, frictionless experiences at all touchpoints, reducing application abandonment and boosting customer satisfaction. Streamlined interactions also open opportunities to expand relationships: when onboarding and origination are efficient, banks can more easily offer additional products and services, increasing wallet share and lifetime value.

A unified platform also makes it possible to embed compliance and risk management directly into the workflow. By centralizing customer and transaction data, the platform can automatically apply event-driven risk checks, enforce regulatory requirements consistently and eliminate duplicated effort across business units. Traditional, disconnected systems, on the other hand, rely on manual handoffs and repeated integrations, making regulatory adherence slower and more error-prone.

pKYC and Smart Friction

At the heart of Origination-as-Engagement are two concepts that make this seamless, continuous journey possible: Perpetual KYC (pKYC) and Smart Friction. Together, they ensure that banks maintain compliance without slowing down customer interactions.

pKYC moves away from traditional, periodic reviews of customer information, instead verifying identity every one to three years, or only when a customer initiates a change. As a result, banks continuously update and validate customer data based on events or risk signals. This means that when a customer applies for a new product or updates their account, the bank already has an up-to-date, verified view, eliminating unnecessary rework and reducing friction.

Smart Friction complements pKYC by introducing checks only when risk actually changes. For example, if a customer updates their address in the same city, the process may require minimal verification. But if they move to a high-risk jurisdiction or attempt a significant financial transaction, the system automatically triggers additional checks. This approach ensures that compliance is targeted and proportionate, while most customers experience a fast, near-instant interaction.

Both pKYC and Smart Friction are powered by real-time data and automation, which allows banks to act immediately on changes, mitigate risk and reduce operational burdens. By continuously analyzing customer information and transaction patterns, banks can maintain regulatory compliance dynamically, rather than relying on periodic, manual reviews. The result is a fluid origination experience: faster approvals, fewer abandoned applications and a smoother journey across all customer touchpoints, without compromising on risk management or compliance. Equally important, it gives banks the agility to deepen customer engagement, launch new products faster and sustain relationships at scale.

Challenges in transformation and how to overcome them

While the promise of Origination-as-Engagement is clear, implementing it requires careful navigation. Traditional banks face multiple structural, operational and cultural hurdles that can slow progress or dilute impact if not addressed from the outset. Recognizing the most common pitfalls helps organizations avoid costly missteps and focus on delivering value quickly.

- Too many point solutions. Relying on multiple disconnected systems for onboarding, origination and compliance creates not just integration headaches, but also data silos, inconsistent customer experiences and duplicated work for staff. In many cases, the same vendor is integrated multiple times across business units, multiplying cost and complexity.

- Overly ambitious transformations. Attempting to redesign every process at once can overwhelm teams and lead to project fatigue. Without a clear roadmap, resources may be spread too thin, resulting in stalled implementations, missed deadlines and difficulty demonstrating early, measurable value.

- Treating compliance as a blocker. Viewing regulatory requirements as hurdles rather than embedding them into the platform from the outset can slow adoption and introduce operational risk. It can also lead to workarounds that compromise auditability and leave the organization exposed to fines or reputational damage.

Banks can navigate these challenges through a phased, practical approach. By starting with high-impact workflows, they can achieve rapid wins, test solutions and iterate before scaling across the organization. Agile methodologies, supported by no-code or low-code tools, make adaptation faster and reduce implementation risk. At the same time, embedding governance, auditability and explainable AI into the platform ensures that compliance is integrated from the start rather than tacked on later.

By avoiding these common pitfalls and combining technology with disciplined process and cultural change, banks can transform friction-filled interactions into seamless, compliant and value-generating experiences. A unified platform for origination, onboarding and compliance breaks down silos, eliminates redundant integrations and frees teams to focus on growth and customer engagement.

Scaling growth and compliance across the customer lifecycle

The future of banking belongs to institutions that can seamlessly integrate speed, customer-centricity and regulatory compliance into every interaction. A unified Origination-as-Engagement platform enables banks to continuously deepen relationships across the customer lifecycle.

By consolidating onboarding, origination and compliance into a single, agile platform, banks can reduce friction, accelerate product launches and offer additional products and services with ease. Real-time data, automation and event-driven pKYC ensure that each interaction is both compliant and efficient, turning regulatory obligations into competitive advantages rather than obstacles.

For banks seeking measurable outcomes, this approach delivers faster approvals, increased cross-selling, higher retention and reduced operational costs. By partnering with an experienced provider such as SBS, institutions can implement a platform that transforms every customer interaction into an opportunity for growth, efficiency and compliance. Get in contact with a member of our team today, and set the standard for the next generation of digital banking.