Unlock the open banking ecosystem to go beyond compliance

SBS Open Banking Platform is a modular, cloud-native SaaS foundation that brings together compliance, integration, and monetization. Our platform lets you meet evolving PSD2/PSD3 mandates, expose and monetize APIs, and embed value-adding use cases while delivering innovation on top of any core banking system.

Harness open finance and embrace the platform economy

The SBS Open Banking Platform processes billions of secure API calls across embedded, open, and platform banking use cases. It delivers enterprise-grade scale, reduces cost, accelerates partner onboarding, and turns compliance investments into genuine customer and employee benefits.

Ready-to-use integrations

Connect your gateways or use ours. Leverage fintech partners, low-code tools, and a robust middleware for faster time-to-market.

Countries, global reach

Leverage our international footprint to unlock growth opportunities and empower your bank to scale across diverse markets.

3rd party providers onboarded

Empower collaboration with trusted partners, delivering innovative and reliable financial services across multiple markets.

API calls executed

Ensure scalability and high performance with reliable, seamless integration for large-scale, API-driven open ecosystems.

Benefits

Unleash the full power of open banking

Drive innovation with security & seamless integration

Accelerate digital transformation with an intuitive developer experience, pre-built open banking APIs, and low-code orchestration. Powered by 75+ connectors and Zero Trust security, our platform simplifies integration, reduces complexity, and enables scalable innovation across your ecosystem.

Fast, frictionless Integration

200+ low-code/no-code connectors and adapters streamline integration with core systems and fintechs, speeding delivery and reducing technical debt.

Scalable, monetizable API marketplace

A secure API marketplace that boosts adoption and monetization, improves experiences, and enables partner autonomy through self-onboarding.

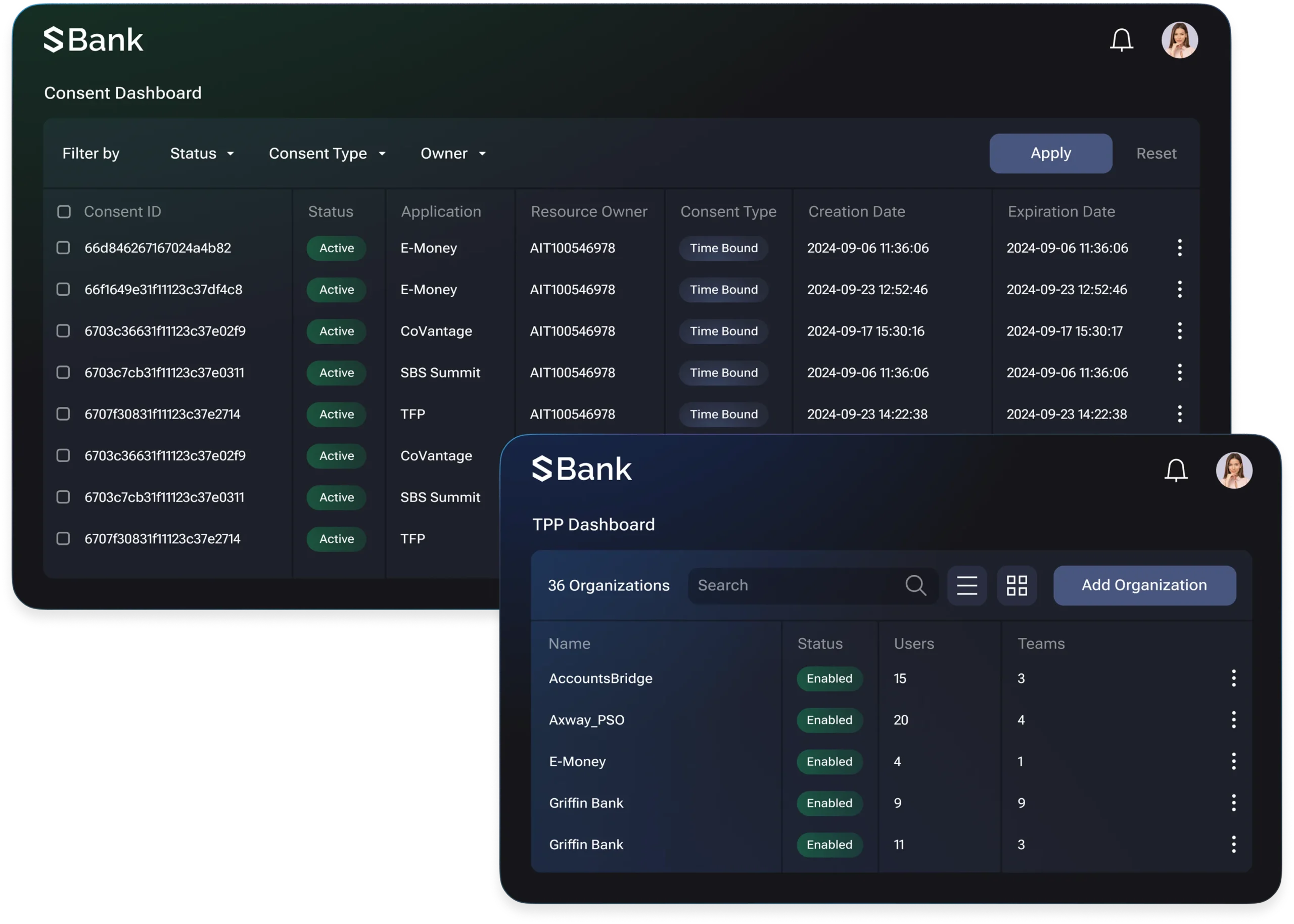

Enterprise-grade security & consent

Built-in identity, consent, and Zero Trust security (mTLS, OAuth 2.0, RBAC) ensure PSD3 readiness and secure, auditable service interactions.

Compliance by design

Stay ahead of regulations with built-in support for PSD2, PSD3, and PSR. Empower developers with documentation, reviews, and ratings to boost API adoption.

Solutions that power unmatched next-gen open banking

Combine compliance, digital wallets, embedded finance, and API monetization in one platform with our open banking accelerators, delivering secure, high-value experiences.

Compliance

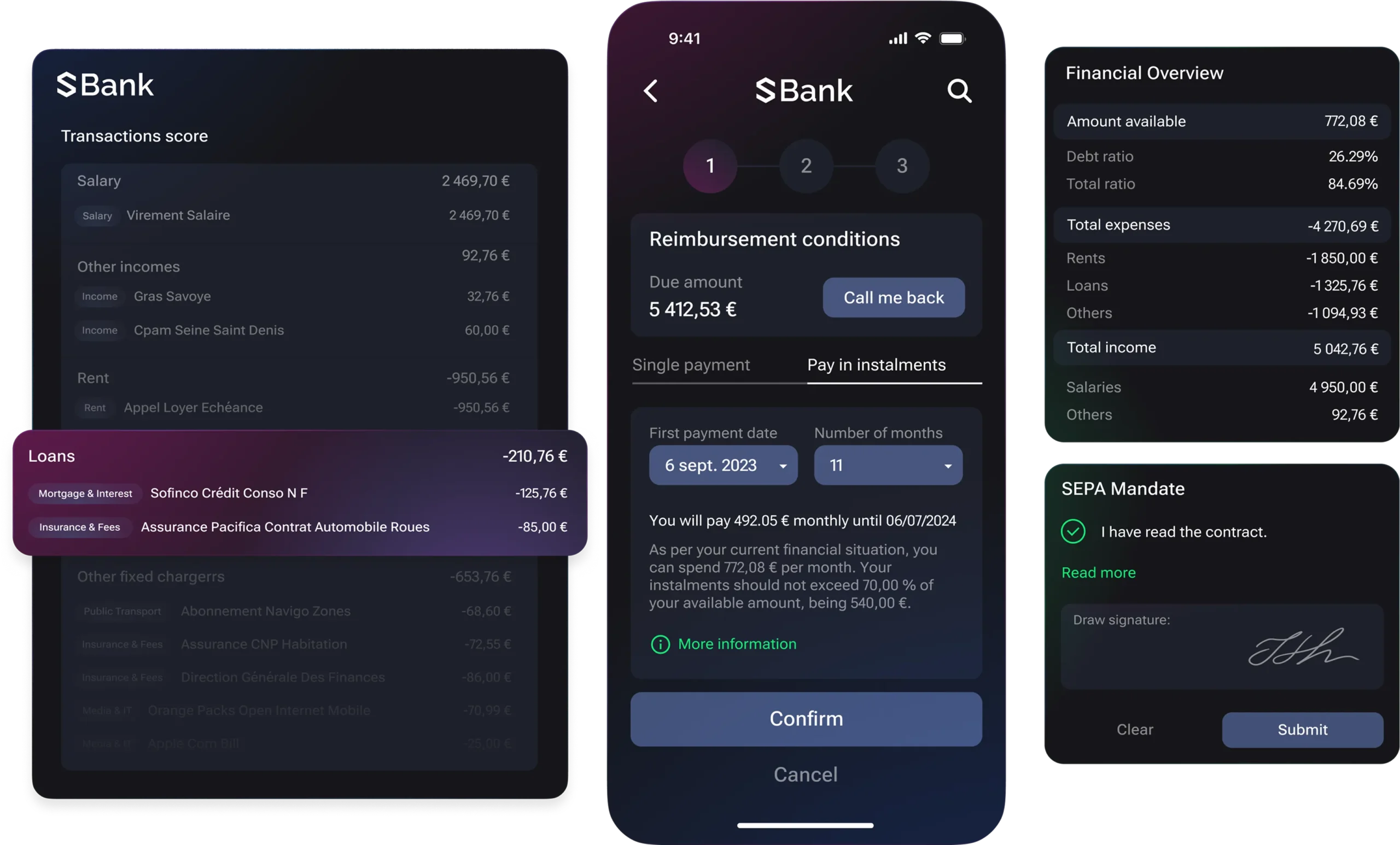

Embedded finance

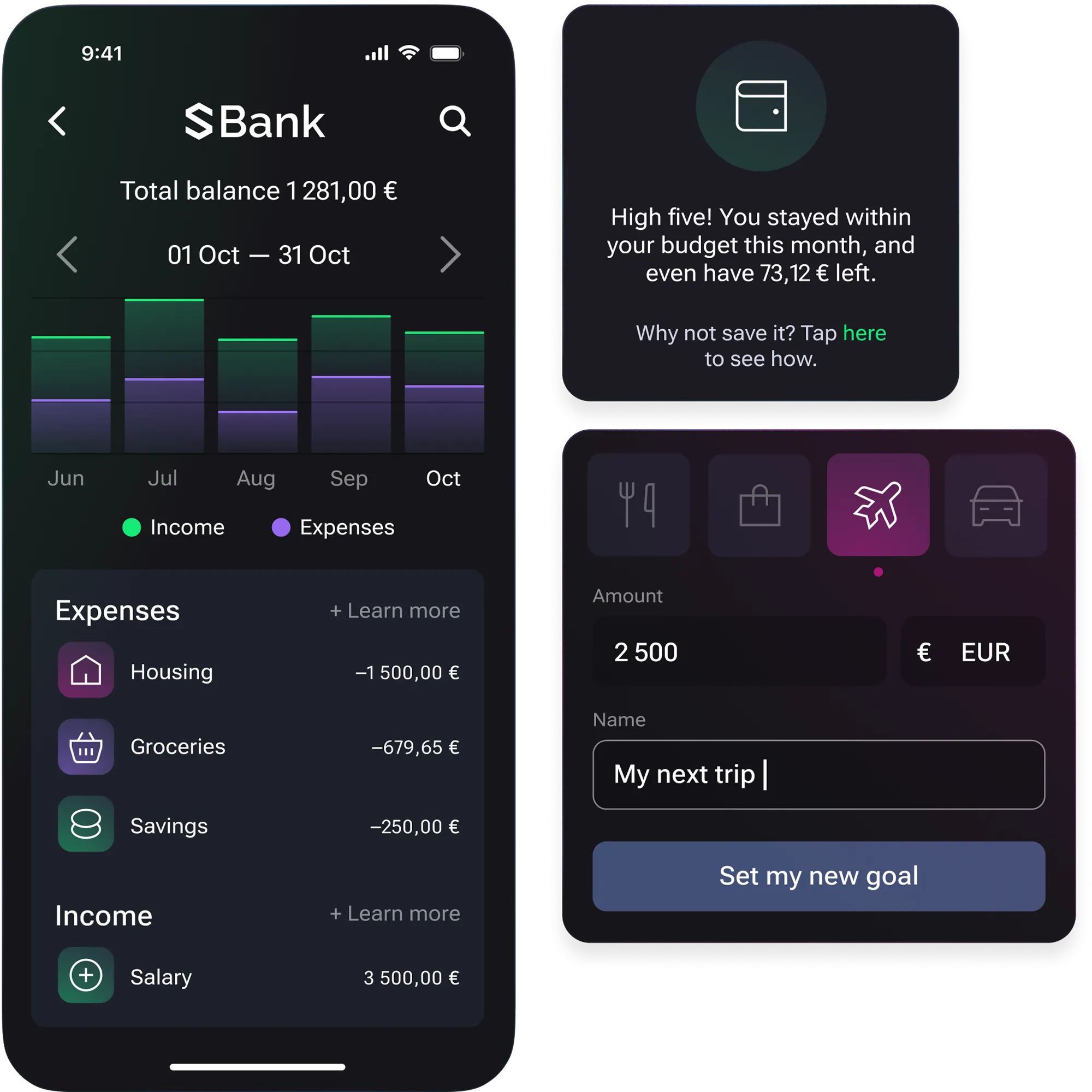

Platform banking

Effortless, continuous compliance

Empower financial institutions with secure open banking APIs for continuous compliance. Seamlessly onboard & share data with TPPs/partners, reduce regulatory risk, and deploy PSD2 evolution APIs with our cost-effective, future-proof SaaS platform.

Expand reach with embedded Finance-as-a-Service

Expose modular banking products via usage-based APIs so fintechs and merchants can embed your services seamlessly. Connect legacy systems to a branded portal with self-service onboarding, subscription models, and real-time analytics.

Expand your role in the platform economy

Expand your offering with fintech partnerships and exceptional UX, just like a Neo bank. Tap into the platform economy and growing the role that your banking app plays in your customers’ everyday financial lives.

Technology

Elevate your financial institution with cutting-edge open banking

Innovative open banking solutions for future-ready finance

Explore

Other products

FAQs

Find answers to our most commonly asked questions about SBS Open Banking.

How does SBS Open Banking Platform ensure compliance with the latest 2026 regulations? + –

SBS Open Banking is continuously updated to support PSD2 compliance and align with Berlin Group NextGenPSD2 standards, while preparing banks for PSD3 and PSR as requirements evolve. It includes secure API management, consent and permission dashboards, Verification of Payee (VoP), and advanced fraud-prevention controls.

What makes SBS Open Banking Platform different from competitors? + –

We offer a comprehensive solution with 75+ ready-to-use integrations and a proven track record of 1B+ API calls executed across 80 countries. Combined with strong API governance and a developer portal/sandbox, banks can meet PSD2 requirements and prepare for PSD3 and PSR.

How quickly can SBS implement the platform? + –

With 200+ low-code/no-code connectors and prebuilt APIs, implementation is significantly faster than traditional approaches. This helps in reducing time-to-market by 60–70%. A developer portal and sandbox streamline onboarding, testing, and certification.

What is PSD3? How does it differ from PSD2? + –

PSD3 is the EU’s Third Payment Services Directive, proposed alongside the Payment Services Regulation (PSR) to update and replace PSD2 and modernise the EU payments rulebook. Compared with PSD2, the PSD3 and PSR package strengthens fraud prevention and consumer protection, including wider use of Verification of Payee (IBAN and name checks) and clearer reimbursement and liability rules for certain fraud scenarios.

It also upgrades open banking rules by requiring clearer user control over permissions (including a permission dashboard to view and withdraw access), removing common obstacles for third party providers, and setting stronger expectations for interface performance and continuity.

How does PSD3 improve consumer protection and reduce payment fraud? + –

PSD3 strengthens consumer protection and reduces payment fraud by making Verification of Payee mandatory for credit transfers, so payers are alerted when the payee name and the account identifier do not match and, under the political agreement, the payment must be refused in case of a mismatch. If a payment service provider fails to apply required fraud prevention measures, it can be liable for customer losses, strengthening reimbursement outcomes in specific scenarios. PSD3 also improves transparency by requiring statements to include information that clearly identifies the payee, helping users recognise payments and spot suspicious activity faster.

What does PSD3 require regarding operational resilience? + –

PSD3 increases expectations for reliability, monitoring, and incident readiness across payment services and APIs, including third-party dependencies. Banks must demonstrate stronger operational controls, faster detection of issues, and clearer accountability across the payment chain.

What changes does PSD3 bring for Payment Institutions and E-Money Institutions? + –

PSD3 merges the licensing frameworks for PIs and EMIs, removes redundancies, and simplifies supervision. Non-bank institutions also receive better access to payment systems, which historically were controlled by banks. This reduces barriers and accelerates fintech innovation.

Is “Verification of Payee” (IBAN-name matching) mandatory under PSD3? + –

Yes. All PSPs must implement verification of payee services for credit transfers. When the payee’s name doesn’t match the IBAN, the payer must be warned before confirming the transaction. This applies to both instant payments and standard SEPA transfers.

How does PSD3 improve the user experience in Open Banking? + –

PSD3 requires clearer consent screens, centralized permission dashboards, transparent explanations of data access, and higher API reliability. Together, these measures create a more intuitive, trustworthy, and consumer-friendly open banking experience.