The wholesale finance sector is poised for further growth in 2025 amid a surge in demand in key industries such as transportation, energy, and manufacturing. This is good news for dealerships and Original Equipment Manufacturers (OEMs), as many continue their digital transformation to improve customer journeys, comply with evolving regulatory requirements, streamline processes, and address a rise in sophisticated fraud cases.

According to data by Allied Market Research, the global equipment finance market is projected to reach $3.1 trillion by 2032, up from $1.2 trillion in 2022. The surge in growth highlights the opportunities available for businesses that stay competitive and embrace innovation.

What is wholesale finance?

Wholesale finance, or floorplan finance, is a financial solution that allows businesses to purchase assets in bulk against credit pre-approved credit lines, with assets typically paid off when they are sold to the end customer. Offered by banks, OEM captives and other specialized financial institutions, it is a revolving line of credit that dealers and distributors in the auto, equipment, and asset finance market use to purchase inventory, such as cars, semi-trucks, motorcycles, boats, and farm machinery and construction equipment. The inventory is sold to end customers, allowing them to track assets and outstanding finance for their operations.

What are the key characteristics of wholesale financing?

Wholesale financing typically allows companies to repay loans under pay-as-sold terms or through extended payment options. Other types of specialized wholesale financing include fleet financing and dealer loans. The assets act as collateral for the loans, while the repayment terms are more flexible and based on the sales cycles of dealers. Risk management helps dealerships monitor their inventory. However, one must manage fees and interest rates to ensure cash flow and avoid overstocking.

Core services offered in wholesale financing

Depending on the software provider, dealers can access a variety of services tailored to their needs. These include:

- Onboarding and decision-making: Lenders can digitalize their Know-Your-Customer processes, as well as expand inventories, monitor and mitigate real-time risk, and manage other operations.

- Wholesale servicing: Support global and localized locations with multiple loan types in an easy-to-use, self-service portal to track and manage their portfolios.

- Pricing calculation: Perform new business quotation calculations, verify and adjust submitted quotes, and evaluate the performance of real-time agreements.

- Digital auditing: Perform hybrid or self-service audits simultaneously to reduce physical asset auditing costs with multiple methods that support real-time issue identification.

Wholesale financing in the global economy

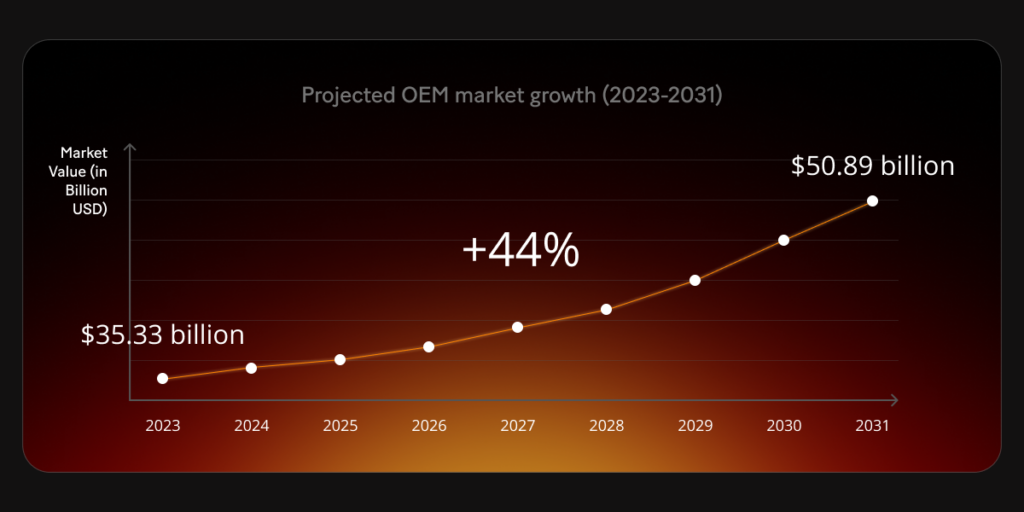

Wholesale financing supports organizations of all sizes worldwide to enhance their business operations. Research shows that the OEM market was valued at $35.33 billion in 2023 and is projected to reach $50.89 billion by 2031. The industry is experiencing growth, but it needs to offer bespoke digital solutions to support a wider range of operations, such as onboarding, decision-making, risk identification, servicing, and auditing.

Internal catalysts that may cause a business to look for new digital solutions include improving operations, streamlining processes, reducing costs, enhancing the customer journey, boosting compliance and risk, and accessing reliable, real-time data.

How technology is shaping wholesale financing

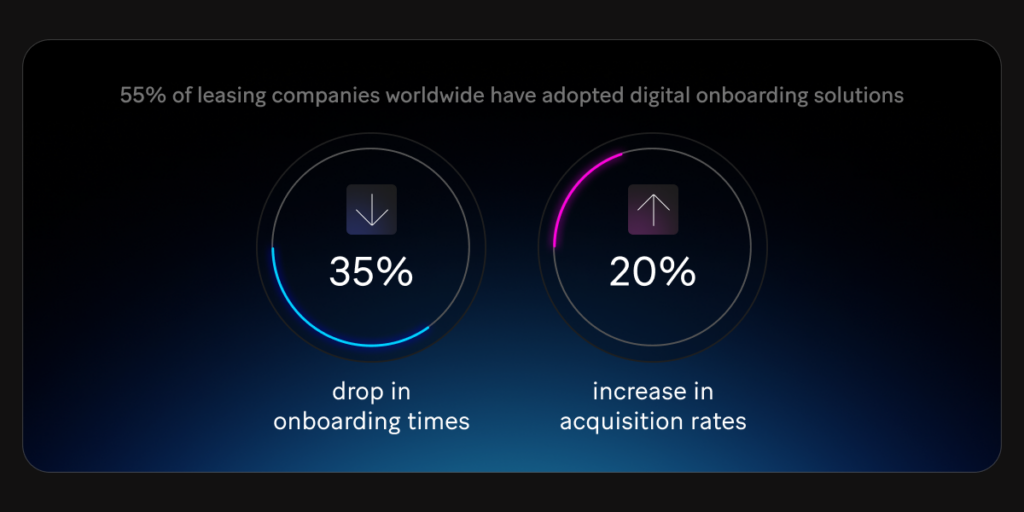

On-site legacy solutions have historically driven organizations in the wholesale finance industry. However, as customer expectations evolve and the need to streamline processes and increase risk management becomes crucial for long-term growth, many are now seeking ways to boost their internal operations and drive costs down, leveraging digital capability, data and AI. Up to 55% of leasing companies worldwide have adopted digital onboarding solutions, according to the 2023 World Leasing Yearbook, which covers the world’s leasing and asset financing markets.

The research notes that this has resulted in a 35% drop in onboarding times and a 20% boost in customer acquisition rates. However, experts say that fully automating the process does not work for all businesses, and artificial intelligence (AI) and machine learning (ML) can help reduce the need for manual intervention. There has also been a significant increase in digital and mobile-based onboarding solutions, which use biometric verification and digital identity systems for customer onboarding.

While geographic locations can often contribute to an organization’s challenges, such as government regulations that differ from country to country or a nation’s available wireless network technology, staying on top of technological innovation is vital for long-term growth.

Challenges and evolution

According to a 2024 survey by Kerrigan Advisors, 54% of respondents expect dealership profits to fall in the next 12 months. This indicates how important it is for organizations to find more cost-effective processes and solutions with predictable costs.

The study also found that OEMs are more supportive of the traditional sales model (which involves selling assets through the dealer networks), and a rising number expect to take a leading role in customer relationships and data ownership. Most respondents believe that OEMs and dealers will share customer relationships and data in the future. The survey also notes that 19% say the OEM will exclusively own the customer relationship and data.

Technological trends in wholesale financing

Future technological trends in the wholesale finance industry will continue to focus on streamlining operations and reducing overall costs, including:

- AI and ML: These help organizations personalize communications with customers, identify potential risks, and automatically process repetitive manual tasks. This helps organizations lower total ownership costs, improve customer experiences, and reduce losses through AI-based risk management tools.

- API and ecosystem: APIs help businesses transform the client experience by providing more digital self-service solutions. By offering a range of APIs, customers can manage their accounts, payments, and communications in real-time through, for example, chatbots and GenAI-based customer engagement.

- Digitizing processes: Implementing digital solutions makes processes such as auditing and servicing assets more cost-effective and saves time. This also enables organizations to access real-time data to enhance decision-making.

- Open banking integrations: Organizations benefit from integrating open banking solutions within their wholesale operations, enabling them to better understand clients’ ongoing affordability.

Wholesale financing plays a crucial role in the global financial ecosystem by offering essential services to OEMs, dealers and fleet companies, driving economic growth and fostering international trade. As technological advancements and sustainability concerns transform the industry, specialized lenders must evolve to address emerging challenges and seize new opportunities for the sector to grow.

For more insights on how these trends are shaping financial services, explore SBS’s perspectives on Specialized Finance.