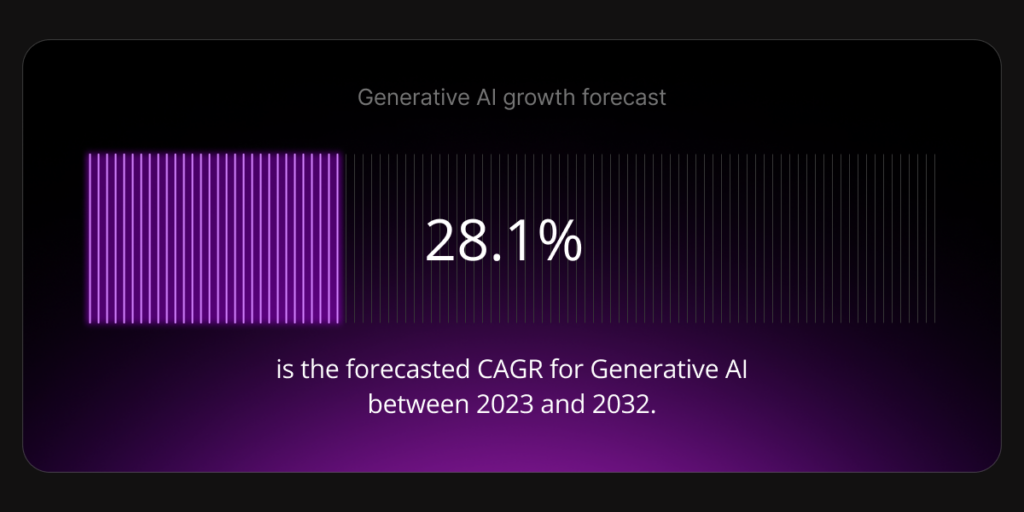

Generative artificial intelligence (or GenAI, as it’s also known) is making its presence felt around the world. Thanks to the technology’s capabilities, coupled with its widespread adoption, GenAI is forecast to grow at a CAGR of 28.1% over 2023 to 2032. From training models in healthcare to personal shopping assistants in retail, GenAI is revolutionizing almost every sector you can think of. And, of course, banking is no exception. The applications of GenAI in banking are extensive, encompassing every department, and include personalizing the banking experience. Driving innovation in customer service, marketing, risk, fraud and cybersecurity, among many others.

However, for banks to fully embrace GenAI at scale, they’ll need to be ready with a cloud-native infrastructure capable of harnessing the potential of this technology. Banks still relying on legacy systems, often characterized by siloed data and inflexible architectures, hinder the rapid integration of new technologies. Banks that delay this transition risk becoming obsolete as the financial landscape rapidly evolves. To stay competitive and relevant, they must act now — those that fail to do so will find themselves left behind in an industry increasingly driven by innovation.

How financial giants are incorporating GenAI

While historically perceived cautious about new technologies, numerous financial institutions—from investment banks to digital payment companies—have swiftly embraced GenAI to enhance their operations and maintain competitiveness. Goldman Sachs and Morgan Stanley, for instance, have made great strides in incorporating GenAI into their day-to-day operations. The two companies are reportedly preparing to roll-out AI projects this year to automate laborious tasks traditionally undertaken by junior bankers, such as document review and basic analysis, enabling employees to focus on higher-value work potentially improving job satisfaction and reducing burnout.

Similarly, payments giant Visa has said that they already have implemented over 500 GenAI use cases. This achievement stems from a proactive strategy and an investment exceeding $3 billion in AI and data infrastructure over the past decade. Visa’s use of AI extends beyond automation, powering hyper-personalized financial services and improving fraud detection, helping the company to deliver more tailored offerings while maintaining regulatory compliance.

Clearly, other financial institutions should pay close attention and act quickly to remain competitive in this rapidly evolving landscape.

Cloud-native banking: A foundation for AI-powered innovation

To fully unleash the power and potential of GenAI, banks need a robust, cloud-native infrastructure in place capable of rapidly adjusting to evolving market demands. Many banks today, however, still rely on legacy core banking systems that struggle to integrate new technologies at speed due to their inflexible architectures and siloed data structures. To embrace a modern banking approach, banks require to adopt a cloud-native API-first architecture.

Such an architecture allows banks to collaborate effectively with partners and integrate their platforms, creating an open ecosystem where the financial products and services can be simply plugged directly into a bank’s core of operations. This fosters innovation and agility. Transitioning to cloud-native banking is challenging, particularly for larger, traditional banks. The process can be time-consuming, costly and operationally disruptive.

Despite these challenges, some banks have already made significant progress in modernizing their infrastructure. Earlier this year, BNP Paribas announced that it would be partnering with Oracle to further develop its cloud strategy. Likewise, in 2021 ING announced it was investing in moving away from legacy IT infrastructures to a modern, cloud-native banking platform. The long-term benefits of such moves, include enhanced scalability, improved customer experiences, and increased operational efficiency, often outweigheing initial hurdles.

The global impact: EU & MEA’s GenAI-driven future

Given its wide-ranging potential, it’s no wonder that GenAI technology is attracting vast sums of investment. In 2024, AI companies raised $8 billion in Europe, accounting for approximately 20% of all VC funding in the region.

At the end of 2024, UK fintech bank Zopa secured €80m in equity funding to support its continued expansion, notably the launch of a pioneering GenAI product designed to transform how customers manage their finances. Even regulators are encouraging AI’s growth, with the ECB creating more than 40 use cases for GenAI in banking supervision. Beyond Europe, the MEA region is also embracing the arrival of GenAI and the positive impact it could have on the banking sector. Spending on AI reached a staggering $4.5 billion last year and is projected to surge to $14.6 billion by 2028.

Gulf Cooperation Council (GCC) banks, in particular, are heavily betting on the technology. In fact, estimates suggest that by 2030 GenAI could be generating as much as $23.5 billion a year in wealth in the GCC area. For banks across the EU and MEA, the message is clear: invest in scalable, cloud-native infrastructure capable of supporting GenAI technology and use cases — before tech-first challengers capture the market.

Meanwhile, these substantial investments underscore the importance of aligning technological innovation with regulatory developments. As banks across Europe and MEA accelerate GenAI adoption, complying with evolving regulatory frameworks—such as the EU AI Act and the Digital Operational Resilience Act (DORA)—becomes critical. Proactively addressing compliance not only reduces potential operational risks but also positions financial institutions to innovate confidently in a highly regulated environment.

Navigating regulatory challenges in Europe and MEA

As GenAI transforms the financial services landscape, governance, risk management and ethical concerns become increasingly critical. There is skepticism around transparency, inherent bias within the technology, safeguarding customer data and maintaining accountability.

Regulators in Europe and MEA are acting to combat these concerns. The EU AI Act, for instance, will be fully applicable in August 2026, introduces stringent risk classifications, enhanced transparency standards, and robust oversight mechanisms. Banks must prepare now, integrating these requirements into their AI governance and operational strategies to ensure smooth compliance transitions.

Likewise, the European Banking Authority’s (EBA) latest regulation, the Digital Operational Resilience Act (DORA), came into force in January 2025, targets enhanced security for financial institutions and their third-party providers. For institutions adopting GenAI, compliance entails ensuring robust cybersecurity practices and maintaining rigorous operational standards around AI-driven processes.

In MEA, regulatory frameworks for GenAI are evolving rapidly. The UAE’s Dubai International Financial Centre (DIFC) recently implemented regulations focused on the ethical use of AI in personal data processing, enhancing trust in digital financial services. Concurrently, Saudi Arabia’s Vision 2030 initiative is driving the creation of a comprehensive national AI governance framework, balancing innovation with ethical considerations, transparency, and accountability.

As regulatory frameworks evolve, FIs must prioritize compliance while embracing innovation. A state-of-the-art, cloud-native banking infrastructure is not only key to enabling the seamless integration of emerging technologies like GenAI but also essential for meeting the growing regulatory demands.

Enabling cloud-native, AI-driven banking with SBS

European and MEA banking executives face exciting and challenging times ahead. There are a multitude number of use cases that banks will be able to employ in the coming years to create a superior, safer and smoother banking experience for their customers. However, to get there, banks will need to lay the groundwork first. And that has to begin with a state-of-the-art, cloud-native banking infrastructure.

Our SBP Digital Banking Suite is built to power AI-driven innovation. As a cloud-native, API-first platform, it embeds advanced AI capabilities,it empowers banks to utilize GenAI for hyper-personalized customer interactions and AI-enabled employee experiences. This improves significantly improve the quality and scale of services a Bank can deliver to their customers, positioning banks to proactively strengthen customer engagement, operational efficiency, and competitive agility.

Also, by partnering with SBS, you don’t need to worry about the banking sector’s increasingly complex regulatory landscape. Our banking experts handle local and global regulatory compliance, so that you can focus on providing your customers with world-beating financial products and services.

Ready to lead with GenAI?

Find out more. Request a demo today and see how SBS can help your bank to embrace the potential of GenAI, without the regulatory and operational headaches.