Today, excellent digital banking experiences are a customer expectation rather than a differentiator, and banks and building societies need to ask themselves continuously how they can make their products and services available via flexible, intuitive and clear interfaces. To do so, a world-leading IT infrastructure is needed to keep up with shifting customer and member expectations – one that can help reduce costs and find efficiencies whilst also meeting the need to improve customer experiences.

The key is to find a technology partner at the forefront of innovation, whilst you focus on your customers and members, ensure you meet their changing demands, and maintain and grow your competitive advantage.

The role of AI in transforming banking and mortgage services

Artificial intelligence (AI) and machine learning (ML) are powerful tools that banks and building societies can use to improve customer experience and streamline process automation. From chatbots to personalised financial insights, these technologies are transforming the sector.

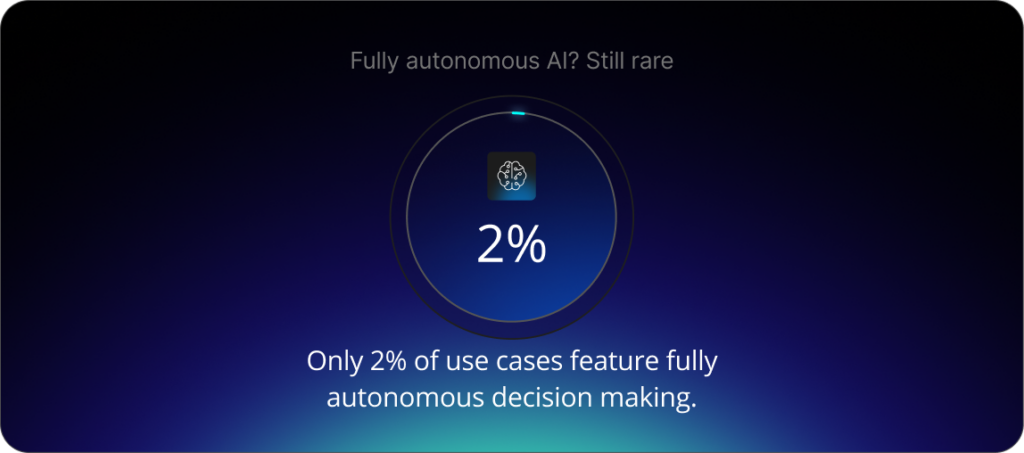

However, most UK banks and building societies are barely scratching the surface of AI and ML’s potential. A recent Bank of England survey found that only around 2% of use cases have fully autonomous decision making, with a further 55% using some degree of AI to complete automated decision-making. Whilst these figures will grow, they highlight a significant gap in the market. Forward-thinking banks and building societies should see this as an opportunity, recognising the importance of being trailblazers in a crowded and ever-changing market.

The product-switch revolution

Rising living costs and economic uncertainty are forcing consumers to constantly be on the lookout for the best deals on the market, and one of the areas under scrutiny is mortgages. As such, we’re seeing a steady year on year increase in the number of borrowers considering switching mortgages once their fixed-term agreements come to an end.

Just two years ago, 84% of re-mortgagers chose to stay with their existing provider instead of moving elsewhere, according to a poll by Primis. Today, the number of borrowers choosing to switch providers when they reach the end of their current fixed term is rising. Clearly, this is a concern for banks, building societies and other mortgage lenders. Faced with a rapidly shifting market, some lenders may find themselves left behind.

The future of product switching lies in advanced analytics, enabling lenders to offer more personalised product recommendations and open banking integrations, which will streamline the process with real-time affordability assessments. Additionally, green mortgages are growing in popularity as customers’ environmental conscience becomes a significant factor.

Making digital onboarding a must

The rise of digital banks such as Monzo and Revolut has shown that customer expectations are changing, and that the new generation are willing to experiment with their banking providers. Indeed, in 2024, Revolut reached 50 million customers globally, growing from just 1.5 million in early 2018. Digital banks have attracted millennials and grown their market share by offering seamless online account opening and a banking experience that mirrors the convenience of platforms like Amazon, Netflix and Uber.

The savings market has been significantly impacted already. And with Revolut’s plans to add mortgages to their offering in 2025, it won’t be long until the mortgage market is as well. Banks and building societies need to respond sooner rather than later. Digital onboarding has become a hygiene factor, and providers can’t expect to compete without it.

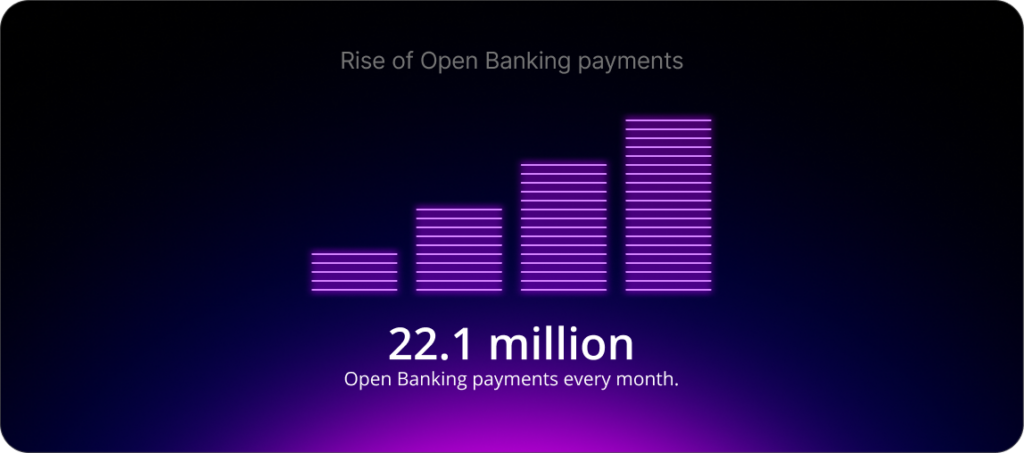

Rise of open banking payments

Open banking enables account holders to view all their accounts in one place and easily make secure payments through other apps and websites. Today, there are over 11.7 million active users in the UK, and 22.1 million open banking payments are made every month, according to FCA statistics.

Per a Mastercard survey conducted in late 2024, 70% of UK consumers connect their financial accounts directly to tools that help them manage financial tasks. One of the top motivators noted in the survey was time saving. This is a key theme across many industry surveys. Account holders value their time and are looking for solutions that integrate their banking experiences. Customers and members will not wait on their banks or building societies to innovate. They will simply look elsewhere if their experience is not meeting their expectations.

How SBS can help

SBS have been a leading partner for UK banks and building societies for over 25 years, helping organisations to enhance their customer journey, reduce processing times and costs. SBS are committed to empowering the UK mortgage and savings market to bring cutting-edge products and services to their account holders, as well as streamlining internal processes and strengthening the customer journey.

The impact of the support given by SBS can be evidenced by the many success stories of our customers. SBS helped one customer move from a 23-day product switch time to just under 10 minutes, achieve a 99% success rate, and see a reduction of costs of 95%.

You can learn more about the specialist UK mortgage and savings solutions offered by SBS by visiting our website.