The banking industry is flush with more data than ever before. From transaction histories to consent records, behavioural patterns and predictive models, banks now sit on vast reservoirs of intelligence. Yet many still struggle to convert that data into meaningful action. Insights stay trapped in dashboards, personalization plateaus at generic messaging, and innovation is slowed by fragmented systems and compliance complexity. As customer expectations rise and regulatory scrutiny intensifies, the gap between data potential and real impact is becoming increasingly visible. Customers want financial partners, not just digital account managers. Regulators want evidence of fairness and positive outcomes, not just reporting. And digital-first competitors are demonstrating what becomes possible when analytics is embedded in day-to-day decisioning rather than treated as a parallel function.

The shift now underway is not about acquiring more data, but using it more intelligently. Banks that operationalize analytics across personalization, marketing, onboarding, measurement and architecture are starting to deliver experiences that are timely, relevant and responsible. They are moving from observing behavior to shaping better outcomes. Those that do not make this transition risk falling behind competitors who have already begun turning intelligence into tangible value.

How banks can create personalization that drives action, not just insight

Too often, banks’ approach to personalization stops at superficial data. Glossy spending charts, balance updates and static budgets are all descriptive tools that provide information, but they rarely help customers to take action. As a result, banks miss opportunities to create deeper relationships through truly personalized products and guidance that improve customers’ financial lives.

The next generation of data analytics goes beyond describing past behavior; it prescribes and prompts next steps. Rather than just reporting what happened, advanced analytics anticipate needs and guide customers toward better outcomes in the moment. For example, analytics-driven personalization could:

- Detect early signs of financial stress and proactively offer support or advice before a payment is missed.

- Highlight “hidden” savings opportunities, from forgotten subscriptions to cheaper service plans, so customers can keep more money in their pockets.

- Encourage progress toward goals with tailored nudges based on a customer’s real behavior, rather than generic one-size-fits-all advice.

At the heart of this shift is AI-powered financial coaching, intelligent, adaptive systems that synthesize data across accounts and channels to deliver personal guidance. These assistants don’t just respond; they anticipate. And critically, they are governed by transparent rules and ethical safeguards, allowing banks to act in real time while staying compliant and fair. Natwest’s GenAI-powered digital assistant, Cora+, is an excellent example of a bank leveraging AI to improve customer experience. Natwest recently reported that Cora+’s rollout has led to a 150% uplift in customer satisfaction.

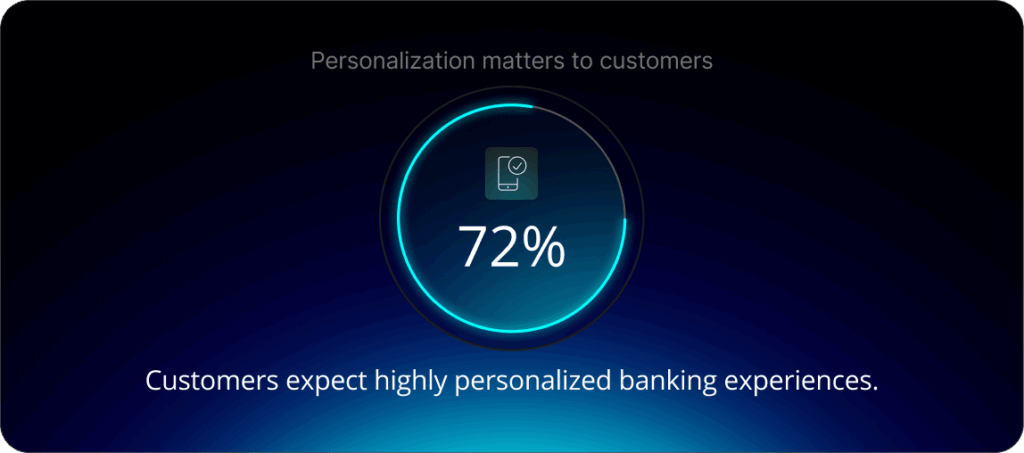

When done right, the payoff is significant. 72% of banking customers rate personalization as “highly important,” and 77% of banking leaders say it boosts customer retention. In other words, meaningful personalization isn’t just a nice-to-have. Rather, it translates directly into a better customer experience and stronger trust for consumers, and into higher engagement and loyalty for banks.

Marketing analytics that drive precision growth and compliance

Many banks’ marketing efforts too often remain disconnected and imprecise, making it harder to keep pace with regulatory change. From GDPR and the incoming EU AI Act to the UK’s Consumer Duty, compliance expectations are rising fast. Nearly 40% of institutions report challenges using market data in ways that fully meet licensing and privacy obligations, adding operational risk to already underperforming campaigns. The result of this imprecision is a double threat. On one side, banks risk failing to reach customers in meaningful, personalized ways that improve financial outcomes. On the other side, they invite scrutiny and risk by operating without clear data controls.

Advanced analytics can change the game by driving precision growth. By crunching vast datasets such as transaction histories, preferences and real-time behaviors, banks can precisely target customers with suitable products and offers at the right moment. Done well, it becomes a competitive advantage, turning marketing from expensive guesswork into targeted, compliant and scalable growth. Equally important, modern analytics platforms automatically log every customer interaction, consent and data usage in real time, creating a transparent audit trail that regulators can follow. This built-in accountability is essential for demonstrating compliance with privacy and fairness requirements.

In short, analytics-powered marketing lets banks grow faster and more efficiently while staying on the right side of data ethics and regulations.

How can onboarding become frictionless without compromising risk?

Customer onboarding is often the first point of failure in the banking journey. Long application forms, redundant document checks and clunky manual reviews create numerous drop-off points. Mandatory KYC/AML steps add further friction. Identity verification, risk scoring, sanctions screening and ongoing monitoring are all frustrating steps that new customers must pass through. It’s no surprise that an estimated 40% of consumers have abandoned a retail bank’s onboarding process when applying for a new product or service. For banks, each abandoned application means lost revenue, wasted marketing spend and a potential customer who might never come back. In today’s competitive climate, many of those frustrated prospects head straight to more agile, digital-savvy competitors with smoother sign-up experiences.

Onboarding analytics gives banks the power to turn this around. By instrumenting the onboarding funnel, banks can pinpoint exactly where users drop out of the journey. Analytics can also reveal where fraud controls are overly sensitive, i.e. triggering false positives and unnecessary manual reviews. Armed with these insights, banks can streamline the process without increasing risk. That might mean simplifying the application flow, introducing smarter identity verification or using risk-based segmentation to fast-track low-risk customers.

The end result is a frictionless, yet risk-aware onboarding experience, where fewer people give up in frustration, legitimate customers get approved faster and compliance teams can still catch bad actors before they enter the system.

Outcome-focused measurement and iteration

A common pitfall in digital banking initiatives is measuring activity instead of outcomes. Many banks still track success with vanity metrics such as page views, logins or click-through rates. All of these indicate usage but not whether a customer’s financial health is actually improving. Without outcome-based measures, it’s impossible to know if a new app feature or product genuinely helps customers or simply generates more screen time. Inaction on this front brings costs, including disengaged customers, wasted investment and rising regulatory scrutiny.

Advanced analytics provides the missing link between customer behavior and outcomes. By applying techniques like holdout groups, incrementality testing and causal modeling, banks can measure whether their interventions truly reduce overdraft incidents, increase savings rates, improve repayment outcomes or otherwise enhance customers’ financial well-being. This creates a feedback loop for continuous improvement. If data shows a new budgeting tool isn’t actually helping users save more, the bank can iterate or pivot quickly.

Digital-first banks that bake these feedback loops into their product design are already seeing the benefits in loyalty and lifetime value. The importance of proving tangible value is underscored by industry trends. In the UK alone, about 15% of banking customers switched their primary bank in 2024, the highest churn rate in Europe. This high churn signals that customers will walk away if they don’t feel real value. By focusing on outcome-based metrics, banks can continuously prove their value to customers, course-correct ineffective initiatives, and ultimately retain more customers through genuine financial improvements in their lives.

Build once, reuse everywhere

The true potential of analytics emerges when banks stop solving problems in isolation and instead build a shared foundation that supports every customer journey. A “build once, reuse everywhere” model enables this shift. With unified data, centralized consent and privacy controls, and consistent AI governance, banks can develop core analytical capabilities once, and deploy them seamlessly across products, channels and use cases.

This approach reduces duplication and cost, but its value goes far beyond efficiency. Because when governance and compliance are embedded at the core, any new model, decisioning flow or personalization layer becomes compliant by design. With standardized consent management, data lineage, fairness testing and explainability, meeting frameworks like the EU AI Act or Consumer Duty becomes far more straightforward.

This model also accelerates innovation. New ideas move from concept to production faster because the safeguards are already proven and reusable. Analytics becomes a living capability, continuously evolving as new data and use cases emerge, yet consistently anchored by shared governance and trust. Banks can scale intelligent experiences confidently, knowing each new capability inherits integrity rather than requiring bespoke controls.

With a modern analytics approach in place, banks can finally close the gap between data volume and customer value. Instead of being data-rich and insight-poor, they can refine experiences, measure genuine outcomes and evolve based on evidence. The result is a model of banking where intelligence scales efficiently and responsibly, and where trust and innovation reinforce each other rather than compete.

| Banking area | Current reality | What analytics enables |

| Personalization | Generic alerts and static dashboards | Real-time recommendations based on individual behavior |

| Marketing | Broad campaigns and high acquisition cost | Specific offers that match eligibility, timing and compliance rules |

| Onboarding | Long forms and unnecessary manual checks | Streamlined journeys with automated verification and risk-based routing |

| Reporting | Vanity metrics (clicks, logins, page views) | Outcome metrics (savings growth, reduced overdrafts, repayment success) |

| Operating model | One-off solutions built per team | Build once, reuse everywhere architecture with shared data, consent and governance |

Get in touch with our experts today.