Design, build and run your digital native bank

SBP Digital Banking Suite empowers financial institutions with next-gen platform to enhance customer engagement via modern mobile-native and web experiences. Future-proof your business with a customer-centric approach—featuring seamless onboarding, personalized marketing offers and AI-enhanced journeys that drive growth and loyalty.

Trusted by banks, proven by results

SBP Digital Banking Suite is a leader in digital banking and a trusted partner for financial institutions worldwide. Celebrated by top global analysts such as Forrester, Gartner, and Omdia, we are recognized for our unwavering commitment to excellence and innovation.

Of the top 50 EMEA banks choose us

Trusted by many of the world’s top banks to provide enhanced technological solutions to drive operational efficiency with ease.

Days to re-architect your bank

Go live in as little as 90 days with a redesigned digital platform, leveraging a model bank approach.

Faster time-to-market

Use low-code/no-code development to increase agility, reduce costs, and accelerate deployment.

NPS for customer satisfaction

Deliver secure, advanced, and user-friendly online banking experiences to drive loyalty and satisfaction.

Benefits

Why SBP Digital Banking Suite

Can your tech keep up with customer expectations?

Transform your business through a modernized infrastructure with a cloud-native, easily configurable, AI-powered platform that delivers exceptional customer & employee experience.

Seamless system integration

Connect core and digital banking with an end-to-end integration and native CBS connectivity. Streamline processes for a unified banking experience.

Cloud-native flexibility

Deliver superior performance, scalability, and cost efficiency with private cloud or SaaS, enabling continuous deployment and innovation.

Data-driven insights

Empower employees to optimize operations, boost performance, enhance engagement, and drive revenue with out-of-the-box dashboards.

Highly configurable platform

Agile innovation with no-code/low-code tools and an open extensibility framework, enabling rapid deployment of new features and services.

Designed to build the bank of tomorrow

A full range of off-the-shelf digital banking capabilities—powered by AI, enabling open finance and offering a third-party marketplace.

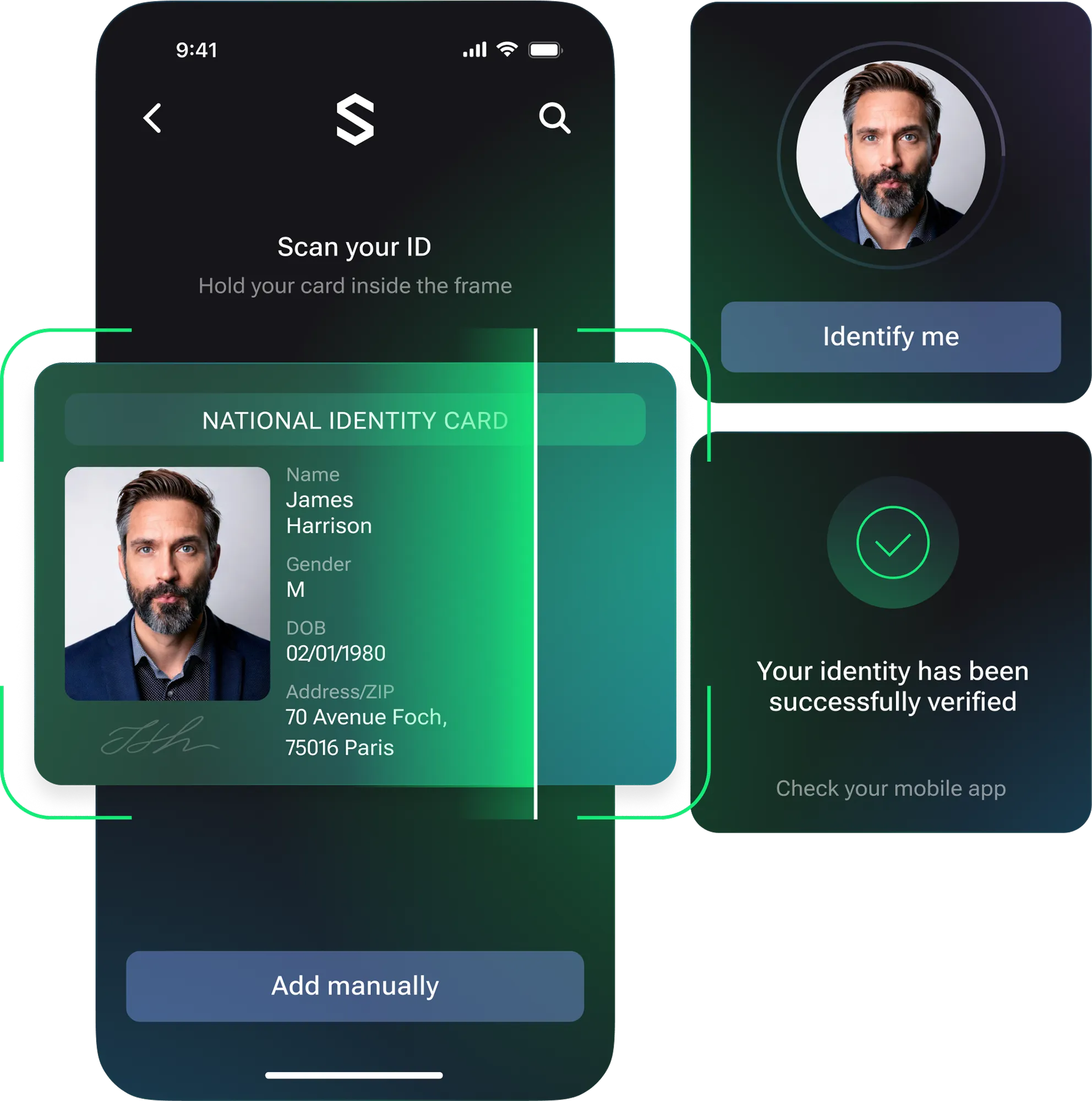

Onboarding & subscription

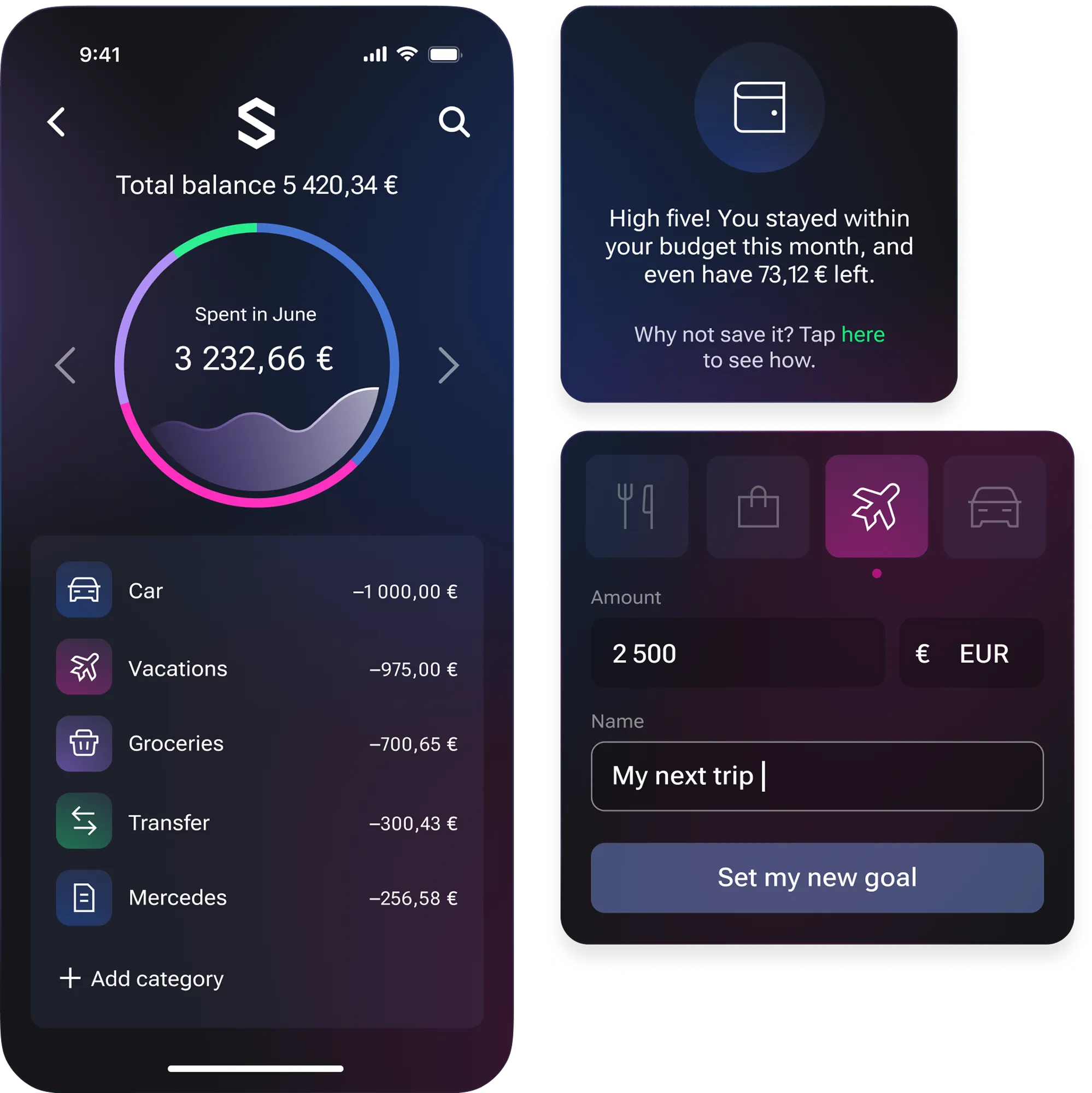

Daily banking

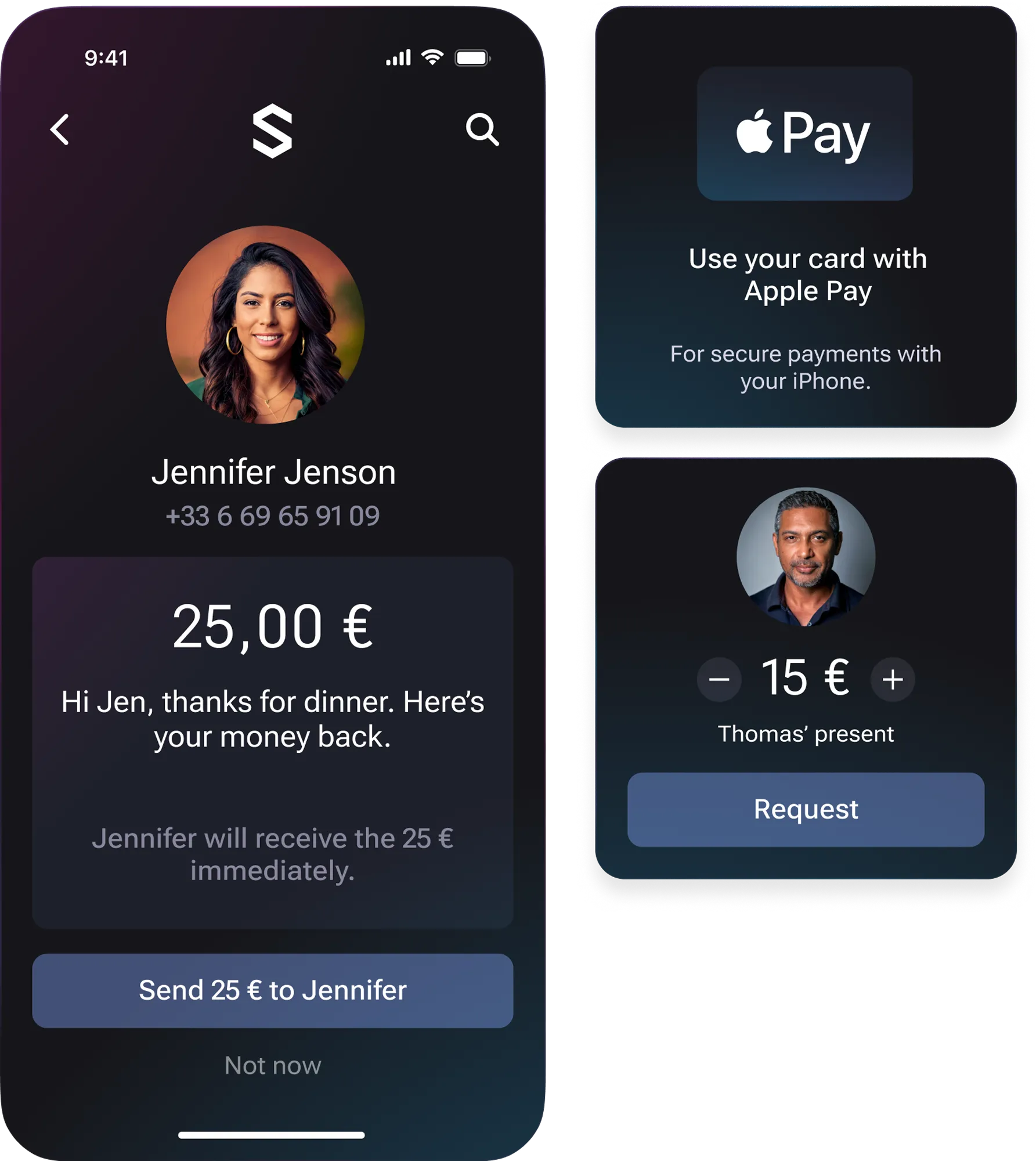

Payments & cards

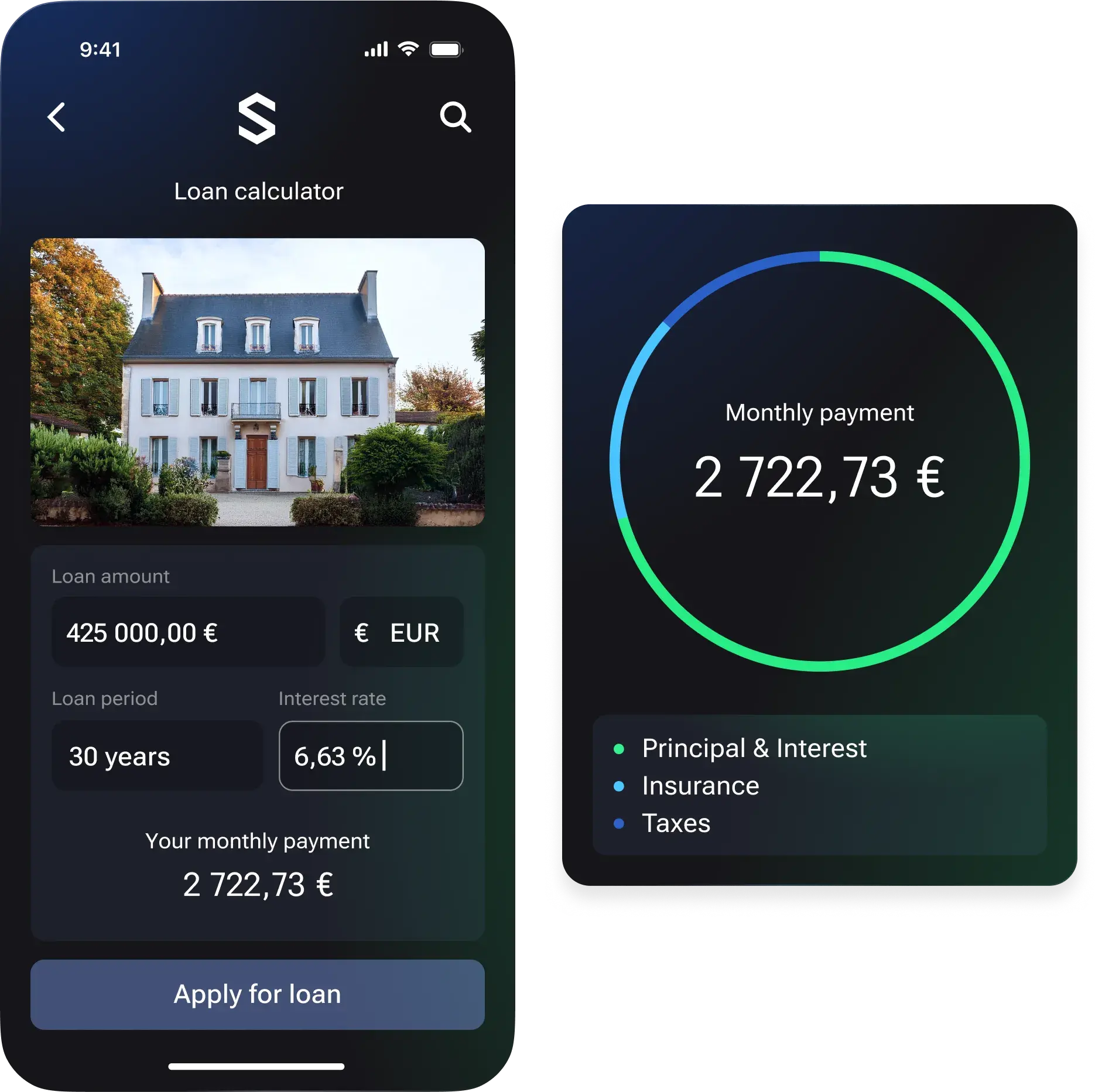

Loan origination & servicing

Seamless account opening experience

Frictionless end-to-end digital onboarding with KYC for new customers. Quick new product subscription for existing customers. Omnichannel, localized, personalized.

Intelligent and personalized experiences

Empower users with real-time insights, financial dashboards, open banking aggregation, and secure account management—all in one app.

Fast and secure global payments

Enable instant, card, P2P and virtual payments with built-in compliance. Support Apple Pay, Google Pay, cryptocurrency, and Request-to-Pay.

From origination to pay-off

Fully digital and automated loan origination, with self-service loan management, driving revenue growth and efficiency.

Deliver smart, secure and engaging AI-powered experiences

Revolutionizing digital banking, our contextual generative AI experiences deliver personalized financial insights for your customers and your employees.

Personalize financial insights in real-time

Deliver customized financial analysis and recommendations, helping customers optimize spending and achieve financial goals.

Enhance user experience with smart automation

Simplify navigation with predictive autocompletion, deep-linking, and AI-powered FAQs. Ensure seamless, fast and intuitive support.

Empower your employees with AI agents

Leverage specialized agents for smarter and more effective customer service, campaign management, and new product launches.

Ensure security and regulatory compliance

Maintain strict data access control with robust AI guardrails, ensuring compliance and preventing misuse.

Technology

Build tomorrow's bank, today

The next-gen digital banking solution for all your needs

Explore