The end-to-end operating system for floor plan financing

SFP Wholesale with Vero modernizes your operations with dedicated modules for underwriting, originations, collections, audits, titles, and real-time risk monitoring. Replace fragmented systems with a single platform that supports every critical process and delivers full lifecycle visibility.

One platform, all your needs

Vero is a digital-first wholesale finance platform that supports the entire lifecycle – from application and underwriting to servicing and portfolio management. With responsive borrower and supplier portals, automated workflows, and real-time portfolio insights, Vero enables lenders to accelerate decision-making, mitigate risk, and enhance borrower satisfaction.

All under one modern platform

Reimagine wholesale finance operations

One platform, every function

Unify every aspect of your wholesale finance operations on a single, end-to-end platform. From borrower engagement to risk management and portfolio intelligence, manage all processes seamlessly with full visibility and control. Simplify complex workflows, improve collaboration, and make faster, data-driven decisions, all in one place.

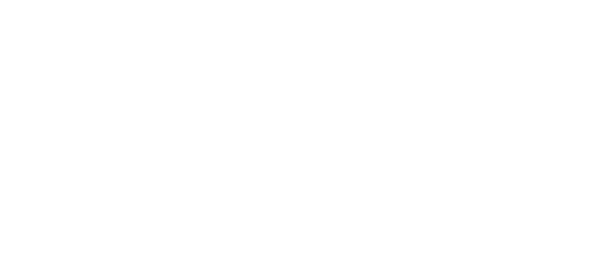

Borrower & supplier portals

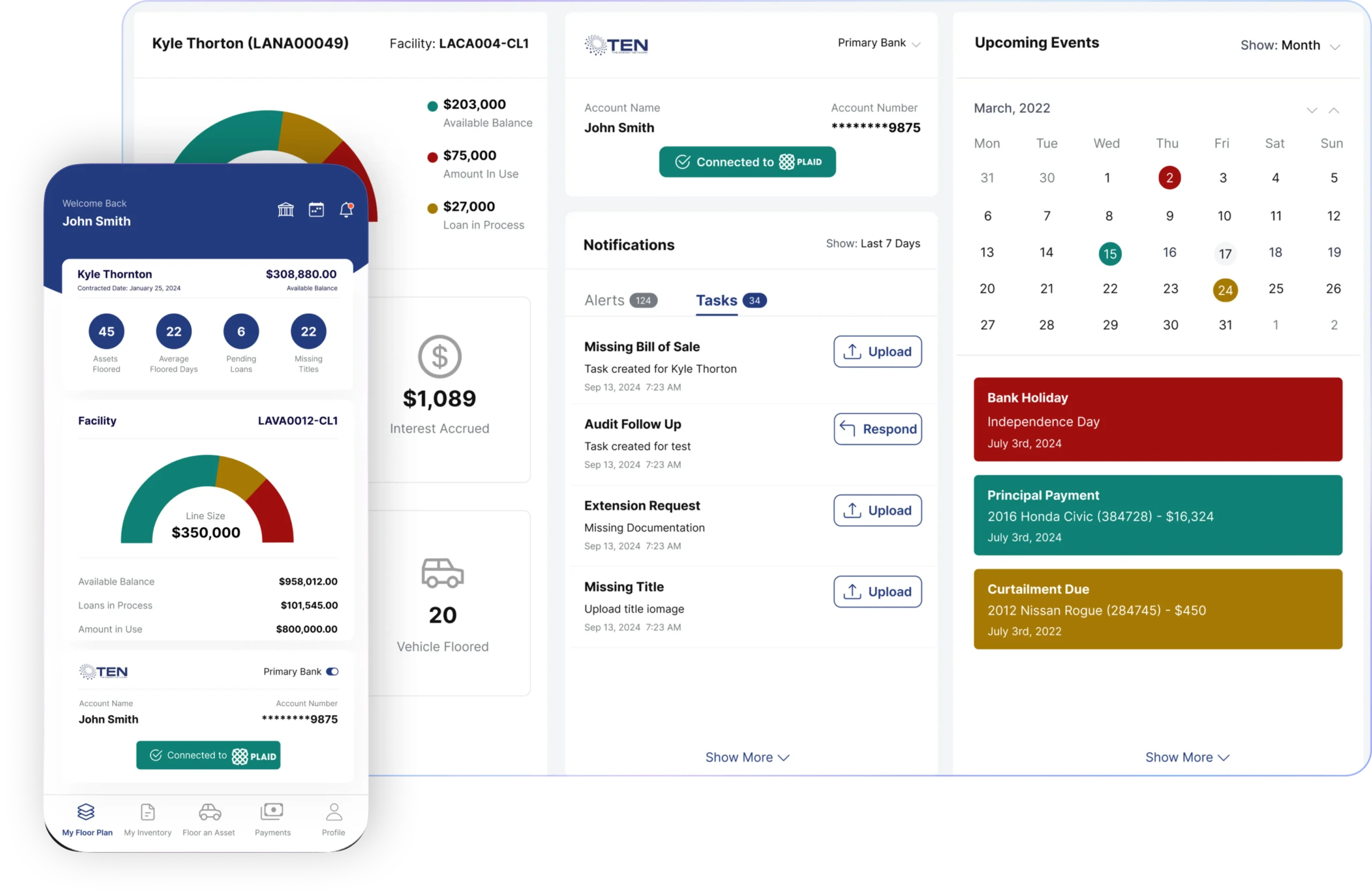

Digital underwriting

Servicing & risk management

Portfolio intelligence

Empower your network with intuitive, connected digital experiences

Borrowers and suppliers can easily request funding, manage lines of credit, make payments, and access reports from any device. The responsive, mobile-friendly portals include integrated chat, notifications, and automated communications, keeping all interactions streamlined and transparent in one centralized hub.

Transform credit decisioning with a fully digital underwriting journey

Applications, document collection, and e-signatures are handled digitally for a faster, more efficient process. All documents are stored securely in a centralized workspace, enabling real-time collaboration and approval. Automated workflows, tiered decisioning, and instant credit reporting help lenders reduce turnaround time and enhance accuracy.

Gain complete control over the entire asset lifecycle

From funding approvals and valuations to payments and collections, every step is automated and transparent. Digital auditing and reconciliation tools ensure ongoing compliance and accuracy, while title vaulting with FedEx integration simplifies asset transfers. Manage servicing and risk seamlessly with continuous visibility into performance and exposure.

Turn portfolio data into powerful, actionable insights

Access a complete, real-time view of borrower accounts, asset performance, and risk indicators. Generate detailed financial and operational reports with ease and receive automated alerts for key triggers such as low balances or large transactions. Empower your teams with intelligence that drives smarter, faster lending decisions.