Stay innovative with future-ready asset finance software

Our asset finance software allows specialized financiers worldwide to offer outstanding customer service, support dealers, gain clear risk insights, and strengthen financial resilience.

70% of global auto finance captives supported worldwide

The SBS Financing Platform offers solutions for all types of lenders including banks, captives, finance companies, and other specialized lenders. It offers a range of end-to-end solutions supporting the front-to-back-office lending cycle for all types of assets, including automotive, heavy vehicles, yellow equipment, energy sector assets, medical equipment, and others.

USD client AUM

The SFP solution empowers organizations with enhanced workflows and risk identification to strengthen finance floorplan, vehicles, agricultural equipment, trucks, and more.

Product implementations

The SBS Financing Platform supports clients by processing 4.3 million wholesale units and transactions valued over $87 billion annually.

Clients served

Throughout its 40+ year history, clients of SFP have included global asset finance organizations including banks, OEMs, captives, and other specialized lenders.

Countries live

The SBS Financing Platform helps asset finance organizations to manage multiple assets, countries, languages, and currencies, all in one user-friendly platform.

Benefits

Combine platform components for full asset lifecycle support

The world's most advanced wholesale platform

SBS Financing Platform is the only provider to take a whole platform approach when it comes to floorplan and wholesale operations. This enables lenders to service all aspects of their asset finance journey from initial onboarding, servicing and audits to asset closure.

Cloud native SaaS

Design and deliver exceptional customer experiences with our scalable asset finance ecosystem.

Optimized operations

Transition to modern, cloud-based solutions for enhanced agility, scalability, and flexibility.

Global ready

Gain transparency with the support of real-time data helping small to multinational businesses.

Digital transformation

Embrace automation and AI for efficient workflows and reduced touchpoints.

For all types of specialized finance lenders

Our solution is trusted by a diverse range of specialized lenders including banks, OEMs, captives, finance companies, and other specialized lenders globally. Trusted by many multinational organizations, the SBS Financing Platform will help your organization scale globally and remain compliant locally.

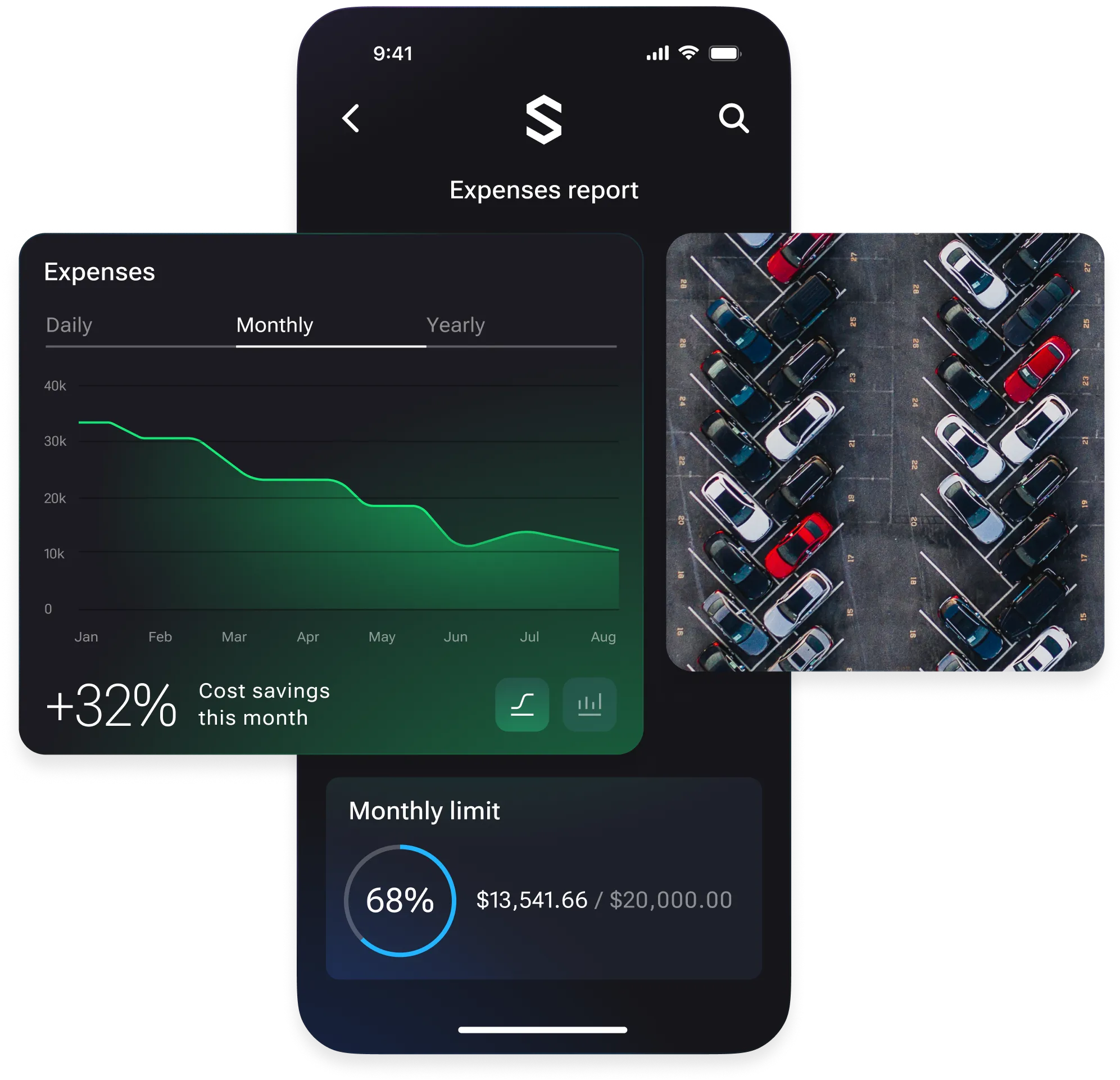

Cost-effective solutions

Customer-centric

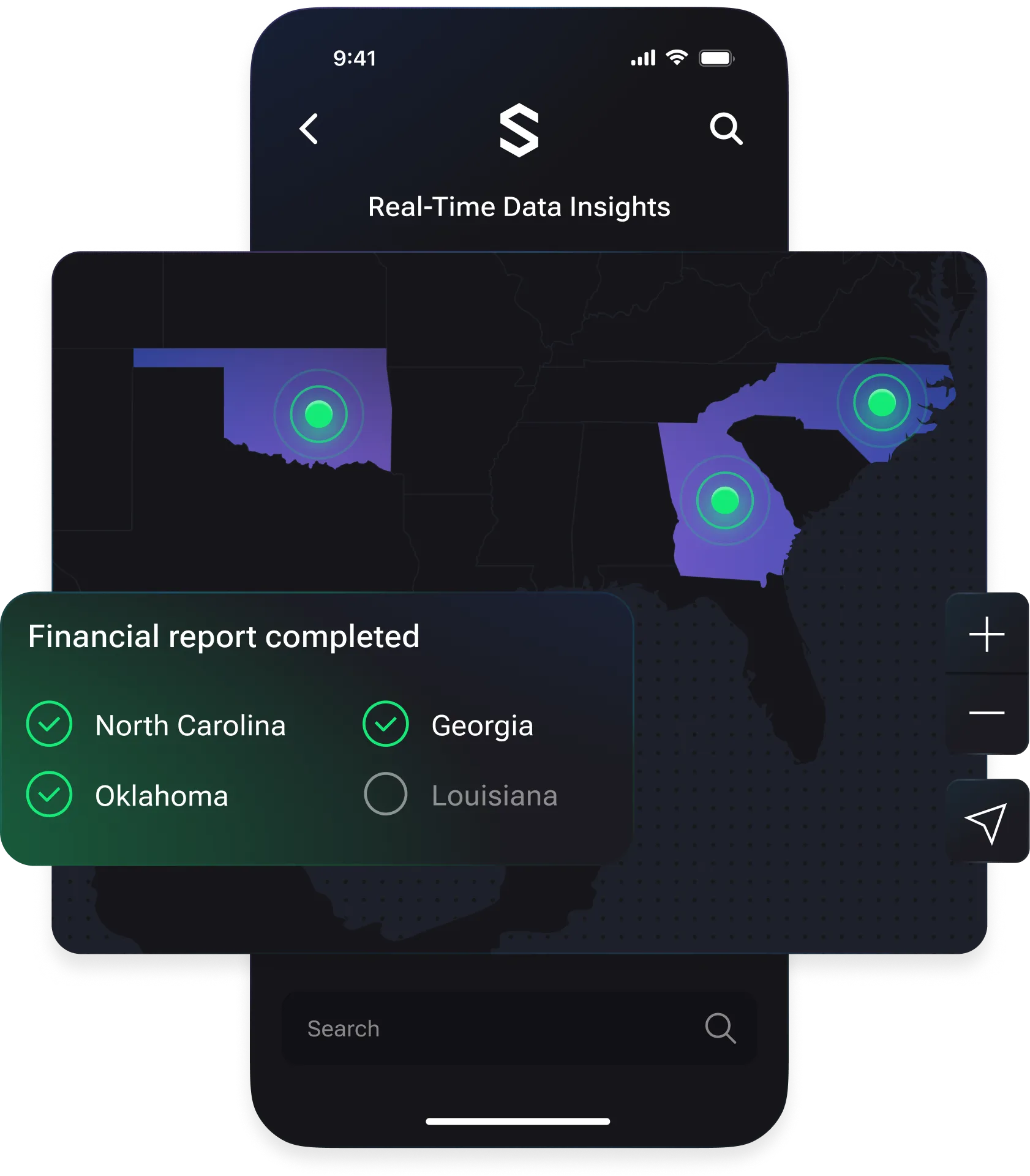

Real-time data insights

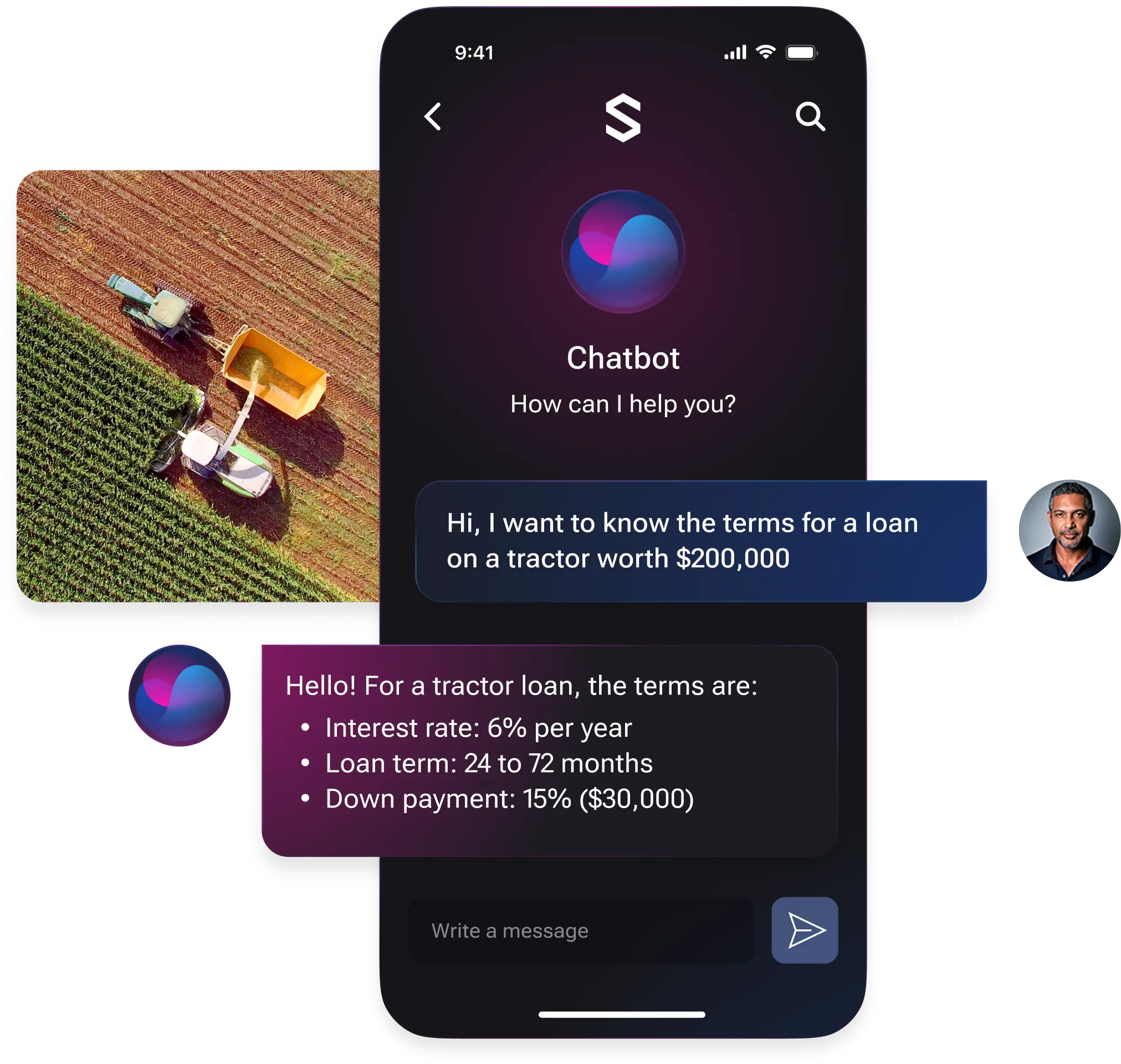

Efficient workflows

Reduce costs with affordable, cloud-based platforms

Lower your total cost of ownership and eliminate high expenses from updates, testing, and setup, allowing for more predictable budgeting thanks to a clear subscription model, free of hidden fees and other costs.

Stand out with user-friendly, client focused systems

Attract new customers and retain existing clients by prioritizing the customer experience, offering a seamless personalized service that enhances the client and user journey.

Actionable and transparent business insights

Use real-time data insights to make informed decisions with reliable, real-time data across all business locations globally. Enhance visibility and identify risks early to reduce and proactively address risk situations.

Reduce manual touchpoints with efficient workflows

Embrace automation and AI and transition to modern, cloud-based solutions that enhanced agility, scalability, and flexibility. Streamline day-to-day tasks and achieve business goals more effectively.

Technology

Blend financing capabilities for a full wholesale platform solution

The next-gen platform for all your asset finance needs

Explore