Make informed decisions on credit risk

SBP Risk Assessment is a SaaS solution designed to provide risk analysis to financial institutions. Based on AI-assisted reports, it guarantees a 360° view of the portfolio to tackle potential fraud, mitigate risks and deliver a credit score to facilitate decision-making and dramatically improve customer satisfaction.

% reduction in processing time

Reduce your credit risk analysis time to just a few hours allowing to boost your profitability.

Hours to access it, a few days to configure it

No need for hours of training – the UI Is intuitive, plug-and-play, and quick to master for any type of users.

Minutes to generate a credit score

Generate instant credit scores based on your ratios to empower your team to make better-informed risk decisions

Banks covered accross the globe

Works seamlessly with all major banks.

Risk Assessment

Seamless credit score and reduced risk assessment

Comprehensive health check and instant financial overview of companies

SBP Risk Assessment is a SaaS solution that provides the best automated risk analysis and fraud detection tools, accessible via web or API on the market. It includes 4 types of reports that extract, analyze and classify financial, banking and managerial data.

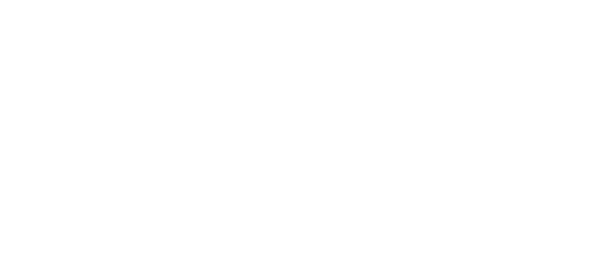

Financial analysis

Bank extract

Document recognition

Manager analysis

Instant credit risk score based on financial and behavioural data

– The collected data comes from external sources and the company’s financial statements to estimate its probability of default.

– Full transparency on the factors determining the score through a visual and interactive report.

– Dynamic score powered by comparative analysis of similar companies’ performance

Real-time cash management view

Decision support report that groups and analyzes bank transactions to monitor cash activity, detect signs of economic distress, and identify suspicious behavior.

– “Company risk analysis”

– Fraud and inappropriate behavior detection

– Long-term customer portfolio management

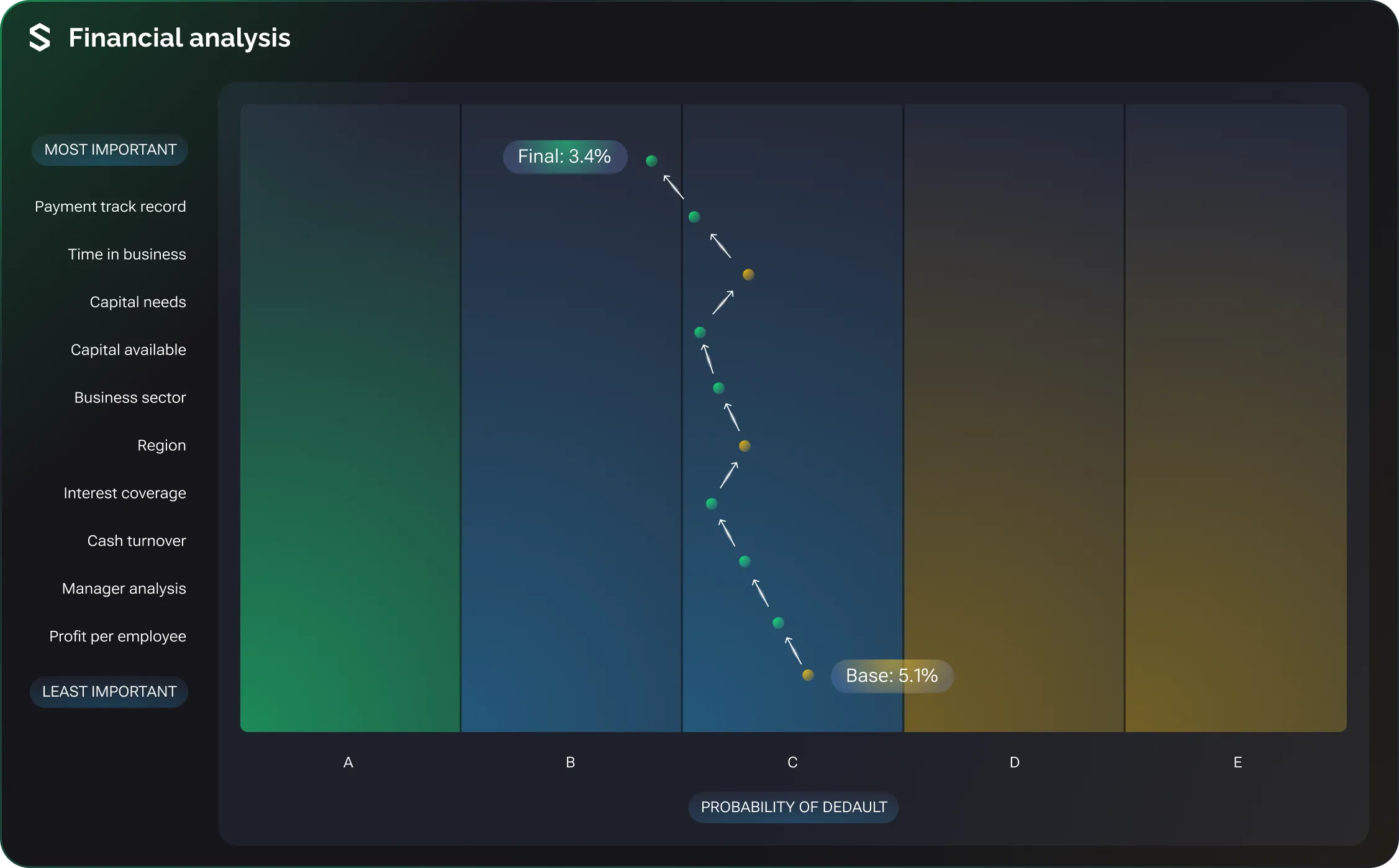

Ensure the documents tell the true story

Powerful Machine Learning Technology that Evaluates Document Authenticity and Accuracy (True PDF or Open Banking)

– Fraud Detection

– Performance Analysis

– Document Classification and Centralization

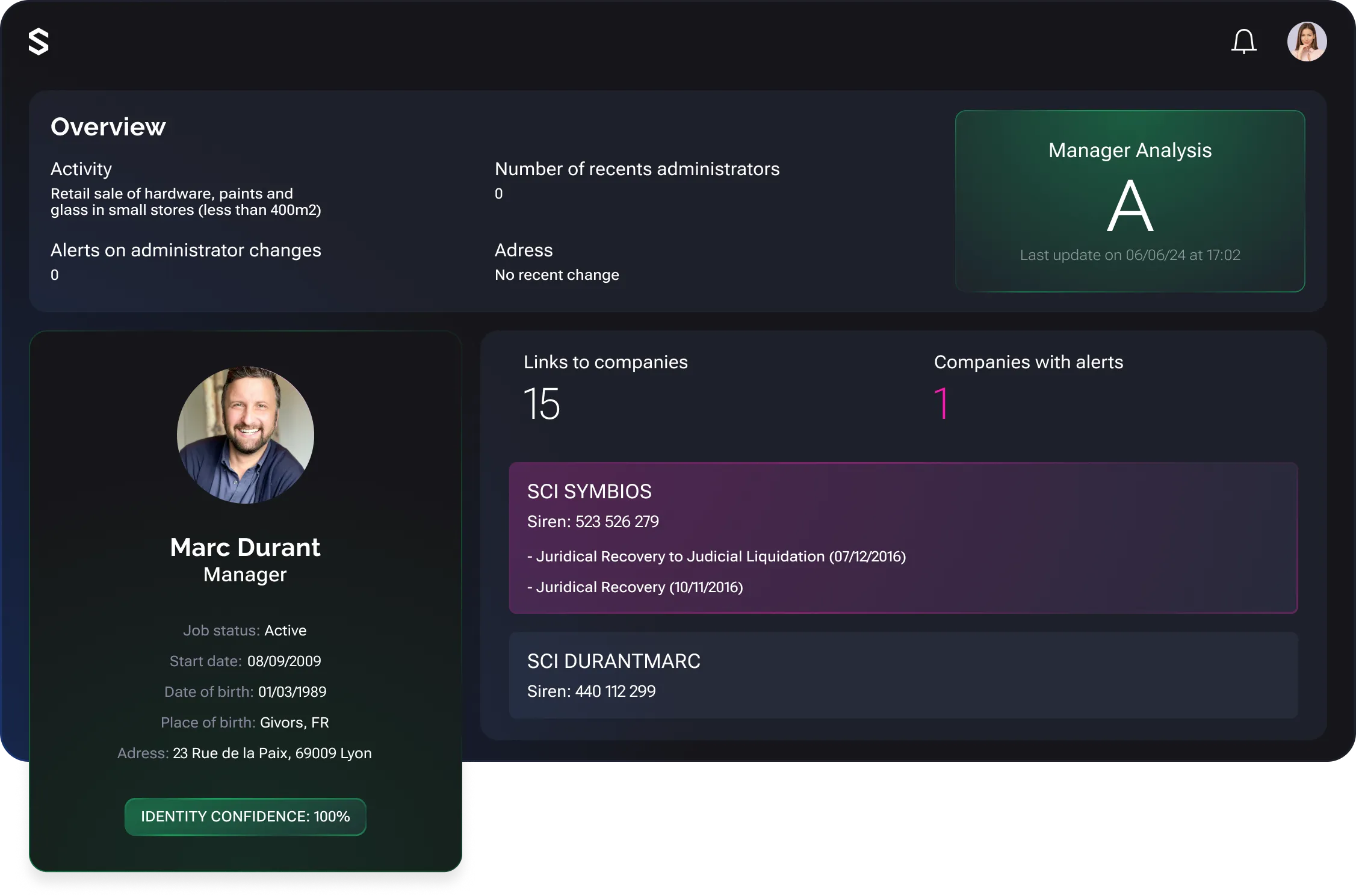

Comprehensive analysis of a company and its management

Identification of suspicious behavior involving company personnel and ultimate beneficiaries.

Our advanced algorithm performs background checks based on various public data sources to identify:

– Traces left by fraud attempts

– Suspicious behavior of counterparties

– Prior economic distress