The best innovative lending solutions for business growth

Design, build, and enhance the lending experience with cutting-edge SaaS solutions. Deliver superior customer experiences while managing credit and operational risk. Our flexible software supports all lending needs. Accelerate time to market, automate processes, and create agile workflows to streamline loans from origination to debt collection.

Clients trust us

With a proven track record in banking and lending, our clients trust our solutions to streamline operations and drive financial growth.

Millions of loans and leases granted worldwide

We finance the world, empowering banks and lenders with innovative solutions to drive economic growth and enhance credit access.

#1 worldwide provider of lending solutions

As the world's leading provider of lending solutions, with decades of expertise, we serve countless cients and shape the future of banking.

SBP Lending

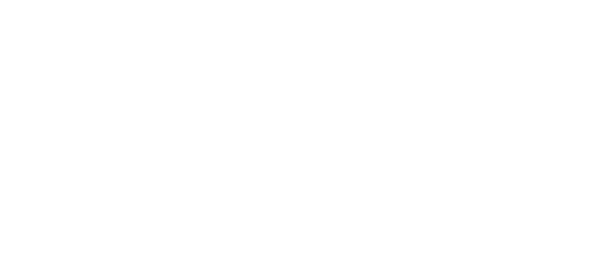

The ultimate lending platform for modern financial solutions

Unlock innovative lending solutions

Reduce time to market, automate processes, and create agile workflows in your financing solution to streamline loans from origination to servicing and risk operations up to debt collection.

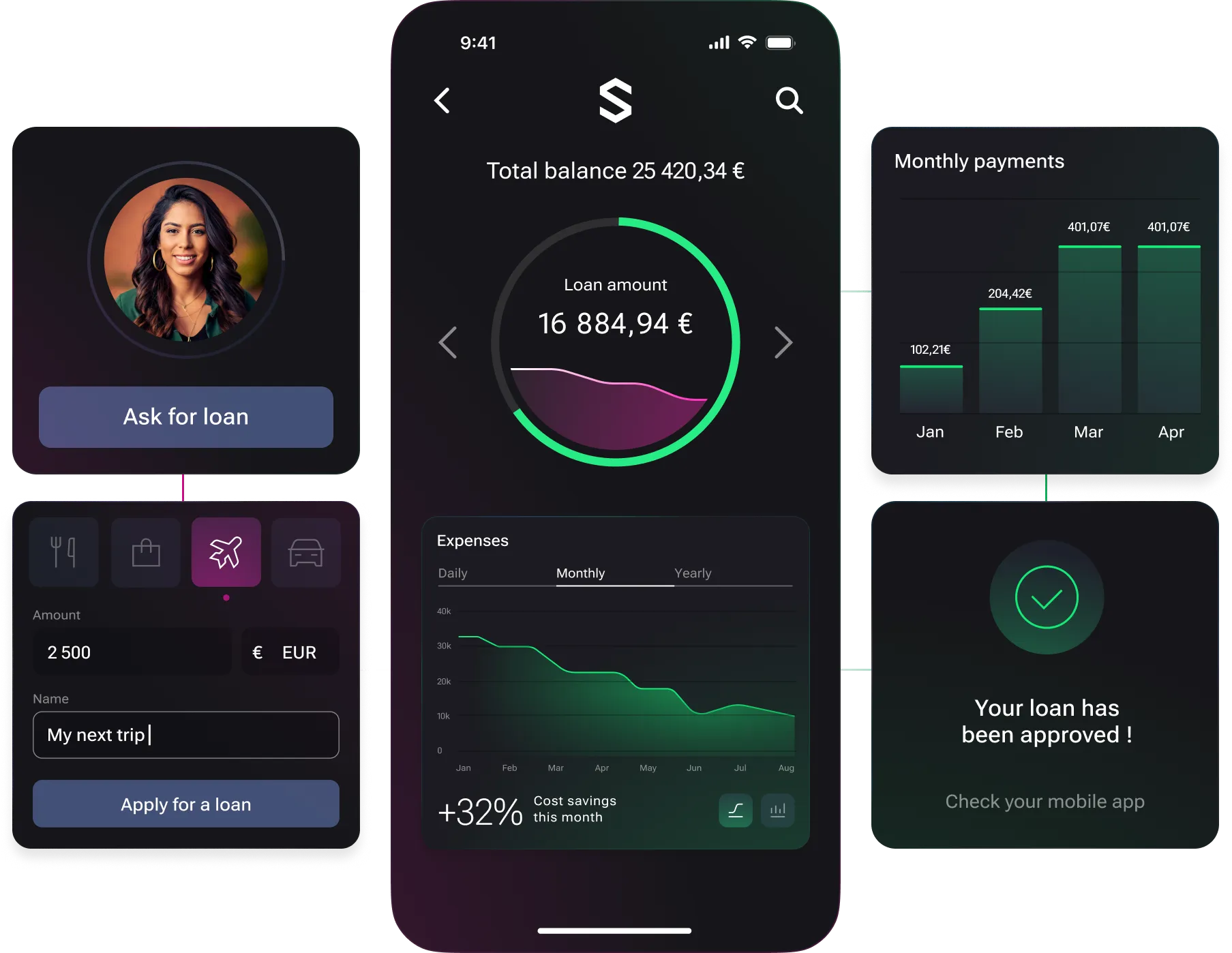

Loan origination

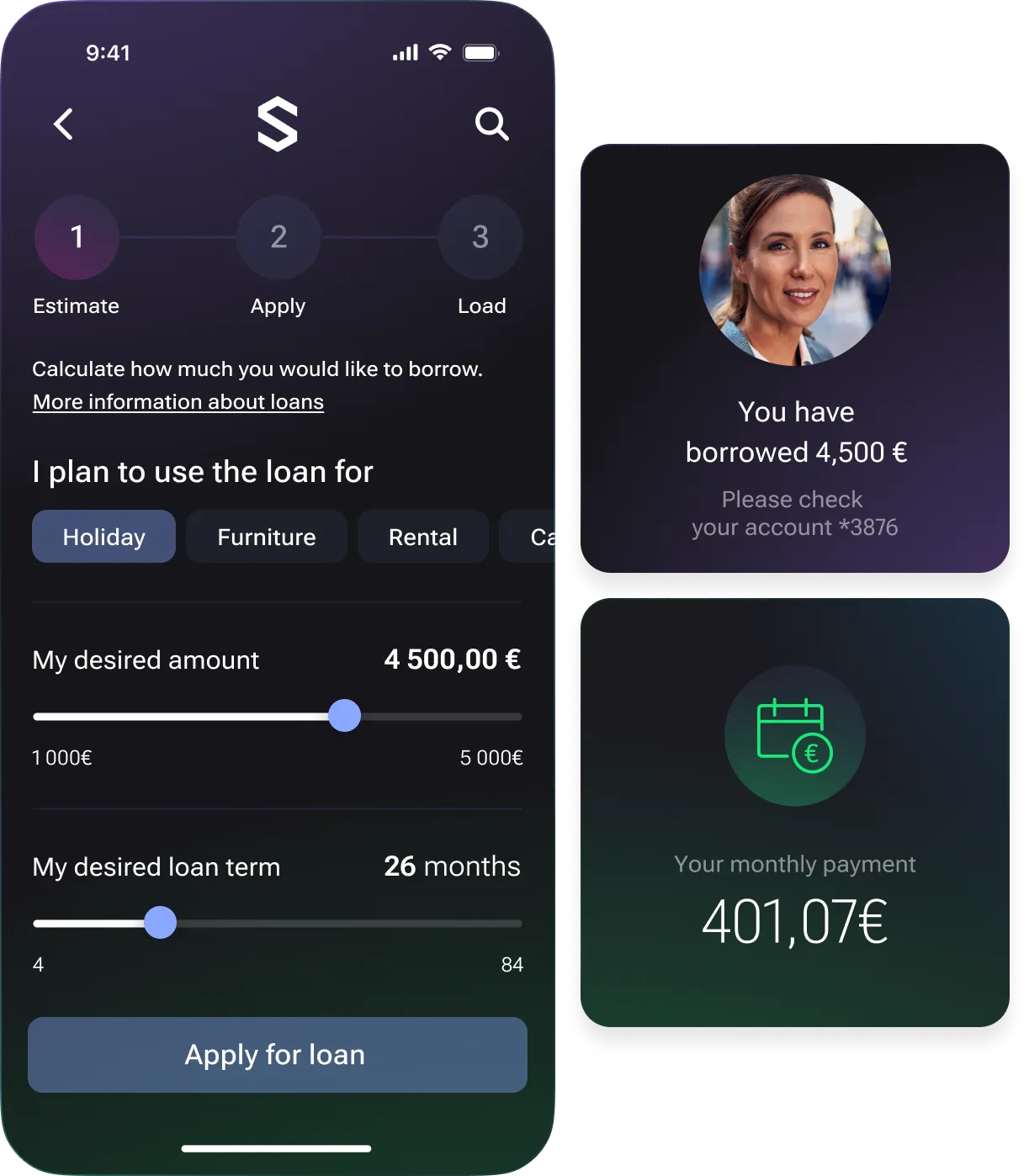

Loan servicing

Risk operations

Collection management

Automate, accelerate and support the entire loan cycle

Our solution supports automated, collaborative and flexible workflow capabilities that serve multiple distribution channels. Product and pricing management is offered with a wide range of rate terms, fees, payments, and periodicities through a fully digital, AI-powered and data-driven user experience.

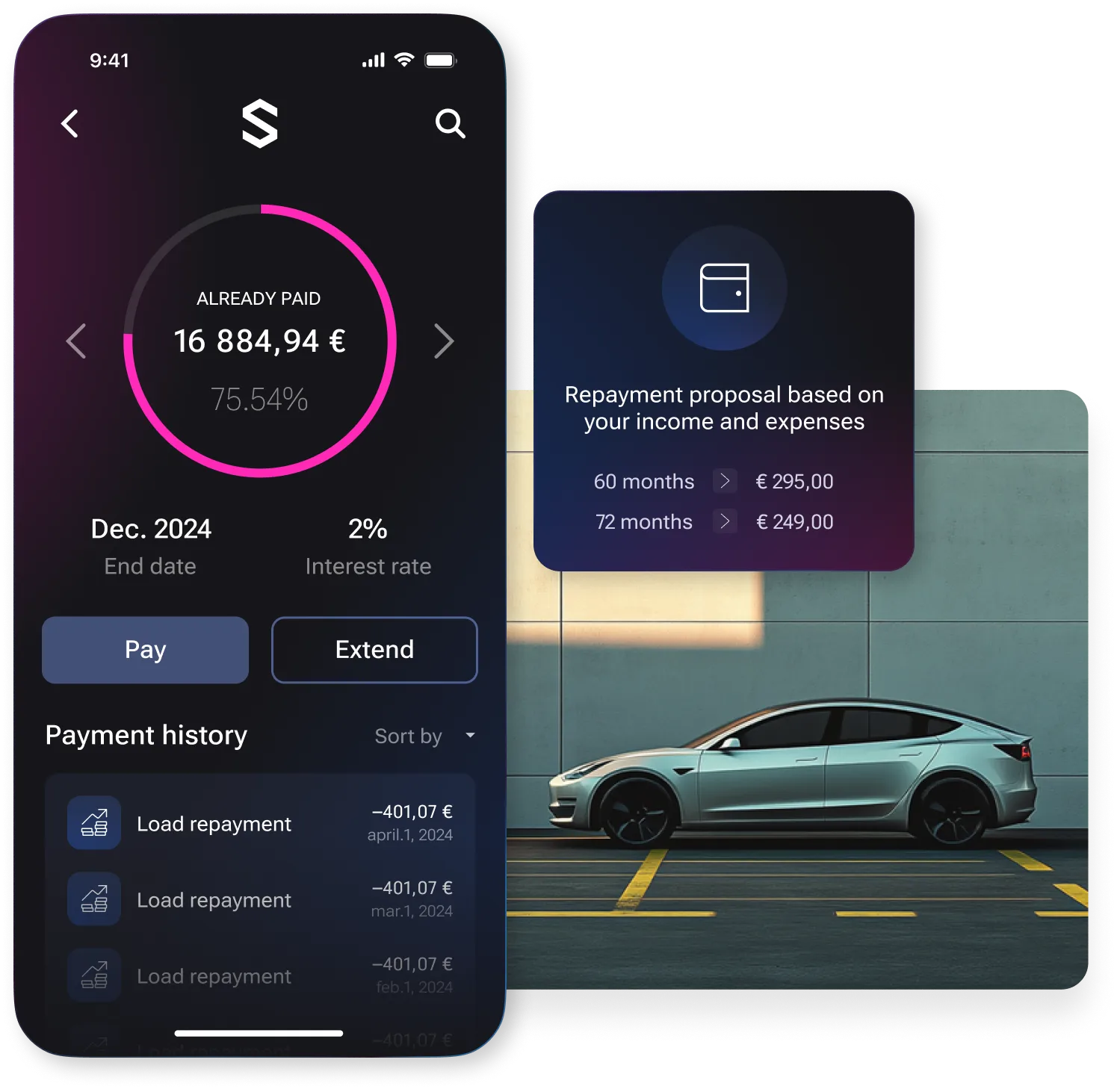

Experience hassle-free daily lending operations

Boost efficiency and control to enhance customer satisfaction with comprehensive loan management. Unlock flexible repayment plans, easy invoicing and seamless debt restructuring with SBS loan servicing solutions. Meet the highest standards of security and traceability.

Make risk decisions faster with data

Whether you’re looking to speed up risk analysis and management, calculate scoring or reduce your exposure to fraud; whether you deal with collateral management, counterparty risk management or credit ratings, we have a solution for you.

Data-oriented and scalable by design for higher recovery rates

Our end-to-end solution automates collections, optimizes recovery rates, and reduces default risk. Tailor strategies based on customer profiles to assess risks and identify vulnerable customers. Boost profitability and communication effectiveness.