Worldwide, the payment system has been going through significant shifts in recent years. The rise of mobile wallets, instant payments and embedded finance has redrawn the global payments landscape. The European payments system has, however, failed to keep pace. And while many European countries have opted to develop their own domestic solutions – such as France’s Paylib, the Netherlands’ iDEAL and Sweden’s Swish – the result has been a patchwork of local payment champions that don’t work across borders.

This segmented approach has allowed the European payments market to be dominated by foreign players; notably Visa and Mastercard, who have enjoyed an increasing market share in recent years. Together, they handled $7 trillion in European transactions in a single year, per the latest available research in 2023. While these networks have introduced improvements such as tokenization and enhanced fraud controls, their continued dominance highlights the absence of a coordinated, sovereign European alternative. Without investment in EU-native infrastructure or cross-border innovation, dependency on non-European schemes has only deepened.

As a result, European merchants pay higher fees, banks lose direct customer relationships, and consumers lose out thanks to inconsistent user experiences. And with Big Tech companies like Google and Apple also gaining traction in the payments market, the threat of competition from abroad is unlikely to go away any time soon. Thankfully, change appears to be on the horizon, with a new payment system emerging, built by Europeans, for Europeans.

Enter Wero: Built in Europe, for Europe

In concrete terms, Wero is a digital wallet overlay that enables real-time payments across Europe, built on top of the SEPA Instant Credit Transfer (SCT Inst) scheme and governed by the European Payments Initiative (EPI). Accessible as a standalone app or embedded within banking apps of participating financial institutions, Wero accommodates different user preferences and integration models across the European market.

Launched by the EPI in 2024 and supported by a host of major European banks, Wero is a landmark response to the fragmented European payment landscape — offering a unified wallet for P2P, C2B and cross-border e-commerce payments.

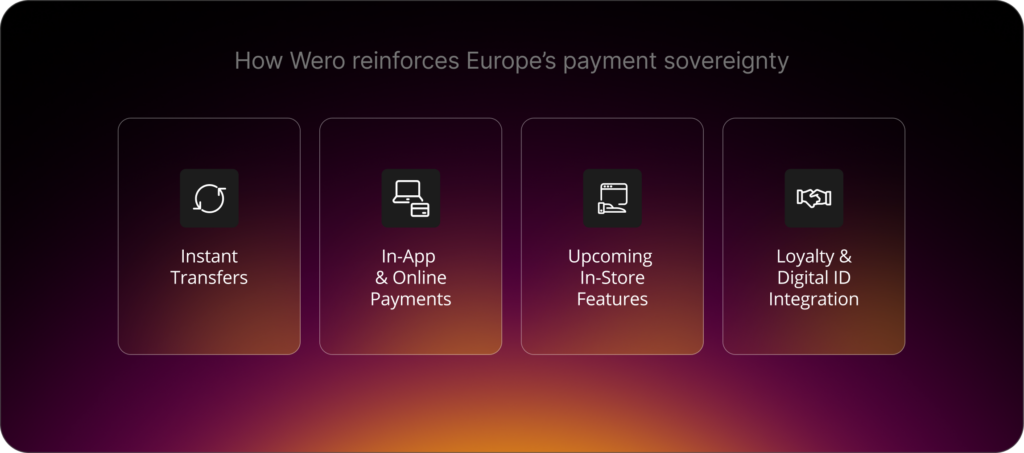

Wero has been described by Flagship Advisory Partners as Europe’s best bet to reclaim its payments sovereignty from foreign ecosystems, offering a number of cutting-edge, CX-friendly functions, including:

- Simple, instant and bank-backed money transfers for friends and family, requiring nothing more than a phone number

- In-app and online payments using a secure, EU-native alternative to cards and PayPal

- In-store payments via QR and tap-to-pay are in the pipeline, alongside loyalty and digital ID integration for seamless experiences

These functions render digital payments in Europe more intuitive, interoperable and competitive, helping consumers and businesses alike benefit from faster transactions, lower fees and greater security — all while keeping control of sensitive financial data within Europe’s regulatory framework. More than just a payments tool, Wero is emerging as a strategic pillar of Europe’s financial sovereignty agenda — a way to reduce reliance on non-European systems and reinforce the EU’s digital independence.

In many ways, Wero is following a path already paved by other successful sovereign payment systems around the world. Brazil’s Pix and India’s UPI, both government-driven initiatives, have attracted hundreds of millions of users in just a few years and now handle billions of transactions every month. While these models – which offer real-time, open, and easy payments – serve as valuable inspiration, Wero’s journey is different. Its success will hinge on strong private-sector collaboration, voluntary adoption, and harmonized standards across EU markets to unlock similar levels of scale and impact in reshaping digital commerce in Europe.

Milestones to date: Adoption and expansion

Wero has only been live under its new name for a short time, but its foundations are well established. The solution was launched following the strategic acquisition and consolidation of two existing European payment systems: France’s Paylib and Belgium/Luxembourg’s Payconiq. These legacy brands are now being progressively phased out in favor of the unified Wero brand — enabling the system to hit the ground running with an existing user base and proven infrastructure.

As of March 2025, Wero had already enrolled 14 million users and processed 8 million transactions across early partner banks in Germany, France, and Belgium, including BNP Paribas Fortis, Deutsche Bank, and BPCE, where it was first activated.

Wero’s also been forging partnerships with powerful players in the financial sector. In May of this year, Canadian fintech Nuvei became the first major payment service provider (PSP) to integrate Wero into its checkout stack, marking a significant boost to its payments offering. More recently, Wero signed an agreement with Revolut, focusing initially on checkout use cases — a promising first step in the EPI’s collaboration with a leading digital banking platform. Both partnerships are likely to accelerate Wero’s development, particularly in e-commerce functionalities, leveraging Revolut and Nuvei’s agile product rollout capabilities.

On Wero’s partnership with Revolut, Martina Weimert, CEO of the EPI, says:

“Revolut’s extensive footprint and their commitment to innovation make them a valuable partner in our shared mission: to offer a secure, easy, pan-European solution and to expand payment sovereignty and freedom of choice to all Europeans. It’s a new chapter in how payments are experienced in this continent.”

This is just the beginning for Wero, who has plans to increase its continental reach in the near future. In fact, it aims to launch in Luxembourg later this year and the Netherlands in 2026, edging closer towards its ultimate goal of being Europe’s go-to digital wallet by 2027. In order to get there, Wero aims to incorporate additional payment services to better compete with its American counterparts, including Buy Now, Pay Later (BNPL), loyalty programs and recurring payments.

How SBS supports Wero’s rollout

Integrating Wero into your payment infrastructure is quickly becoming a competitive necessity. As adoption grows, early movers will gain a strategic edge in offering better digital experiences, reducing reliance on non-European schemes, and staying aligned with evolving EPI standards.

SBS brings deep open banking expertise and a strong track record with Europe’s top financial institutions. Our Payments & Wallet Accelerator delivers everything you need to launch Wero quickly and confidently, from wallet provisioning and transaction orchestration to e-commerce payments and compliance with EPI rulebooks.

Aligned with the European Payments Initiative architecture, our solution simplifies integration while enabling future scale. With prebuilt APIs, embedded consent and fraud controls, and seamless core banking connectivity, we help reduce time-to-market without added complexity or risk.

Wero is reshaping Europe’s payments landscape. SBS gives you the tools, expertise, and acceleration to lead this transformation, and stay ahead of the curve.

Don’t wait. Let’s talk about how your institution can take the lead in Europe’s instant payments revolution.