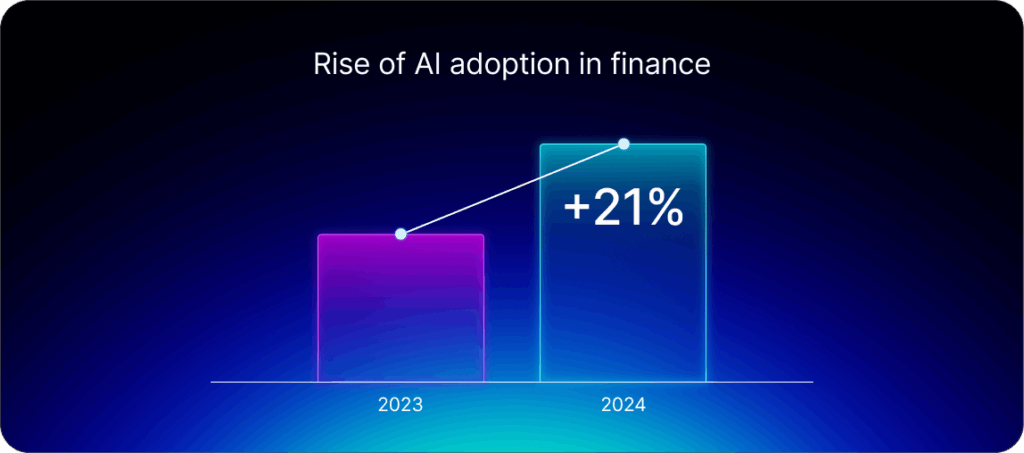

Wholesale finance platforms have matured significantly in recent years, with artificial intelligence workflow capabilities enhancing back-end operational processes. This was highlighted in a Gartner survey, which showed that the adoption of AI finance had increased by 21% from 2023 to 2024. As a result, tasks related to risk control and funding orchestration have become more robust and resilient. The future of these operations is expected to shift towards how users experience platform capabilities. Dealers, lenders, and internal teams increasingly expect the same clarity, speed, and responsiveness that they get from mainstream consumer applications.

For many organizations, the return on investment will be front of mind when considering the adoption of AI technologies. The benefits of being an early adopter are evident: 57% of leaders say the ROI exceeds their expectations, according to research by KPMG.

Small and medium-sized enterprises (SMEs) working with limited budgets may find it challenging to identify where to start. Many will already work across multiple systems, which becomes costly. Often, this will lead to silos being identified across the business. This creates a barrier to growth and leaves floor plan lenders vulnerable to the unknown. Real-time data in the modern world is a must for momentum. One thing that has become clear is that today’s users engage best with technology that recreates journeys they are used to. Positive experience leads to better adoption. Better adoption leads to growth.

User experience: Design for habit

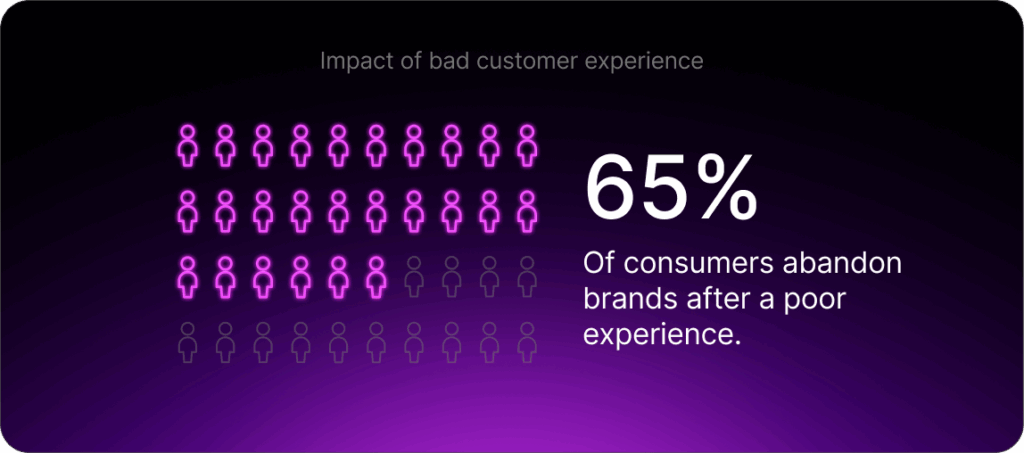

Think about front-end systems you are used to working with in your daily life. Gitnux statistics show that 65% of consumers will stop doing business with a brand after a bad experience. Now apply this to the internal adoption of new systems. If the user experience has not been addressed and they do not offer a similar streamlined experience to clients, how engaged will they be?

Internal adoption follows the same psychology as customer loyalty: if an interface feels confusing, users disengage. A clear, consistent UX builds confidence and routine, turning use into a habit. Offering a unified interface for servicing, risk, audits, and communications, built on shared context and data, can simplify this user engagement. Everything they need in one place, laid out in a way that is easy to digest and understand.

Plain language should explain why without further clarification. This helps ensure that transparency and ease of use are at the forefront of the user experience. Another way usage can be streamlined is through prefilled forms designed to reduce duplication and inline validation checks to ensure accuracy. Helpful defaults and clear task lists reduce user hesitation and rework.

Avoiding risk

By implementing a user experience that is clean, clear, and ensures submissions are right the first time from dealers and suppliers, risk is reduced through up-front validation. Lenders gain clear obligations, audit trails, and clean data. This is important to improve decision quality and overall portfolio hygiene. Tracking adoption metrics will not only identify anomalies to address, but also highlight points of friction, establish the time taken to complete tasks, and provide a continuous feedback loop. When the experience improves, engagement rises, data quality is strengthened, and operational risk declines.

These processes help build operational momentum by tracking due dates and providing clear ownership to engage all stakeholders, every step of the way. The next step should always be clear. Timestamped, traceable actions help promote accountability and confidence across lenders, dealers, and partners. The result is measurable: cleaner data, faster approvals, and lower operational risk across every dealer network.

Turning strength into everyday performance

The SBS Financing Platform has partnered with Vero Technologies to modernize Wholesale operations, providing modules that support activities such as underwriting, collections, originations, audits, titles, and real-time risk monitoring tools. This system consolidation enables SMEs to support all essential processes on one single platform, streamlining costs and simplifying operations.

“Wholesale finance excels at systems and falls short on experience,” according to John Mizzi, CEO of Vero Technologies.

“Going into 2026, design maturity becomes the bridge between capability and outcomes. Adoption improves when software behaves like the best consumer applications while respecting the complexity of regulated workflows. The result isn’t just happier users; it’s lower risk for lenders and their dealer and supplier customers,” Mizzi adds.

Great systems are necessary. Great experiences make them work every day. In a market facing cost pressure and rising expectations, UX turns technology investment into fewer clicks, faster cycles, cleaner data, and safer books. By combining SBS Wholesale Finance engine with modern UX principles, lenders will deliver a modern user experience that grows with them, adapts to their needs, and builds confidence among the wider team.

Get in touch with our experts today.