As of June 30, 2025, European banks and financial institutions will be required to submit their financial reports via a new digital platform called “Pillar 3 Data Hub.” This measure, put in place by the European Banking Authority (EBA), applies to the vast majority of banking sector players within the European Economic Area (EEA), including large investment banks and traditional credit institutions, as well as mid-sized structures. Only small, non-complex entities are exempt from this obligation. The reports will need to be formatted according to a specific technical standard (XBRL-CSV) and transmitted exclusively via the new centralized platform.

This regulatory reporting falls under Pillar 3, which requires banks to publish mandatory public reports detailing their financial strength, risk exposures and governance frameworks.

The first publication deadline within the P3DH framework deliberately coincides with the launch of the DPM 4.1 framework, which integrates important developments introduced by CRR III. These include the new credit risk treatment according to standardized and internal approaches, adjustments to the operational risk framework, new reporting models for credit valuation adjustment (CVA) risk, an expansion of information to be provided on ESG matters, as well as specific guidance concerning exposures to crypto-assets. The publication areas are grouped into 22 sections.

Pillar 3 covers a wide range of financial information and methods used to calculate risks, including:

- Summary of risk management, main prudential measures and risk weighting amount

- Risk management objectives and policies

- Scope of Pillar 3

- Own funds and countercyclical buffers

- Leverage ratio

- Credit risk quality

- Credit risk under standardized approach

- Credit risk under internal ratings-based approach

- Credit risk mitigation techniques

- Specialized lending and equity exposures

- Counterparty credit risk

- Exposures to securitization positions

- Market risk

- Credit value adjustment

- Operational risk

- Interest rate risk of non-trading book activities

- Remuneration policy

- Encumbered and unencumbered assets

- Prudential information on ESG risks

- Exposures to crypto-assets

The new format will be deployed in two phases: June 2025 for large systemic banks, and December 2025 for other institutions.

Financial institutions will have to transmit their reports via this new platform (P3DH) when they publish their financial statements, or as soon as possible after this date. Strict deadlines apply: six months after the reference date for annual reports and four months for quarterly and semi-annual reports.

As for language, financial institutions will have a choice. Their reports will be able to be submitted in English, in the institution’s language, or in both languages. While the technical format of the data (XBRL-CSV taxonomy) remains in English, comments and explanations can be written in the country of origin’s language, in English, or in both versions according to the institution’s preferences.

Piller 3 marks a major turning point in the administrative practices of the European financial sector. This model, which is entirely digital, allows regulators to directly control mandatory communications from banks to markets, while ensuring that this information remains comparable between institutions.

A broader regulatory landscape

P3DH is part of a wider European strategy in modernizing banking supervision. Its objective is to make regulatory data more consistent, comparable and accessible.

Since 2021, the EBA and the ECB have been preparing this digital shift through several actions. First, they have developed several technical initiatives – P3DH, IReF and BIRD, for instance – to modernize supervision tools. They have also strengthened European regulations that already demand greater transparency from banks, including CRR III and CRD VI. While these reforms are not directly related to digitalization, they do reinforce its urgency and necessity.

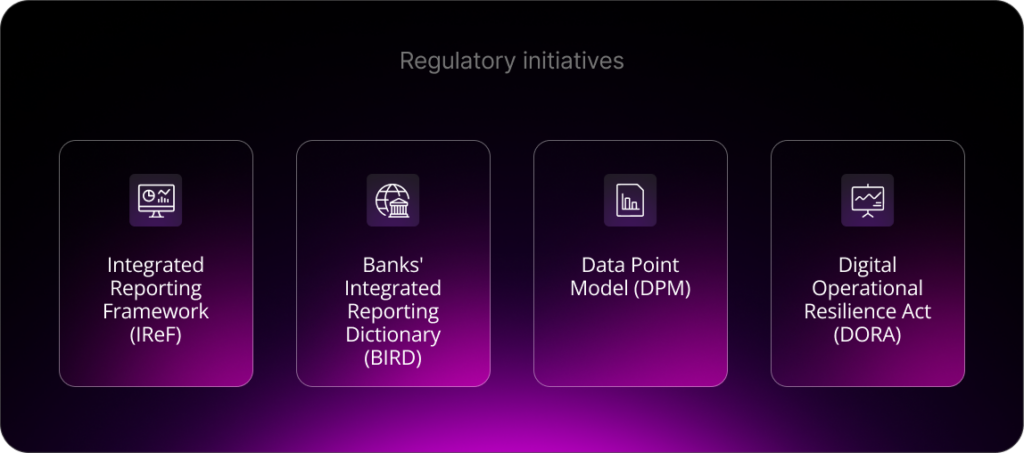

Indeed, Pillar 3 is just one piece of the puzzle. Other initiatives are shaping this new regulatory landscape, including:

- The Integrated Reporting Framework (IReF), led by the European Central Bank (ECB) aims to harmonize statistical reporting by 2027 — reducing redundancies and lightening banks’ reporting burden.

- The Banks’ Integrated Reporting Dictionary (BIRD) supports this effort by helping banks align their internal data models with regulatory requirements, promoting consistency from the source.

- The EBA’s Data Point Modelling (DPM) and XBRL taxonomic standards, already used for supervisory reports, now extend to Pillar 3 disclosures, strengthening interoperability between reporting regimes.

- The Digital Operational Resilience Act (DORA) has also been strengthening the regulatory landscape since January 2025. It requires banks to report ICT-related incidents in a standardized format, reflecting a growing appetite for real-time supervision.

At the same time, new European requirements on environmental and climate transparency are being added to this transformation. Institutions must now provide detailed data on their environmental and climate risks (the CSRD Directive and EBA guidelines on ESG disclosure), much of which also feeds into Pillar 3 reports.

Together, these initiatives outline a major evolution, suggesting that European regulatory reporting is moving from fragmented digital production to a centralized model, with uniform, structured and consistent formats.

For banking institutions, the challenge now goes beyond simple regulatory compliance. They must integrate into a European-scale structure around digital supervision.

The challenges of Pillar 3 compliance

Faced with this new regulation, financial institutions find themselves confronted with a problem. They must now produce more than 100 different tables, while ensuring that the relevant data remains consistent with their other regulatory declarations, such as those of Pillar 1. This is a complexity that far exceeds the capabilities of current working methods.

This requires institutions to completely rethink their way of producing, verifying and transmitting their regulatory reports, which in turn results in several specific challenges that need to be addressed.

- Ageing legacy systems. Many institutions – particularly smaller ones – still rely on obsolete reporting processes, based on PDF or manual. These are incompatible with structured data formats like XBRL-CSV. In order to successfully adapt, institutions will need to rework their reporting architecture.

- Operational overhaul. Transmitting the new Pillar 3 report requires reviewing the entire data lifecycle — from extraction and validation to formatting and publication.

- Data consistency. Reports must now meet stricter standards in terms of validation, quality control, traceability and, above all, consistency with Pillar 1.

- Reinforced governance. Submitting highly sensitive data and obtaining management validation require systematic integration of verification and validation processes across Finance, Risk, IT and Compliance departments.

- Cultural change. Reporting, risk and IT teams must work more closely together, break down traditional silos, and rethink established workflows that rely on outdated tools like Excel.

- Condensed transition window. The dual publication (on the bank’s website and via P3DH) from June to December 2025 is intended to secure the migration. However, this period is short in light of the technical and operational challenges to be overcome.

The repercussions of non-compliance are real. Incorrect or incomplete reports could trigger regulatory sanctions, increased surveillance and reputational damage – particularly for listed banks. Institutions that delay their investments risk falling behind in regulatory agility and operational efficiency.

Towards a winning Pillar 3 Data Hub strategy

The disappearance of publications on institutions’ websites in favor of a single channel — the P3DH — centralizes access to prudential information. This approach strengthens comparability and transparency, while requiring increased rigor in the production, validation and traceability of data, with full editorial responsibility remaining with the banks.

To effectively meet the needs of PHD3, banks must adopt a proactive and structured strategy. This means establishing a cross-functional compliance program led by financial management and risk, based on three pillars: modernizing reporting architecture (via tools capable of producing native XBRL-CSV), aligning processes between Pillar 1 and Pillar 3 filings to guarantee data consistency, and establishing robust governance integrating systematic managerial validations. The objective is no longer just to produce the required reports, but to align with a coherent and sustainable digital supervision model.

Beyond compliance, this reform can help to generate performance gains thanks to a higher quality of data, increased trust and reduced long-term costs. Adopting a strategy anchored in the centralization and reutilisation of data is the most effective way to respond to the requirement of Pillar 3 Data Hub, all the while gaining robustness and regulatory agility. This foundation (XBRL, data mapping, governance) can be reused in other frameworks — ESAP, ESG reporting, digital resilience — generating lasting synergies.

How SBS can help you

P3HD represents a fundamental change in how prudential data is reported and accessed across the EU. By introducing a harmonized digital platform for structured communications, the EBA is seeking to strengthen market discipline, reduce fragmentation and lay the groundwork for simplified access to supervisory data. The pressure is on for institutions to not only comply, but to do so efficiently.

To help with these challenges, SBP Regulatory Reporting offers a comprehensive toolbox for Pillar 3 compliance, including the ability to create P3DH tables with automatic recovery of existing Pillar 1 data, an intuitive table editor to adjust tables efficiently, verification of consistency between different declarations (Pillar 1/Pillar 3), traceability workflows, validation, and automatic generation of reports in the right format (XBRL-CSV for P3DH) and direct submission via P3DH.

Whether you’re tackling Pillar 3 for the first time or you’re looking to streamline your reporting architecture, our teams will know how to adapt to your profile. Thanks to their experience with several financial players already engaged in this Pillar 3 Data Hub transition, they favor an approach centered on data quality, control processes and operational efficiency.

Contact us today to learn more about how SBP Regulatory Reporting can help you to stay compliant.