Banking is a serious business. It manages the money people save, transact, and borrow, decisions that carry huge value and impact our everyday lives. While other sectors embrace artificial intelligence (AI), many banking customers remain wary, intimidated by technology advancements, overwhelmed by financial options, and anxious about cyber fraud. That is why banks of the future must evolve into enablers of their customers’ financial well-being, moving away from being product-centric to becoming customer-centric partners that utilize technology to simplify and support people’s financial lives. With AI, banks can go even further by dynamically customising products, such as features, rates, and offers, to meet customers’ individual needs and behaviors.

This is no longer about segments or cohorts. It is about understanding each customer as an individual in real-time and giving them what they need when they need it. Customers already experience this level of personalization in other parts of their lives, leaving them to wonder why their banks, which should know them best, continue to treat them like strangers. To close the gap, personalization must move from being a feature to becoming the foundation of customer experience, woven into the core of banking strategies.

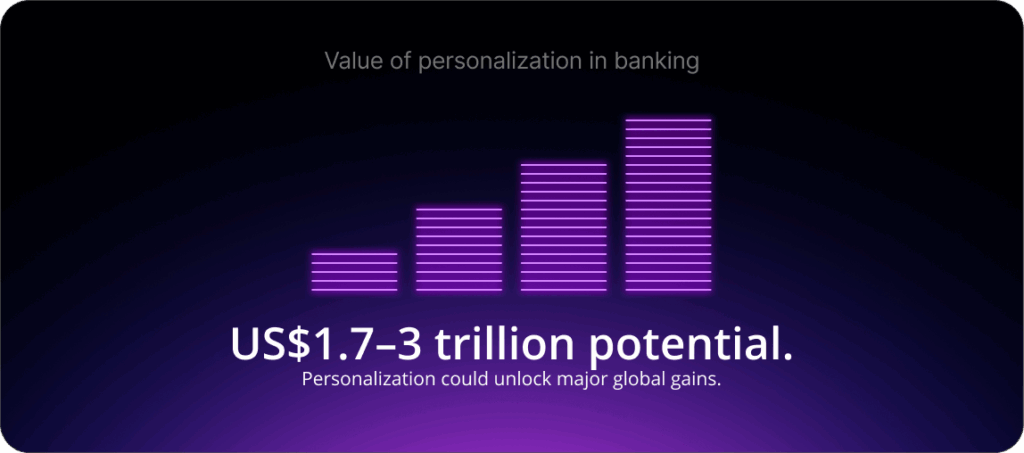

The stakes are too significant to ignore. According to McKinsey, unlocking personalization at scale could generate between $1.7 trillion and $3 trillion in global value for banks through higher revenues and cost efficiencies. Here, we explore what happens when personalization becomes the foundation of customer experience and how it evolves across four distinct levels.

Level 1: No personalization

At the baseline level, users receive a standard, well-designed digital experience that is simple, reliable, and intuitive.

In this case, the bank’s role is to act as a guardian of customers’ finances, ensuring an optimized user experience across all types of devices and interactions. That means:

- Making frequent tasks like bill payments or money transfers easy to carry out.

- Simplifying complex actions, such as onboarding.

- Designing responsive layouts that adapt to the type of device being used and its screen size.

- Building adaptive interfaces, such as showing a list-plus-details view via a desktop, but one clear item at a time on a mobile phone.

This stage involves designing for usability in various scenarios. It also works as a baseline for all online activities and forms the foundation for future personalization.

Level 2: Segmented personalization

At this stage, users are grouped into broad categories based on demographics, location, or other shared characteristics, in what is known as a “one-to-many” customization.

This is when a bank, as a long-term trustee, gives customers an experience that feels like a continued engagement. Examples include:

- Personalized landing screens: The bank app dynamically reorders its homepage based on behavior, showing frequently used services, such as transfers or bill payments. For instance, a customer who checks their credit card daily sees that widget first, while a freelancer might see expense tracking.

- Senior-friendly modes: This mode offers simplified interfaces, such as larger text, minimal clutter, and clear navigation, for older users. It is similar to Chinese tech giant Tencent’s WeChat “Easy Mode.”

This level is about designing for flexibility by adapting the interface to different types of usage for bank products and services. Based on principles of progressive enhancement, it provides an appropriate experience for customers regardless of the device or platform they use, while keeping the experience flexible, familiar, and intuitive.

Studies show that banking customers of all ages want a more personalized experience, according to a report by Ermarketer. Citing a 2024 Harris Poll, 74% of customers say they want more personal experiences from their banks, while 66% are comfortable with banks using their data to personalize their experiences.

Level 3: Behavioural personalization

At this level, personalization becomes dynamic, where the experience adjusts in response to individual actions and transaction patterns in the recent past. This “one-to-some” personalization is driven by profiles and behavioral data.

This is when the bank acts as an enabler of financial health, using insights to help customers make better money decisions. Examples include:

- A customer who spends on travel receives a travel card offer with cashback and FX fee waivers rather than a generic promotion. In this case, the bank recommends a personalized product that aligns with the customer’s income, spending category, and lifestyle based on pKYC and transaction history.

- A user who pays off a loan or receives a salary increase receives a personalized message, such as: “Congratulations! You’ve just cleared your loan / received a pay rise, would you like to move that extra cash into a high-yield online savings account?”

This level is about sincerity and trust, proving that the bank understands a customer’s situation and is working towards their financial well-being. As McKinsey notes, 71% of consumers expect companies to deliver personalized interactions, and 76% are frustrated when this fails to happen.

Level 4: Contextual personalization

The highest level of personalization is focused on tailored content, recommendations, and dynamic information that is based on current events, a customer’s location, the time of day, and the type of device being used to access a banking app or platform.

Here, the bank acts as a trusted financial partner, anticipating customers’ needs and offering personalized experiences with “nudges”, or recommendations, as well as pre-approved credit offers, or repayment negotiations. Examples of personalized value propositions include:

- “Your Spotify bill has increased by €3, do you want to check your subscription?” or “We’ve spotted duplicate payments to vendor X, would you like to dispute this?”

- A more sophisticated scenario could be offering a flexible credit line to a small business owner showing cash-flow strain.

- A retail customer has maxed out their credit card at Home Depot and clearly needs money for home renovations that the bank could provide.

- A loyal retail customer is shopping for a new car but doesn’t want to fill out a loan application. Their bank gives them a pre-approved loan at a personalized rate.

- Banks have access to a wealth of data to identify early signs of financial stress. By proactively contacting customers to discuss repayments, they can de-stress portfolios and preserve positive relationships.

This level is about evolution, translating financial insights into proactive, human-centered journeys that build loyalty.

Hyper-personalization is currently the most promising, and challenging, frontier for banks. The answer lies in the combination of behavioral data, contextual data, and declared preferences to create experiences that feel helpful rather than intrusive.

However, just 4% of banks are currently scaling AI to achieve this level, according to a report by BCG. The remaining 96% are either not ready for hyper-personalization or are stuck in pilot mode, running experiments that never scale and treating AI as a feature bolted on rather than integrated into their business strategies and core systems.

Conclusion: Start small, learn fast

From a customer’s perspective, the timing and context of information are essential elements to create personalized journeys that lead to successful outcomes. In other words, banks must recognize when customers make important financial decisions and recommend relevant, personalized solutions with a clear call to action. It is also important to note that success doesn’t come from one-off transformations. Instead, it is about starting small and learning fast, as personalization is iterative, not a big bang.

Digital banking may feel impersonal by nature, but technologies such as machine learning and generative AI can change that, turning transaction data into continuous, emotionally engaging conversations.

The key to achieving this is to move from siloed systems to connected ecosystems, processes, and communications. This includes switching from a product-centric business model to solution-centric thinking and offering customised advice and dynamic pricing rather than static offers. These shifts will help make financial services more relevant and personal for all customers, at every stage of their lives.

Explore more on this theme in our podcast episode, Hyper-personalization: The key to customer growth in banking.

Get in touch with our experts today.