In recent years, the bar for customer experience has risen sharply. The likes of Amazon, Netflix and Uber have reset expectations by offering services that are streamlined, personalized and available at the touch of a button. At the center of these frictionless interactions is a finely tuned engine: vast amounts of data processed in real time to anticipate needs, remove barriers and make the complex feel effortless. That shift has spread far beyond entertainment and retail. It has reached banking, where embedded finance is transforming how customers access financial services, and where traditional institutions have struggled to keep pace. Younger, digital-first competitors have stepped in to offer the kind of instant, seamless services customers now expect everywhere.

Through open banking and embedded finance, traditional legacy banks can unlock the value of the data they hold and deliver services where customers already spend their time: inside the platforms and transactions that shape daily life. Done well, finance becomes less about clunky processes and more about invisible support, with banking that fades into the background and enables moments of ease and delight.

Many banks are currently failing to turn data into seamless CX

Legacy banks have long relied on reputation and trust to secure their place in the financial system. But when it comes to digital experience, they have slipped behind. Everyday tasks still require in-branch visits or long online forms. Payments can take days to settle. Mobile apps crash or lack basic features. Logins often mean juggling passwords, codes and security questions.

The irony is that banks already hold the kind of data that could remove many of these obstacles. Used well, it could make financial services almost invisible: payments clearing instantly, tailored offers appearing at the right moment, authentication blending into daily life. Instead, too much of this data remains locked away. A bank may see a customer paying rent each month yet fail to translate that into a timely mortgage offer. More often it sends irrelevant promotions, like credit cards to those who already have them, or loans to those who don’t qualify.

These frictions are not small annoyances; they shape loyalty. More than a billion people worldwide now use digital-first challengers such as Revolut and Monzo. A survey of 7,000 banking customers found that nearly three-quarters considered personalization highly important, and just as many said they would switch providers to get it. For legacy institutions, the risk is clear: unless they learn to begin using their data to better serve the customer, they risk losing ground to the competition.

The next generation of banking customers

Today’s and tomorrow’s banking customers are digital natives, Millennials, Gen Z and soon Gen Alpha, born into an always-on, one-tap world. For them, waiting days for a payment to clear or filling out forms on desktop computer feels archaic. They expect the same instant, tailored experience they get from Netflix, Amazon and Uber: real-time responses, frictionless journeys and services that anticipate needs before they’re expressed.

This mindset is now spreading across all age groups. A 2024 Harris Poll found that 74% of customers want more personalized experiences from their banks, while 66% are comfortable with banks using their data to deliver them. These are clear signs that the expectations shaped by younger generations are rapidly becoming the norm. The next generation of clients will reward banks that act at their speed and on their terms.

Open banking and embedded finance

The trouble for many traditional banks is that they still treat banking as a destination: a branch to visit, an app to open, a website to log into. Each interaction is framed as a separate process, pulling the customer out of their own journey and into the bank’s. By contrast, companies such as Netflix, Uber and Amazon, and a growing class of digital-first banks, succeed precisely because they are not destinations. They disappear into the background of something larger and more meaningful, such as booking a ride, watching a film or making a purchase. In these moments, finance is present but almost invisible.

Open banking allows customers to share their financial data securely across providers, giving institutions the raw material for real-time personalization. Embedded finance takes this further by placing services directly inside the platforms where people already live their lives. Together, they point to a future in which banking is not a channel to visit but a hidden layer that supports the things people care about. The bank is still there, underwriting the payment, providing the credit, managing the account, but it fades into the background, turning what was once effortful into something closer to effortless.

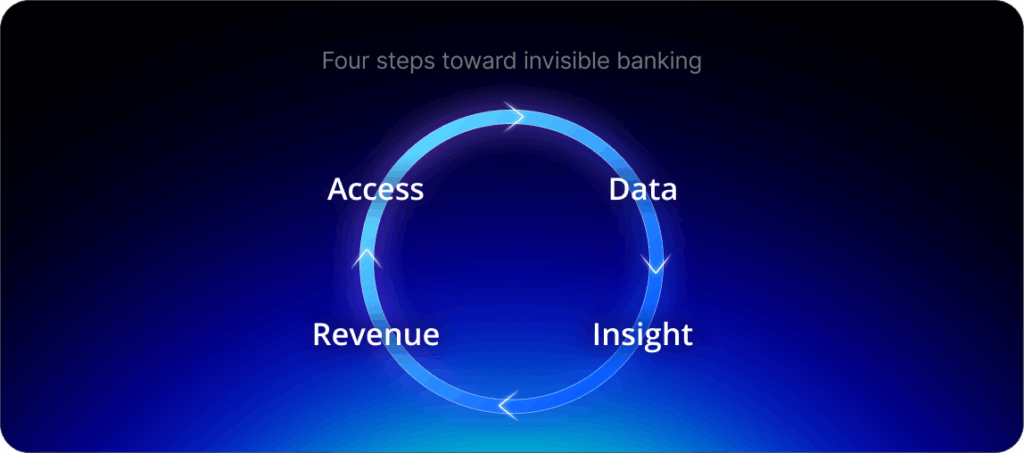

Four steps toward invisible banking

If traditional banks are to close the gap, they need more than better apps or faster log-ins. They need a structural shift in how they design, deliver and distribute services. The good news is that the foundations are already in place. A global survey on APIs in banking found that 88% of respondents believe APIs have become more important over the past two years, a sign that the industry understands where things are heading.

Digital-first firms already treat data and distribution as core infrastructure. They are built on APIs, making it easy to plug services into different contexts, and they are skilled at turning customer signals into relevant offers in real time. For them, personalization is not a tactic but the operating model. Banks have the scale, trust and customer base, but too often lack the agility to use these tools effectively. Closing that gap requires a clear plan. It is not about tearing up the system, but about rethinking existing strengths. The path forward can be broken into four steps.

Access

Stop treating banking products as static offerings. Credit scoring, payments, KYC checks and lending can all be made available through secure APIs and plugged directly into other customer journeys. A loan no longer has to sit on a bank’s website; it can appear at a retailer’s checkout. A payment option can live inside a gig-work app. An account can be embedded in the software a small business already uses. Opening access multiplies distribution overnight.

Data

Each time a financial product is used in this embedded way, it generates new context. Who clicked, when, from what device, in the middle of which transaction? That information is far more valuable than the static records banks have traditionally relied on. Combined with consented open banking data, it allows decisions to be made instantly and tailored to the moment.

Insight

Data only matters when it becomes intelligence. This is where invisible banking takes shape. Instead of sending generic offers, banks can use live signals to shape meaningful responses. A small business with delayed invoices might be offered a 60-day working capital line, not a standard loan. A family saving for a holiday might see a short-term product that matches that goal. This is personalization as service, not marketing.

Revenue

When relevance and timing align, the economics change. Conversion rates rise, acquisition costs fall, in some cases by 15 to 20 times compared with traditional channels. Retention improves too, because the bank is no longer pushing products but solving problems in real time. Over time, this creates a defensible position: once a service is embedded in someone’s workflow or daily routine, it is not easily replaced.

Taken together, these steps form a reinforcing cycle: access creates data, data produces insight, insight enables relevance and relevance delivers revenue. With each turn, the model becomes sharper and more effective. What may start as an experiment in distribution can evolve into a new operating model, one in which banking no longer interrupts life but supports it, quietly and continuously, in the background.

Open banking and embedded finance: the key to turning data into delight

The lesson from Amazon, Netflix and Uber is not that banks should become retailers or entertainment companies. It is that convenience, relevance and invisibility now define good service. Customers do not wake up wanting to log into a banking app. They want to buy a home, run a business, plan a holiday, pay a bill. Finance works best when it enables those goals without getting in the way.

Open banking and embedded finance give traditional institutions the chance to meet that expectation. But the window is narrowing. Customers will not wait. Those who act quickly can transform data into trust, utility into delight. Those who hesitate may still be present, but increasingly invisible in the wrong sense: a service people use only because they must, not because they choose to.

For banks, the choice is plain. The future belongs to those who make themselves invisible in the right way.

Explore more on this theme in our podcast episode, The age of invisible banking.