Loan origination has failed to keep up with other areas of digital banking, often weighed down by fragmented data, complex, customer-sensitive processes and high costs. With inflation pressure, rising credit risk, and tighter supervision, improving origination isn’t “digital nice-to-have” it’s becoming a margin and risk imperative. Open banking is changing the game. What started with PSD2 compliance has evolved into a strategic capability: permissioned access to real customer cash‑flow signals.

Research shows that an increasing number of banks now cite open banking as a top enabler of digital transformation in credit and risk. By combining open banking data with artificial intelligence, banks can improve the efficiency, quality and customer experience of loan origination.

From a compliance burden to a strategic advantage

When PSD2 arrived in 2018, many institutions treated it as a cost. But the same API foundations now underpin Europe’s faster, safer data sharing ecosystems. When PSD2 came into force in 2018, many banks saw it as a costly compliance exercise. However, the same framework of open APIs now supports Europe’s digital banking transformation.

The EU’s upcoming PSD3 and proposed Financial Data Access (FiDA) framework promise even greater interoperability and consumer trust. At the same time, the AI Act will introduce rules for responsible automation rather than impede innovation. This has reframed regulation as a foundation for growth, with clearer rules and shared data standards that allows banks to treat regulatory compliance as a platform for innovation, such as building data-driven lending models that are both secure and transparent.

Europe’s regulatory architecture is also the perfect sandbox for data-driven lending as other countries are watching how PSD3 and FiDA reshape data access, as well as how responsible AI and data portability will converge.

What pain points is Open Banking solving?

For banks and financial institutions, many lending journeys breaks down at the onboarding stage, typically caused by complex paperwork, fragmented data, and slow verification processes, leading to lost revenue and customer frustration.

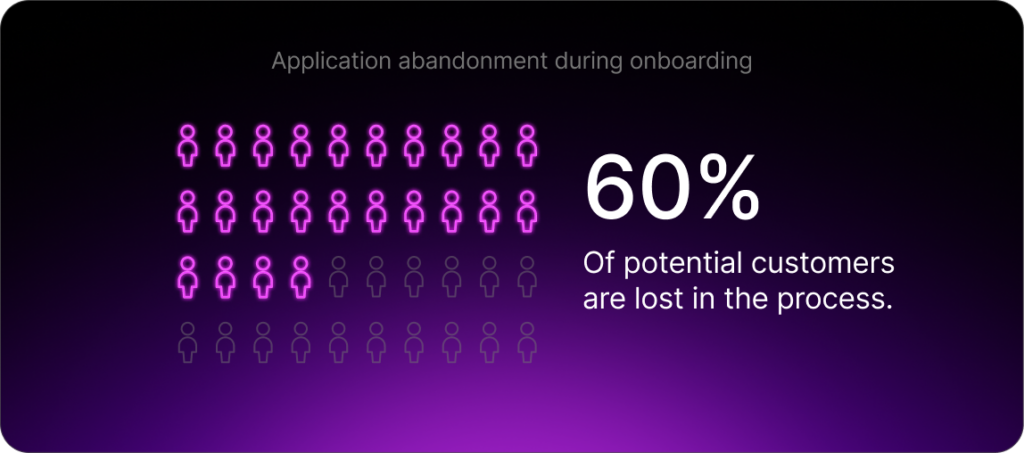

For instance, 68% of consumers in Europe have abandoned a financial application, according to Signicat’s 2022 Battle to Onboard study. The average speed of abandonment is also growing, according to Signicat. The study found that customers abandoned an online application for a financial product in just 18 minutes and 53 seconds, seven minutes faster than in 2020. Application abandonment is a costly exercise for banks. According to a report by The Financial Brand, banks lose up to 60% of potential customers this way.

“Every abandoned application is more than just a lost conversion – it represents missed revenue, increased customer acquisition costs, and a missed opportunity to build lasting relationships and higher lifetime value,” The Financial Brand notes in the report.

And the issue is not confined to Europe. A 2024 study by Fenergo found that 67% of banks worldwide have lost customers due to slow and inefficient onboarding. Open banking helps by enabling real-time data sharing, automated verification, and instant consent based access to verified account data. This allows banks to make faster, more accurate risk assessments and reduce the friction of loan applications for both retail and business borrowers.

How does AI transform Open Banking data into lending intelligence?

Open banking provides the data and AI transforms it into insight, turning raw transactions into real-time credit intelligence. Combined, they allow banks to make faster, fairer, and more inclusive credit decisions.

“In the next two years, creditworthiness will be defined more by real-time cash flow than static credit scores. That is the shift open banking makes possible.”

Nicolas de Genot de Nieukerken, Lead Product Manager of Open Banking at SBS

Mastercard research shows that 46% of small business owners in the US say limited credit history affects their loan opportunities, an issue that open banking data can help solve.

AI models trained on permissioned real-time datasets can analyse cash flow, spending, and income trends to evaluate affordability. The result is faster approvals, more consistent outcomes, and broader access to credit. The real shift is this: lending decisions become less about static snapshots and more about living financial behavior. This help banks reduce approval times from days to minutes, while improve accuracy and compliance posture.

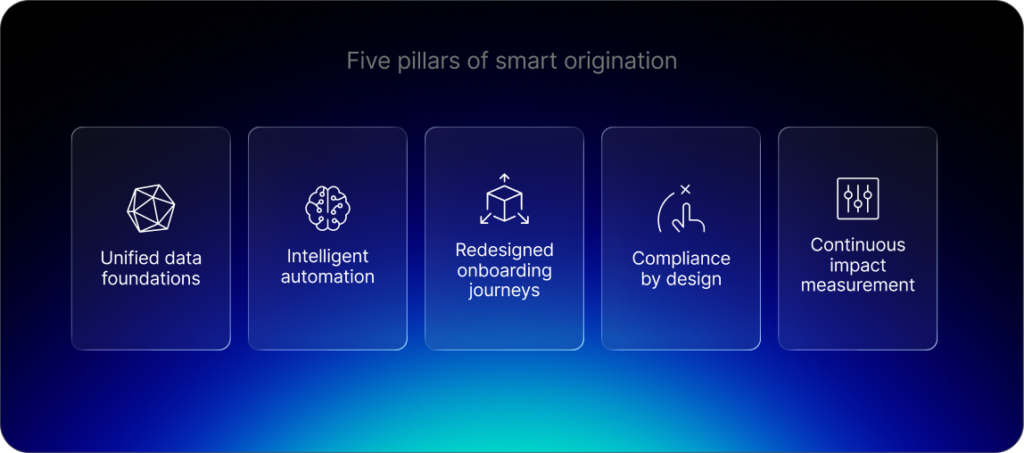

What are the five pillars of smart origination?

Efficiency alone is not the goal. Smart origination is about building intelligence, governance and learning into every stage of the process. Some banks have adopted several best practices to cement their loan origination transformation. These include:

- Unified data foundations.

- Intelligent automation.

- Redesigned onboarding journeys.

- Compliance by design.

- Continuous impact measurement.

Embedding compliance monitoring directly into origination workflows can improve efficiency while freeing up teams to focus on other revenue streams within the business. It is also worth noting that efficiency is now an essential metric for banks operating under ever-tighter margins and growing competition.

Benefits to share

While compliance may have been the spark that started the transformation, open banking and AI are redefining smart lending today. It is data-driven, transparent, and designed to mitigate the pain points in loan origination.

For banks ready to embrace the open banking shift, loan origination no longer needs to be a costly, time-consuming exercise. Instead, it is a powerful engine for efficiency, cost reduction, improved customer experience, and revenue growth.

“Speed alone is no longer the differentiator; speed with intelligence is. Open banking gives us data, but explainable AI gives us the confidence to act on it.”

Hassan Nasser, Deputy General Manager of Digital Engagement at SBS

How SBS can help

Our SBP Loan Origination and SBP Open Banking solutions are already enabling European banks to achieve instant, compliant credit decisioning, without overhauling their legacy systems. The modular, API-first, AI-ready architecture is compliant by design and can be deployed quickly across existing systems. The future of lending will not be defined by how fast banks process data, but by how intelligently they act on it. Open banking and AI make that intelligence possible today.

Questions & Answers

What is open banking and how does it relate to lending? + –

Open banking provides permissioned access to real customer cash-flow signals through secure APIs. In lending, it allows banks to use real-time transaction data and cash-flow analysis to make faster, more accurate credit decisions.

How quickly can AI-powered loan origination process applications? + –

By combining open banking data with AI, banks can reduce approval times from days to minutes. AI transforms real-time transaction data into instant credit intelligence, enabling faster and more accurate decision-making.

Is open banking data secure for loan applications? + –

Open banking operates within Europe’s regulatory framework and supports faster, safer data sharing. Regulation provides clearer rules and shared data standards that allow banks to build data-driven lending models.

How does this technology help customers with limited credit history? + –

Mastercard research shows that 46% of small business owners in the US say limited credit history affects their loan opportunities. By analysing real-time cash flow, open banking and AI enable faster, fairer, and more inclusive credit decisions.