The rapid rise of neobanks in France since the 2008 financial crisis has revolutionized how consumers are banking and managing their money. While the financial crisis kicked off the neobank trend, it was the Covid pandemic lockdowns that cemented the fintech sector’s innovative banking solutions, as physical branches closed and millions of people worldwide switched their financial lives online to pay bills, send and receive money, and manage their accounts 24/7.

“During the period of Covid-19 in 2020, the rise in the demand for neobanking has created an opportunity for neobanking service providers in Europe,” Polaris Market Research says in a report on Europe’s neobanking market.

In our Banking is Local series, we turn our focus to neobanks in France, as fintechs challenge traditional brick-and-mortar lenders with their data-driven agility to adapt to evolving consumer demands, create seamless onboarding processes, and offer hyperpersonalized services.

A brief history of neobanks in France

The seeds of digital banking in France were planted after the 2008 financial crisis, triggered by the US sub-prime mortgage crisis and the collapse of Lehman Bros, as consumer trust in traditional banks plummeted and fintech innovations began to reshape the global financial landscape. In the 2010s, traditional banks responded to shifting consumer expectations by launching digital subsidiaries. Leading the way is Société Générale’s BoursoBank, the biggest online bank in France with 7 million customers, and BNP Paribas subsidiaries Nickel and Hello bank!

All three have leveraged their parent companies’ resources to establish a strong foothold in the digital banking market. Business-focused digital banking is also gaining traction in France, with Paris-based platforms Qonto and Memo Bank thriving—and signaling a different type of fintech innovation thanks to their focus on the backbone of the French economy: small-to-medium enterprises.

“They offer services like managing credit, transactions, and assets. Furthermore, small and micro businesses are attracted to features like easy account creation, smooth transactions, and creative methods for assessing creditworthiness,” according to a report by Spherical Insights.

What makes neobanks stand out in France?

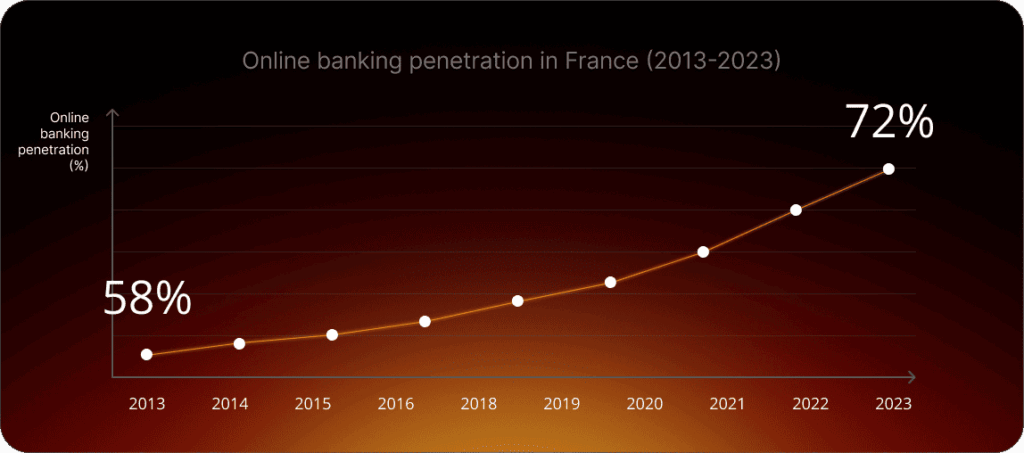

Online banking penetration in France has reached a relatively high rate of 72%, up from 58% in 2013. This is 9% above the EU average and a reflection of French consumers’ growing comfort with digital financial services, according to Statista.

Neobanks in France are gaining traction for several reasons, including:

- Mobile-first convenience: Real-time banking services align with evolving consumer preferences, allowing them to manage their finances, budget, save, and apply for credit and other financial products at any time of the day or night.

- Data-rich hyperpersonalization: From customer support to tailored recommendations and financial advice, neobanks have access to a wealth of customer data, enabling them to personalize their services. Driven by artificial intelligence and machine learning, studies show that this approach not only boosts customer satisfaction and loyalty, but also revenue growth.

- Cost transparency: Thanks to their cost-efficient digital business model, neobanks can offer lower account fees, which appeal to cost-conscious customers. For instance, Germany’s N26 and the UK’s Revolut offer free accounts in France with competitive foreign transaction rates. Interest rates are also typically higher than traditional banks.

- Streamlined onboarding: Instant account setup and virtual cards are key differentiators in neobanking. BoursoBank and Nickel have perfected these processes, ensuring rapid adoption by users seeking streamlined onboarding processes.

Combined, these elements have enabled neobanks to carve out a niche in a market that has been dominated by the digital banking platforms offered by traditional banks.

The role of regulation and market context

France’s robust regulatory framework, particularly the EU’s Payment Services Directive Two (PSD2), has played a key role in enabling open banking and fostering competition in digital banking, as well as ensuring that consumers can protect their sensitive financial data. French regulators have actively supported the adoption of instant payments through incentives and aligning with broader EU initiatives.

These include integrating with pan-European infrastructure—such as the European Banking Authority’s RT1 system, which provides a platform for real-time payments under the SEPA Instant Credit Transfer scheme, and the European Central Bank’s Target Instant Payment Settlement (TIPS) service—to ensure that both incumbent and challenger banks can provide real-time transactions.

This has allowed international neobanks like Revolut and N26 to enter the French market and challenge traditional incumbents. “By giving access to customer data to third-party service providers as well as increasing authentication and security measures for online payments and transactions, the PSD2 has been seen and realized to be a revolutionary move toward a standardized uniform digital market that is more customer-centric than any other policy,” according to a report by US-based tech company Prove.

However, local regulations also favor traditional banks, which continue to dominate digital banking by leveraging their established customer bases and infrastructure. BoursoBank and Nickel are good examples of traditional banks that have successfully adapted to the digital age.

What do French banking customers want?

When it comes to banking, French consumers’ preferences have been shaped by cultural and economic factors, including:

- Trust in established brands: Traditional banks remain the first choice for many due to their historical presence and perceived stability.

- Tech-savvy demographics: Younger users, particularly those aged 25-34, demand mobile-first solutions, making up the largest share of digital banking users.

- Practical features: Budgeting tools, real-time transaction notifications, and seamless international transfers are highly valued, driving the popularity of neobanks.

However, it is the 25-34 age group that has emerged as the most digitally engaged demographic in France, boasting an impressive 86.71% online banking penetration rate in 2023, the data platform says.

“These users primarily leverage mobile banking apps for fundamental financial management tasks, with checking account balances and transactions being the primary use of mobile banking apps,” Statista says.

“[This is] followed closely by budgeting and expense tracking functions, indicating that digital banking has become deeply integrated into daily financial routines.” French women are also showing higher engagement with digital banking services than their male counterparts, Statista adds. In 2023, over 73% of female internet users conducted banking activities online compared with 71.66% of men.

Meanwhile, a French Banking Federation (FBF) survey conducted in February 2024 found that 79% of French banking customers had downloaded at least one banking app, and 94% consulted their bank’s website or app to track their accounts and monitor their budgets and spending. “More than eight out of 10 French people acknowledge the innovative nature of banks and believe this innovation is going in the right direction,” FBF said.

What does the future hold?

As the challenger bank trend continues, neobanks are poised for greater growth in France in the coming years. This is despite Europe’s third-largest economy lagging behind EU neighbors when it comes to a successful, homegrown consumer neobank, such as N26 or Revolut. However, French fintech Lydia, a peer-to-peer payments app launched in 2013, aims to shake up the country’s neobank sector after announcing in May 2024 that it will split its app into two and launch the Sumeria banking app with an investment of €100 million. Despite being several years behind its competitors, the fintech says it expects to receive a banking license by 2026.

In the meantime, the number of digital bank users in France is forecast to continue rising between 2024 and 2028, according to a report by Statista. The segment counted 11.16 million users in 2024 and is expected to grow by 3.31 million users, reaching approximately 14.47 million by 2028. There is also room for growth, particularly among older demographics and underserved rural areas, while new regulatory frameworks and open banking initiatives will continue to shape the competitive landscape.

Conclusion: France’s unique digital shift

France’s digital banking sector is a story of adaptation and evolution as players embrace cloud computing, big data, and AI. The dominance of traditional banks’ online subsidiaries, combined with the gradual rise of neobanks, highlights the country’s unique approach to digital transformation—and how it has been embedded into consumers’ daily financial routines.

As consumer preferences continue to shift and new players enter the market, the banking landscape is becoming more dynamic, showing that local factors heavily influence global trends in fintech.

For more expert content on industry outlooks and innovation, subscribe to our newsletter or visit our Insights page.

This article is also available in video format—watch below.

Questions & Answers

What is the difference between a neobank and a traditional online bank? + –

Neobanks are fully digital financial institutions with no physical branches. They rely on cutting-edge technology to deliver banking services entirely online. Traditional online banks, by contrast, are often subsidiaries of established banking groups. They combine digital services with potential access to their parent banks’ physical branch networks.

Are neobanks safe in France? + –

Neobanks operating in France are regulated by the same authorities as traditional banks. They must comply with European security standards and regulatory requirements, ensuring a high level of protection for customers’ funds and data.

How do you open an account with a neobank? + –

Account opening is fully digital and carried out via a mobile application. The process usually takes less than 10 minutes. Customers are required to provide a valid ID, proof of address, and in some cases a selfie for identity verification.

What fees do neobanks typically charge? + –

Most neobanks offer free basic accounts. Fees generally apply to premium services, foreign withdrawals beyond a certain threshold, or high-end cards with additional features.