Instant payments have come a long way since 1997, when global soft drink conglomerate Coca-Cola emerged as an unlikely pioneer of the world’s first mobile payment system. A Coca-Cola vending machine was installed at Helsinki Airport in Finland, allowing passengers to pay for their drinks by sending an SMS from their mobile phones. The simple pilot system sent the payment to the customer’s mobile bill, removing the need for cash or cards, and paving the way for the development of international payment processing services. A year later, Confinity, now known as PayPal, launched and the company processed its first payment in 1999, showing that digital, account-based payments could work at scale. Just over a decade later, mobile wallets pushed payments further into the mainstream with the rollout of Google Pay, followed by Apple Pay, which embedded payments directly into smartphones.

Fast forward to today, and the global transaction value of instant payments has reached $60 trillion, according to a study by Juniper Research. Over the next five years, it is expected to grow by 115% to reach $129 trillion, driven by instant payment schemes such as Europe’s SEPA Instant Credit Transfer (SCT Inst) and the growing adoption of FedNow in the US, Juniper Research says. As a result, consumers and businesses now expect real-time transfers 24/7, accelerating the shift toward instant payments and driving banks and financial services firms to modernise their payment processing systems.

Instant payments have become an integral part of everyday life, with users able to tap, scan, or click to move money in seconds. But behind the seamless experience lies a complex payment infrastructure and evolving regulatory measures to protect consumers. Here, we look at how instant payments work.

What are instant payments?

- Verification of Payee: Banks verify the recipient’s name before authorisation for all euro credit transfers.

- Fee parity: Instant payments cannot cost more than a standard SEPA transfer.

Common use cases for instant payments

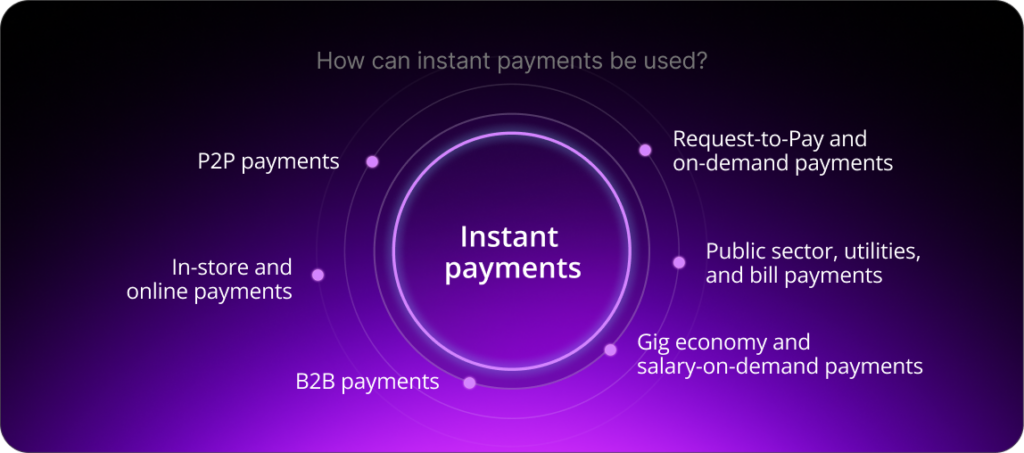

Instant payments are increasingly embedded across a range of use cases to support both consumer and business transactions. For example:

| Use case | Description |

| Person-to-person (P2P) payments | Users can send money to friends, family, or other individuals directly through their bank’s mobile app or other integrated service. |

| In-store and online payments | Instant payments can be used for retail transactions, including QR code and contactless payments. |

| Business-to-business (B2B) payments | Companies can pay suppliers or service providers as soon as an invoice is approved, boosting cash flows and reducing settlement delays. |

| Gig economy and salary-on-demand payments | Employers and platforms can pay gig workers or employees instantly after a task or shift is completed, rather than waiting for monthly or fortnightly payroll cycles. |

| Public sector, utilities, and bill payments | Taxes, government fees, and utility bills can be paid and received in real time, with immediate confirmation for both the payer and recipient. |

How do instant payments actually work (SCT Inst)?

In Europe, instant payments are processed through the SCT Inst scheme. While the process is complex, transactions are typically processed within a target time of five seconds, ensuring that funds are made available to the beneficiary within a maximum of 10 seconds. According to the SEPA Instant Credit Transfer Scheme Rulebook, there are eight steps:

- Step 1: The process begins when the payer, either an individual or business, initiates an instant credit transfer through their bank or PSP via a mobile app or online platform. A time of receipt is generated for the instruction, and the PSP must perform all processing condition checks, such as compliance, and verify the availability of funds.

- Step 2: The payer’s PSP sends the SCT Inst transaction message to the Clearing and Settlement Mechanism (CSM), which instantly reserves the funds for transfer. It also sends the SCT Inst Transaction to the CSM of the beneficiary’s PSP.

- Step 3: The beneficiary’s CSM instantly sends the transaction message to the account holder’s PSP, which then verifies whether it can apply the transaction to their account and executes various validation checks.

- Step 4: The beneficiary PSP sends a confirmation message to its CSM, indicating that it has received the transaction and can process it immediately (positive confirmation) or not (negative confirmation with an immediate reject). If rejected, the payer’s CSM releases the reservation of funds.

- Step 5: When the beneficiary’s PSP sends a positive confirmation via the message in step 4, the funds are instantly available in their account.

- Step 6: The CSM of the payer’s PSP instantly reports to the account holder whether the transaction succeeded or failed.

- Step 7: If a negative confirmation is received within 9 seconds of the timestamp, the payer’s PSP must inform them and lift the fund reservation. However, if the transaction confirmation is positive, the PSP debits the payer’s account.

- Step 8: If the payer’s PSP receives no confirmation message within 10 seconds of the timestamp, it must restore the payment account to its original amount by lifting the reservation instruction.

What’s next in Europe?

The European Central Bank says its instant payment strategy is focused on the scheme’s full deployment across the EU to ensure that it is available at every point of interaction, such as retail stores, online platforms, and on mobile devices.

“Customers should be able to make payments at the physical point-of-sale or via e-commerce, including on their mobile, throughout the entire European Union just as efficiently and safely as in their home countries,” the ECB says in the strategy report.

“At the moment, we lack a pan-European solution for payments made in physical shops or online.”

The ECB adds that it is working toward five key objectives, including pan-European reach and customer experience, convenience and low cost, safety and efficiency, and European brand and governance, while its long-term goal is global acceptance.

Beyond Europe

Instant payment schemes are increasingly being implemented worldwide, including in Asia and Africa. However, a Juniper Research report notes that many are limited by national payment rails that can only process payments domestically, resulting in slower cross-border transactions.

Countries in Southeast Asia are overcoming this challenge. For example, cross-border payments have been boosted by connecting standardized QR code systems across a number of countries, according to the Asean+3 Macroeconomic Research Office (AMRO).

These include Cambodia’s KHQR instant payment system, Indonesia’s QRIS, Thailand’s PromptPay, Singapore’s PayNow, Malaysia’s DuitNow, and the Philippines’ QR Ph, among others, the AMRO adds. The Bank for International Settlements has also launched Project Nexus, which aims to connect cross-border instant payments within the 11-member Association of Southeast Asian Nations (ASEAN).

Meanwhile, Africa is making inroads with the Pan-African Payment and Settlement System (PAPSS), an initiative backed by the African Union and Afreximbank. PAPSS provides low-cost, instant or near-instant cross-border transfers, settlement in local African currencies and is available 24/7, 365 days of the year.

Instant payments are not only a European story. They mark a global shift in how value moves across economies, despite differences in regional strategies and timelines. What began as a simple vending machine pilot in Finland has evolved into today’s modern payment infrastructure, giving consumers and businesses a convenient, low-cost way to move their money in real-time.

For more expert content on industry outlooks and innovation, subscribe to our newsletter or visit our Insights page.

Get in touch with our experts today.

Questions & Answers

Which company is credited with pioneering the world’s first mobile payment system? + –

In 1997, Coca-Cola installed a soft drink vending machine at Helsinki Airport , which allowed people to pay for drinks by sending an SMS from their mobile phones.

Can consumers make instant transfers every day of the year? + –

Yes, instant transfers can take place 24/7, 365 days a year.

How do consumers use instant payments to support their daily financial management? + –

They support everyday use cases, including P2P transfers, shopping, and tax and utility bill payments.

What is the value of instant payment transactions per year? + –

Instant payments reached $60 trillion in 2025 and is projected to grow by 115% to reach $129 trillion by 2030.

Which countries are adopting instant payments? + –

Many countries have either adopted instant payment schemes or are in the process of introducing them. This includes the European Union, the US, Malaysia, Singapore, Cambodia and countries across Africa, among others.