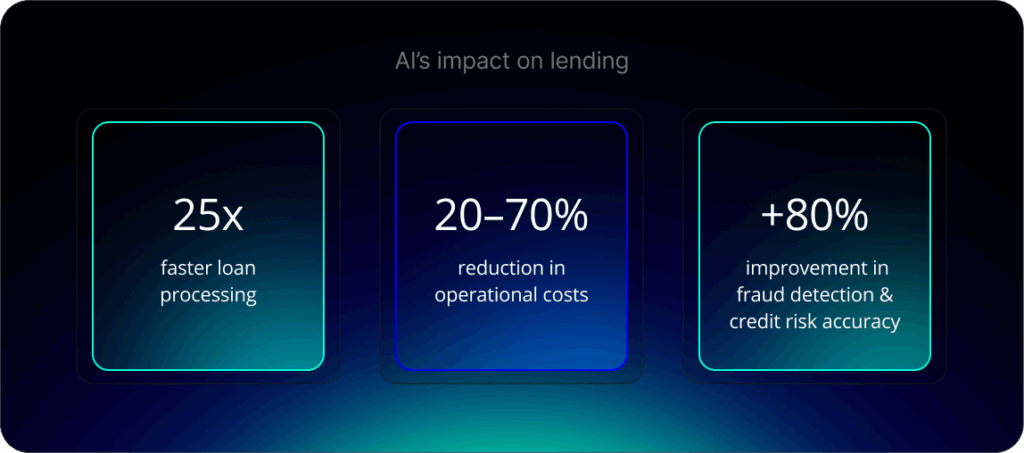

In recent years, artificial intelligence has become a ubiquitous presence in the lending sector. Key areas affected within the digital lending process include predictive analytics to improve approval rates and reduce default risk, NLP automation of document reviews and real-time transaction monitoring to enhance KYC/AML compliance. The results of AI’s impact on lending are clear: loan processing is up to 25 times faster, operational costs are reduced by 20%–70%, and fraud detection and credit risk accuracy are improved by over 80%, according to ScienceSoft Finance.

Undoubtedly, AI technology is no longer a differentiator. It’s a must-have. A minimum viable capability that is expected by today’s customers. But how can banks go beyond adoption and achieve cutting-edge AI implementation in the lending sector to steal a march and outstrip the competition? Read on to find out.

To cut through the competition, lenders need to go beyond the initial stages of AI implementation ScienceSoft

For end-customers, AI-powered lending brings a suite of advantages to improve the borrowing experience. By enabling faster approval times, more inclusive credit decisioning, personalized offers, and lower rates or fees, AI helps financial institutions better meet customer expectations — leading to higher satisfaction, loyalty and trust. Problematically, many banks and lenders are struggling to turn their beginnings of AI adoption into world-beating use cases and exceptional customer experience for borrowers.

Of the 90% of financial services firms that have incorporated AI to some extent, only 9% consider themselves ahead of the curve, per a 2024 survey. The reason? Many banks still run on legacy systems and data silos that struggle to implement fast-moving, innovative technologies like the latest AI use cases. Furthermore, much of the AI adoption is focused on back-office functions, with significant underutilization in customer-facing applications and strategic areas.

Banks and lenders wishing to succeed in maximizing the potential of AI will need to overcome these problems, and fast.

What next-gen AI-powered lending will look like

It’s one thing to say that banks and lenders should adopt AI more rapidly, but what does that actually look like in practice?

Rather than thinking of the next generation of AI in lending through individual use cases, banks should approach it as a holistic overhaul, where AI tools are integrated into every step across the lending lifecycle, from initial application to servicing. Below are three key areas where AI is reshaping the future of lending for financial institutions:

Alternative data sources

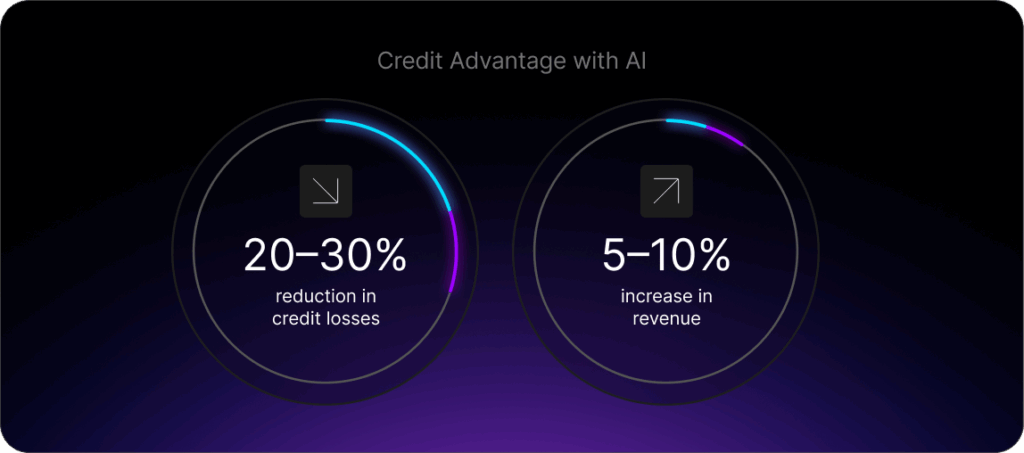

A fully integrated, mature AI will enable lenders to move beyond traditional credit scoring by analyzing alternative data sources, such as bank transactions, spending patterns and past activity, to assess creditworthiness. This approach allows for more accurate and inclusive lending decisions. Research has shown that banks that fully integrate AI across the credit lifecycle can reduce credit losses by 20–30% and increase revenue by 5–10%.

This will also provide a wider pool of borrowers with access to credit that they may otherwise be excluded from by traditional credit scoring systems.

Ongoing risk assessment

Cutting-edge lenders are adopting AI-powered systems for ongoing risk assessment, allowing for dynamic adjustments to credit limits and interest rates based on real-time borrower behavior. This proactive approach enhances portfolio management and reduces default rates. Upstart, an AI lender in the US, uses continuous AI-based risk assessment to dynamically adjust offers and pricing based on borrower signals, even post-origination. They claim this has reduced default rates by 53% compared to traditional FICO-based models.

For borrowers, real-time risk assessment means lenders are able to flag issues earlier, before they result in fines or penalties, adjusting repayment plans accordingly.

Customer engagement

By leveraging AI to examine customer behaviors in detail, banks and lenders can create hyper-personalized, tailored borrowing solutions, instead of one-size-fits-all products.

US FinTech SoFi, for instance, uses AI and machine learning (ML) technologies to personalize loan offers and financial advice based on the borrower’s current situation. For example, specific refinancing options for recent graduates with student loans.

As a result of these better-personalized offers, customers receive products and support more aligned with their unique financial situations and goals.

Challenges in achieving next-level AI in lending

Achieving next-level, AI-powered lending solutions and becoming a market leader is, unsurprisingly, easier said than done. Many lenders lack the technological foundations, cultural willingness and regulatory know-how to take their AI-lending capabilities to the next level.

To move from experimentation to transformation, banks must overcome several persistent roadblocks. The most pressing include:

- Data quality and accessibility. Legacy systems, siloed data and inconsistent formats prevent AI models from accessing clean, comprehensive and real-time datasets. Only 26% of companies have developed the necessary capabilities to move beyond proofs of concept and generate tangible value from AI initiatives.

- Lack of internal AI expertise. There’s often a skills gap between business stakeholders, data scientists and IT – slowing deployment and alignment with strategy. Indeed, a third of banks cite a lack of Al skills or expertise among their workforces, and nearly a quarter are reluctant to use AI tools.

- Evolving regulatory landscape. Lenders must navigate a rapidly evolving patchwork of global AI and financial regulations, such as the EU AI Act and DORA. Only 11% of FI firms feel prepared for upcoming AI regulations and just 14% having a fully functional AI ethics framework in place.

Lenders should go all in on AI

Treating AI adoption as the next big milestone is already a step too late. AI is now the baseline rather than a differentiator. To pull ahead, lenders must weave AI into every stage of the lending lifecycle, from application to servicing. That means dismantling data silos, modernizing core systems and building cross-disciplinary AI teams that can move as fast as the technology itself. It also means navigating complex regulations and embedding AI ethics at the heart of operations.

This transformation will demand bold leadership and investment, but the rewards are clear: a lending model that is faster, smarter, more inclusive and, ultimately, positioned to set the standard for the age of AI.