Digital-savvy Millennials are reinventing the world of financial services, influencing transformational change in the sector based on their values, personalization demands, and a need for financial literacy guidance. Combined with Generation Z, they form the largest generational demographic in the world and have significant economic power as they progress through key financial milestones. This includes buying homes, starting families, planning for retirement, or launching businesses.

Millennials and Gen Z represent more than $3 trillion in spending. At the same time, Millennials are more likely than other generations to have multiple products with their financial institution, according to research by FinTech Futures. They are also preparing for the world’s largest transfer of wealth as their baby boomer parents begin passing on their estates. It is estimated that the two generations will inherit up to $70 trillion in the coming decades, MX research found.

“There’s a lot on the line in this race to gain (and retain) loyal customers. There’s also abundant opportunity for innovative Fis,” MX says.

“Close to $70 trillion has been set in motion, highlighting the need for institutions to more fully understand today’s banking attitudes as well as the habits and preferences of these different groups,” it adds.

Meanwhile, as older Millennials reach their forties and transition into mature banking customers, they are making new financial decisions regarding direct-deposit accounts to fuel, for example, their retirement plans or mortgages. Here, we explore how Millennials’ banking preferences and values have reshaped financial products, customer experience journeys, and business models within the banking sector.

The digital-first mindset

Known as the “digital-first” generation, Millennials are currently aged between 29 and 44 and grew up with high-speed internet, smartphones, and the convenience of apps. This has resulted in a majority of Millennials in the US preferring to access and manage their finances through online or mobile banking providers, according to the Generational Trends in Digital Banking Study conducted by Alkami.

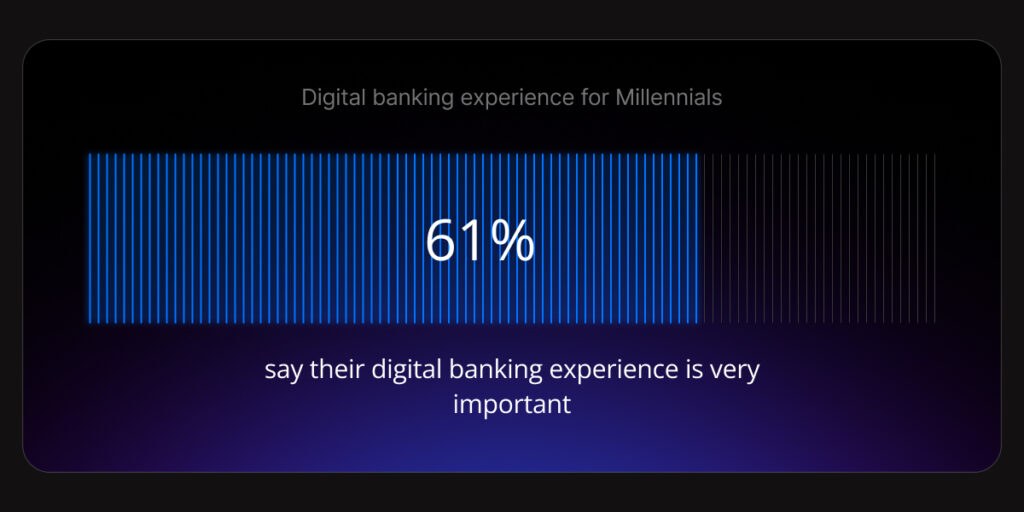

The study also found that 58% of Millennials are more likely than older generations to change financial providers if another offered a better digital banking experience. In comparison, 61% say their digital banking experience is very important. This highlights the need for banks to offer convenient, intuitive digital tools to become the primary financial provider for Millennials. “The digital baking experience is the cost of entry to the Millennial financial relationship, Alkami says in the report.

Simplification and speed

Millennials expect their banking experience to be fast, intuitive, and effortless. When digital processes become confusing or take too much time, they simply abandon them and look for alternatives.

Top pain points for Millennials in digital banking:

- Want interfaces that are intuitive and consistent across both mobile and web

- Abandon processes if they are too long or complex (48%)

- Expect fast onboarding and real-time transactions

- Prefer apps that reduce steps for everyday actions such as transfers, loan applications, or payments

“The digital banking experience is so important to Millennials that they would be more likely than older generations to focus more on their finances if it were easier to use, navigate and understand,” Alkami says.

Growing demand for personalization and education

After growing up during the 2008 global financial crisis, many Millennials continue to face economic challenges as adults, including high student loan debt, increased housing costs, and high interest rates and inflation. They have also faced more urgent economic headwinds, such as recovering financially after losing their jobs or experiencing furloughs during the Covid-19 pandemic.

Banks that provide AI-driven recommendations tailored to Millennials’ needs often gain loyalty, the Alkami study says, adding that this generation also prefers to receive relevant product suggestions, such as customized savings plans or budgeting tips. However, a Trends in Millennials’ Banking study by Deloitte highlighted that participants demand personalized expert services in context.

“They asked for trusted advisors who ‘get them’ and their life stage at that moment, not just a generic solution based on age, income, personas, products, etc,” Deloitte said.

Essential financial wellness tools

A lack of financial literacy knowledge has also resulted in Millennials seeking help and personalized support with their finances, according to the Deloitte research. In the US, 60% of Millennials say they lack the confidence to plan for or achieve their financial goals, while 68% have asked for help to figure out how to pay for a goal or create a savings plan, the Deloitte study found.

“Many mentioned a need for better tools,” Deloitte added. “Participants felt under-informed about the long-term impacts of their financial decisions and asked for personalized tools to help guide them through the process.” This includes tools that will improve their financial literacy knowledge and help them to make informed decisions about their finances, such as integrated budget trackers, savings planners, personalized content on debt repayments, and dashboards that are easy to use and understand.

Rethinking payments and everyday banking

Thanks to the rise in contactless payments, digital wallets, and auto-pay options, Millennials have also embraced new ways of paying, transferring, and managing their money. Peer-to-peer payment (P2P) apps, including PayPal, Venmo, and Zelle, are now considered mainstream, reflecting Millennials’ preference for convenience and real-time transactions. At least 50% of Millennials now use P2P payments for in-store and online purchases, according to a 2024 report by Pymnts.com.

“With increased adoption come raised expectations for what a P2P app should offer, with seamlessness and convenience emerging as consumers’ top priorities,” the report says. In response to the rising demand for real-time payment apps, banks have integrated the method into their apps and are offering added-value perks such as cashback offers or instant transfers to remain competitive.

Balancing technology with human support

While technology is important for Millennials, they also value human support when making important financial decisions, such as applying for a mortgage or seeking investment advice. This means they seek an omnichannel approach: a combination of online and offline services. For quick tasks like checking balances or transferring money, Millennials will use their banking app. But for bigger issues or personalized financial planning, they prefer to talk to a live agent, either face-to-face, over the phone, or via chat.

“They expect to manage their banking as easily and conveniently as ordering a ride,” according to a Lanvera report on Millennial banking.

“Banks are creating more engaging mobile experiences and applying proven UX [user experience] principles to make apps simple to navigate and easy to use,” Lanvera adds.

Winning Millennials in banking: The path forward

As Millennials move into a new financial services segment as mature customers, they have helped to transform the traditional banking models along the way, demanding digital innovation, enhanced personalization, and smart money management advice.

Their willingness to explore new platforms and apps has also ramped up the competition between traditional banks and fintech start-ups. However, banks that invest in fast and frictionless platforms and personalized experiences, while maintaining an empathetic human presence, stand to win the loyalty of this generation – and the tech-savvy generations to come.

For more expert content on industry outlooks and innovation, subscribe to our newsletter or visit our Insights page.

Questions & Answers

What percentage of Millennials prefer digital banking? + –

The majority of Millennials in the US prefer online or mobile banking to access and manage their finances, with 61% saying their digital banking experience is very important.

How much wealth will Millennials inherit? + –

Millennials and Gen Z are expected to inherit up to $70 trillion in the coming decades as baby boomers pass on their estates.

Why do Millennials switch banks? + –

58% of Millennials are more likely than older generations to change financial providers if another offers a better digital banking experience.

What financial tools do Millennials want most? + –

Millennials want integrated budget trackers, savings planners, personalized content on debt repayment, and easy-to-understand dashboards.

Do Millennials still value human support in banking? + –

Yes, while they prefer digital for quick tasks, Millennials still want human support for major decisions like mortgages or investments.