Artificial intelligence has become an inseparable part of modern life. What once sounded like science fiction, a child chatting naturally with an AI companion, not just asking questions but dreaming with it, is fast becoming reality. For the next generation, AI will not be a tool; it will be a companion they grow up with, shaping how they learn, communicate and ultimately how they manage money. This marks a profound shift. Unlike previous technological revolutions, AI does not simply extend human capability; it learns with us and adapts to us. As we evolve our tools, our tools evolve us.

The effects are already there to be seen. In classrooms, AI-powered tutors are personalizing education. In hospitals, predictive algorithms are transforming diagnosis and care. Across every sector, intelligence is moving from the margins to the centre of daily life, changing not just how we work but how we think.

The financial industry is no different. As AI begins to redefine the relationship between people and money, banks face a decisive moment. Decision makers must now begin to ask themselves how they can harness this technology responsibly while preparing for a new generation of customers who expect intelligence, transparency and trust at the core of their financial lives.

AI in finance: A seamless, always-on presence

We can already see the outlines of a new financial landscape taking shape. In the coming years, AI will power a generation of financial assistants capable of guiding customers from childhood to retirement, helping them save, invest and protect their assets across life’s milestones. These systems will evolve with their users, learning from behavior and anticipating needs before they arise.

Customers will no longer interact with their bank. Instead, they will live within it and each financial relationship will become fluid and responsive, woven seamlessly into every step of the customer’s financial journey. Whether it’s an automated reminder to rebalance a portfolio, a proactive warning about potential fraud or a personalized mortgage offer surfaced at the perfect moment, banking will move quietly in the background. Intuitive, intelligent and always on.

This shift redefines what it means to be a bank. For the AI-native generation, a bank that is not intelligent, transparent and ever-present simply won’t feel like a bank at all. The ability to guide, protect and advise customers, not just process their transactions, will become the new benchmark of success.

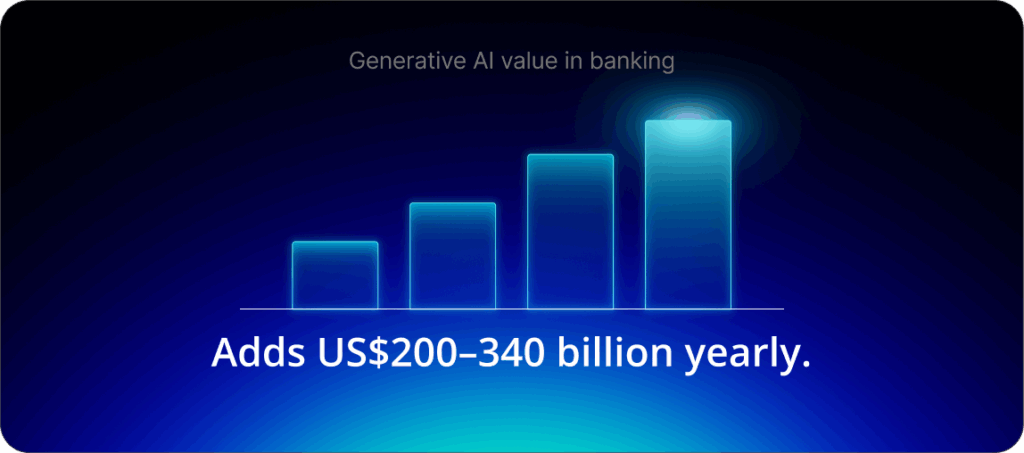

Financial institutions are already recognizing the scale of the opportunity. Nearly half (49%) expect AI to reduce their cost base by at least 10%, underscoring its potential as a major lever of efficiency. At the same time, McKinsey estimates that generative AI could add between $200 billion and $340 billion in annual value to the global banking sector. The early evidence is clear: the banks that embed intelligence into their operations are capturing measurable gains in productivity and profitability.

Yet the value of AI extends far beyond cost savings. Its true potential lies in building stronger, longer-lasting relationships with customers. Research shows that banks using predictive AI to engage proactively with customers can achieve double the retention rates of their peers. Intelligent systems that can understand and anticipate human needs do more than optimize efficiency, they cultivate trust and loyalty.

This is the beginning of a new relationship between humans and money. Finance will no longer be a service people use intermittently, but a constant, adaptive presence that helps them make better choices, plan confidently and navigate risk. In this world, the banks that combine intelligence with integrity will define what “banking” means for the next generation.

Banks need to be preparing for tomorrow, today

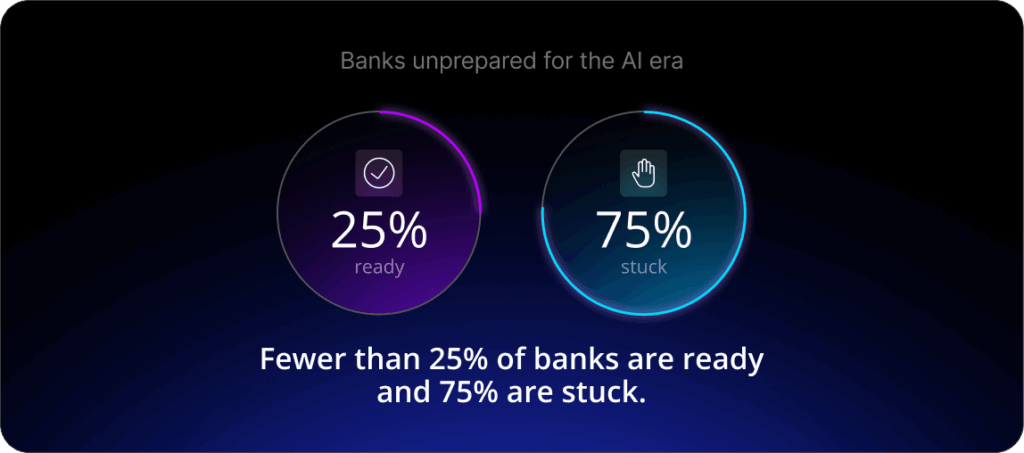

Worryingly for banks, many have so far been unable to weave AI capabilities into their future-thinking strategies. According to BCG, fewer than 25% of banks are ready for the AI era, with the remaining 75% “stuck in siloed pilots and proofs of concept, risking irrelevance as digital-first competitors accelerate ahead.”

The barriers are structural as much as technical. After decades of consolidation and incremental modernization, many institutions still operate on fragmented systems that keep data locked in product or regional silos. AI cannot function effectively in that environment. Without unified data or consistent governance, models remain narrow, unreliable and difficult to scale.

This fragmentation carries more than an operational cost. It exposes banks to growing strategic and regulatory risk. As AI becomes central to decision-making, institutions must be able to explain how those decisions are made. Regulators are already tightening expectations, demanding greater transparency, traceability and human oversight.

The banks that succeed will be those that treat AI as infrastructure, not experiment. They will build connected data systems, accountable governance and clear lines of control. That foundation is what will enable them to deliver intelligence that is consistent, compliant and trusted by both customers and regulators.

How SBS is enabling the transition

At SBS, the transformation toward finance’s future is already underway. Our next generation of platforms, unveiled at the 2025 Summit, enables banks to unite innovation with responsibility, while building the infrastructure for intelligence-first finance allowing to address the main barriers for the wider AI deployment across the financial sector. Next year, we’re excited to roll out the SBS Data Platform, which will provide a unified, real-time environment to connect and enrich data across the banking ecosystem, creating a single source of truth for predictive insight and decision-making.

Built on this foundation, our Generative AI Platform will feature novel generative and agentic capabilities to handle structured and unstructured data and operate directly within core banking operations (via the SBS data platform), from customer engagement to marketing to risk management and product management, empowering banks to act proactively, safely and at scale to realize hyper-personalization while exposing explainable AI decisions and recommendations. This reflects SBS belief that transparency and accountability must underpin every intelligent system. It provides banks with clear visibility into how AI-driven decisions are made, aligning with industry best practices and regulatory expectations such as the EU AI Act.

Together, these systems enable banks to move to be AI native while realizing sovereign AI systems which can be deployed on the cloud or on-premise under the bank full control. AI is already transforming how the next generation learns, heals and manages money. The future they inherit will depend on the choices the industry makes today, including ethics, sovereignty, transparency and the responsible use of intelligence.

At SBS, we believe the opportunity is not just to make banking smarter, but to make it more human. We’re proud to be working with our partners to build that future. Not tomorrow, but starting now.

Get in touch with our experts today.

Watch Hani Hagras share his perspective on this topic at the 2025 Summit.