This year, SBS will host a Connect event in Dallas from 16 to 18 July. During this session, we will be joined by some of the asset finance industry’s leading experts, who will be sharing their insights into some of the changes and challenges being faced by specialized lenders, and how they are impacting businesses, specifically in the US.

We wanted to take the opportunity to share some of the significant thought leadership topics we will be exploring during the sessions.

Create resilient digital engagement

Artificial Intelligence (AI)-powered engagements are revolutionizing the customer experience across many markets, and the asset finance sector is no different. Innovators are leveraging the latest technologies, such as predictive analytics, to improve business data and deliver more personalized communications to dealerships. By analyzing data in real-time, AI can help businesses to detect anomalies, identify and predict risks, and enable faster onboarding and validation of new customers.

New technology is helping asset finance businesses to rapidly progress applications through the funnel by simplifying processes, applications, underwriting, documentation and decisioning. Instant credit decisioning tools help to expedite approvals and reduce the time and effort required by the lender and the dealership.

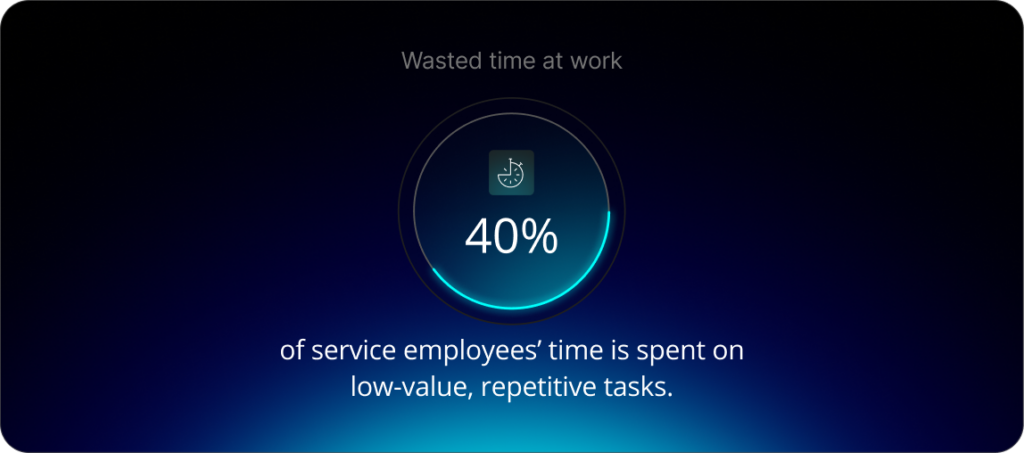

A recent keynote address by Salesforce CEO Marc Benioff suggested that service employees are estimated to waste 40% of their time on low-value, repetitive tasks. By enhancing processes with AI tools, asset finance organizations free up their staff to focus on more complex issues or reallocate them to work on tasks that will bring new value to their business. Aside from improving the customer experience, this also helps businesses increase efficiency and remain competitive in a market where standing out is critical.

The future of asset audits is hybrid

Bad debt often refers to loans or leases extended to borrowers – usually equipment, vehicles or other tangible assets, that are unlikely to be repaid and will directly impact profitability. The cause is often the result of customer default, insolvency or the customer experiencing significant financial distress, but it can also be caused by loss or fraudulent activity. Typically, these debts are written off by lenders once recovery efforts fail, but they can also be manipulated to smooth earnings.

A recent 2025 CreditGauge edition showed that auto loan delinquencies increased across all Days Past Due categories in February, both year-over-year and compared to pre-pandemic levels. The report also showed that auto loan balances increased by 1.7% in the year. With the growth in both balances and delinquencies increasing, asset finance organizations need to find ways to reduce risk wherever possible.

Risk involved with bad debt is pushing auditors to spend more time diving deeper to investigate where weaknesses lie in internal processes, including credit approval, loan monitoring systems, collection procedures and what finally constitutes as a write-off. As a result, there is a huge amount of pressure on auditors to conduct in-depth, accurate checks across multiple dealership locations.

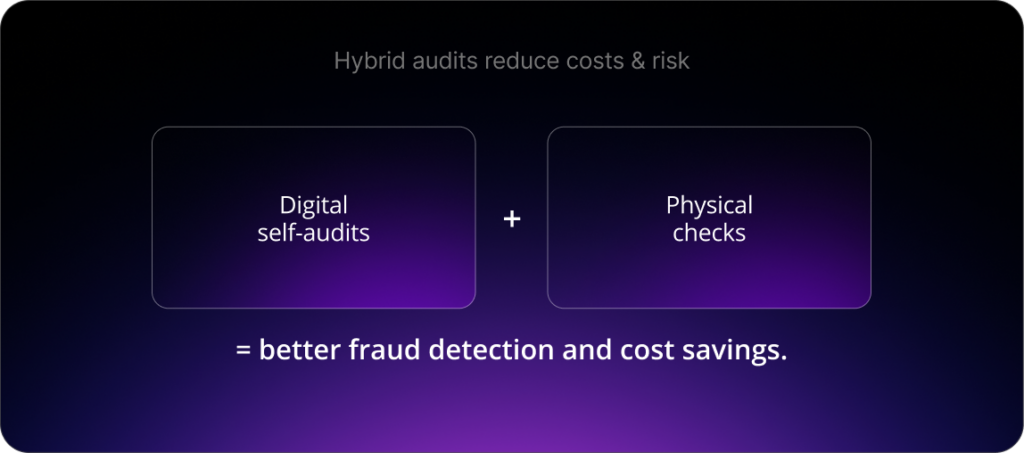

Effectively mitigating this risk is a challenge. It is not cost or time efficient to send an auditor out to a physical location regularly, especially for organizations with multiple locations across the country. This is where implementing a hybrid auditing approach can help strengthen internal audit processes. Hybrid auditing combines the accuracy and fraud detection of physical audits with the efficiency, scalability and cost savings of digital dealership self-audits, providing a balanced and comprehensive verification process that optimizes resource allocation.

By using a digital, self-audit solution to complement on-site physical auditors, businesses can implement a process that fills the gaps between on-site auditor visits, providing accurate, real-time data. This helps to reduce time and cost constraints, enabling businesses to allocate auditors to locations with the highest-value items or the highest-risk locations, giving them more time to utilize their expertise to identify risks, fraud or potential losses. With the right digital auditing solution, conducting self-audits becomes effectively limitless and empowers organizations to implement more comprehensive risk management processes.

Full control data platform

What would it mean for your day-to-day business operations to have full control over your onboarding, servicing and risk management data platform? This is a question that we discuss with asset finance businesses around the world every day. And the possibilities are endless.

When a business has full control over its platform, it helps ensure data integrity and transparency across the whole system. This can significantly improve risk monitoring, compliance and the overall dealership experience. In turn, dealerships become partners rather than channels for business growth.

Leveraging AI and automation can power workflows to manage approvals, funding, compliance, and other tasks related to onboarding and KYC. Automated processes can also help identify unusual behavior and potential risks. These insights can allow businesses to evolve, becoming more proactive and dynamic.

With a rise in deepfake media being used to manipulate images and exploit weaker KYC processes, it is important for businesses to maintain control over data, workflows, and business rules to prevent potential fraudulent activity or losses. The key to achieving this lies in reducing the burden of legacy software, moving to a more robust, modern framework and supporting ecosystem.

Continuous delivery release with SaaS

Perhaps one of the most important elements of what we have reviewed in this article is implementing a SaaS solution that is supported by continuous delivery release. A well-designed SaaS platform gives organizations full control to enhance digital customer engagement, streamline onboarding, provide access to real-time data, and pave the way for more efficient, agile processes that will help them grow their market share.

SaaS platforms support open API integrations and frameworks, enabling lenders to plug into third-party sources, such as credit bureaus or fraud checks, without waiting for long development cycles. It reduces the need for in-house teams to manage deployments, perform maintenance on a server and maintain version control. With a SaaS solution, organizations can redistribute IT staff to value-adding tasks, such as implementing automation, enhancing analytics or reviewing strategic integrations.

By reducing the need for large updates, continuous delivery rolls out platform changes in smaller bite-size pieces, helping organizations to reduce or avoid downtime and the risks involved with large-scale upgrades. This also enables back-office underwriting and servicing teams to adapt the products and services offered, allowing the business to enter new markets faster and reduce the time it takes to respond to changes in the market. This provides a new level of business agility and helps to create unique differentiators with a better overall user journey with faster credit decisioning, enhanced risk assessments and more. It also provide businesses with real-time data to help identify bad debt, potential compliance issues and system manipulation.

Conclusion

With digital transformation at the forefront of many of the industry leaders’ lists of priorities, it is important to consider how your business will address adoption of new processes and technologies. One consideration when assessing the impact on your business is the power of a partner who is invested in the growth and development of your capabilities, processes and, ultimately, your organization. The right partner can make all the difference.

For those of you who have already registered for Connect, we look forward to seeing you in Dallas to discuss these topics in greater detail. If you are not able to join us but would like to understand how our SBS Financing Platform can support your business with AI-driven engagement, digital auditing and SaaS innovation, please get in touch today.