Beyond cutting-edge technology

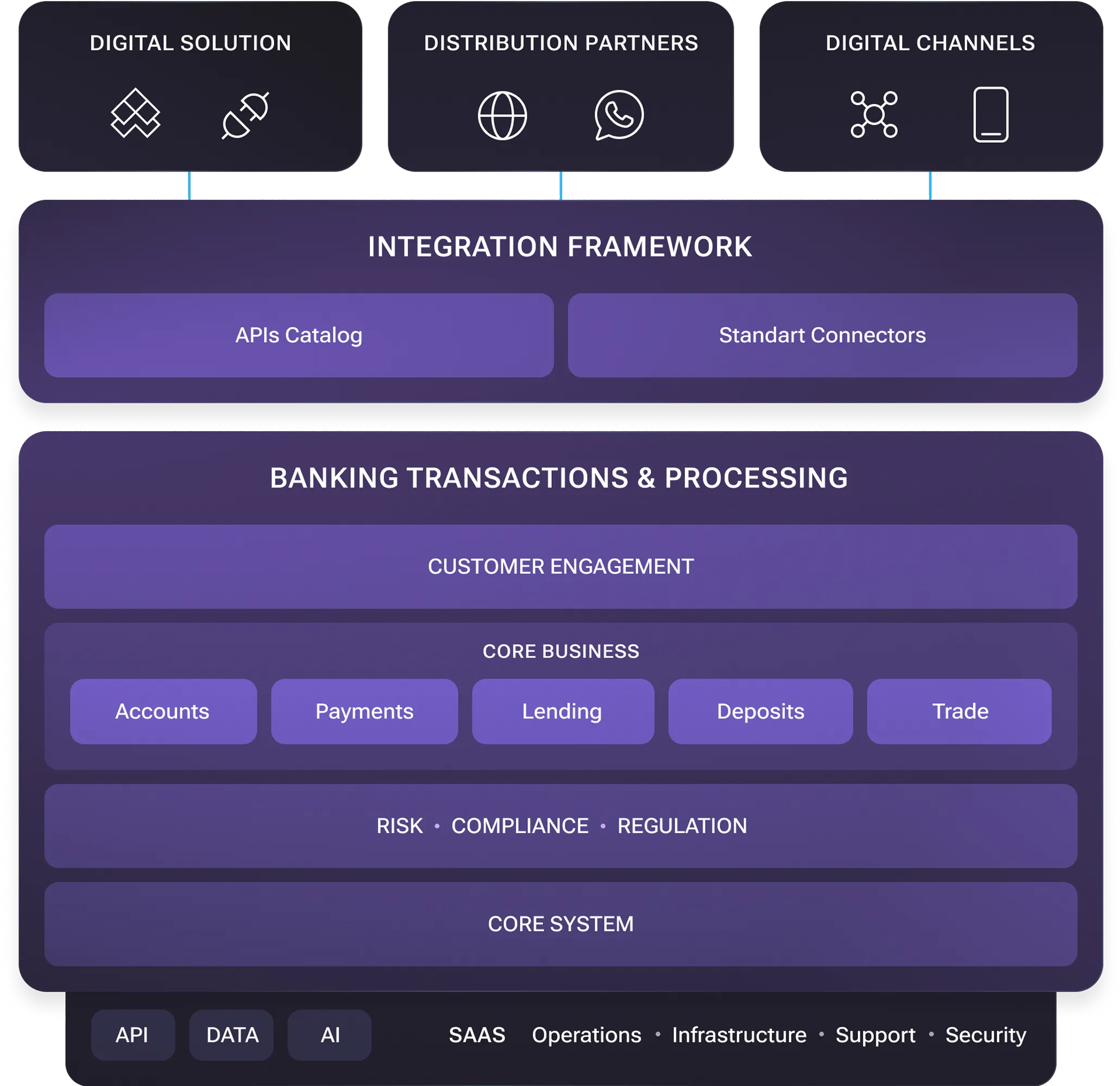

Empower your bank with a modular, scalable, and secure core banking platform tailored to the needs of the dynamic MEA market. Modernize your operations, accelerate product delivery, and expand your reach — while ensuring compliance with evolving regulations and driving financial inclusion across diverse ecosystems.

Bn transactions processed annually

We process more than 11 billion transactions globally on our core banking software.

Financial services experts

With a huge team of experts, we ensure local support anywhere.

Clients trust us

Our large clientele is an indicator of trust and inspires us to innovate.

Countries

Gateway to global opportunities with our core banking solution.

Benefits

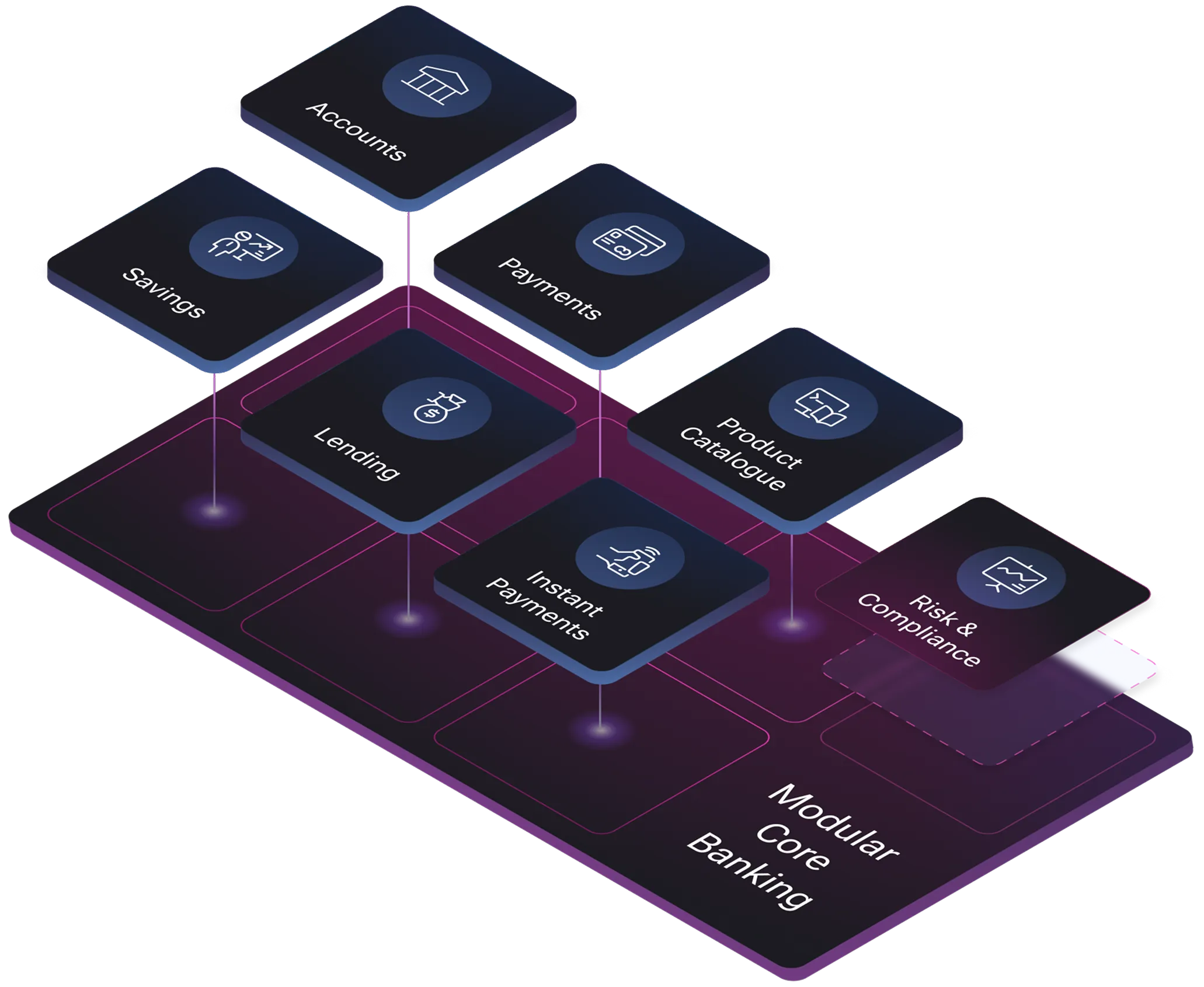

Simplify success, enhance efficiency

Full banking scope: retail, commercial, corporate & more

Our solution is a fast, open & flexible core banking solution, able to run any type of financial institution. More than just a leader in financial technology, our mission is to contribute to a better Financial World.

Banking

Microfinance

Compliance

Customer engagement

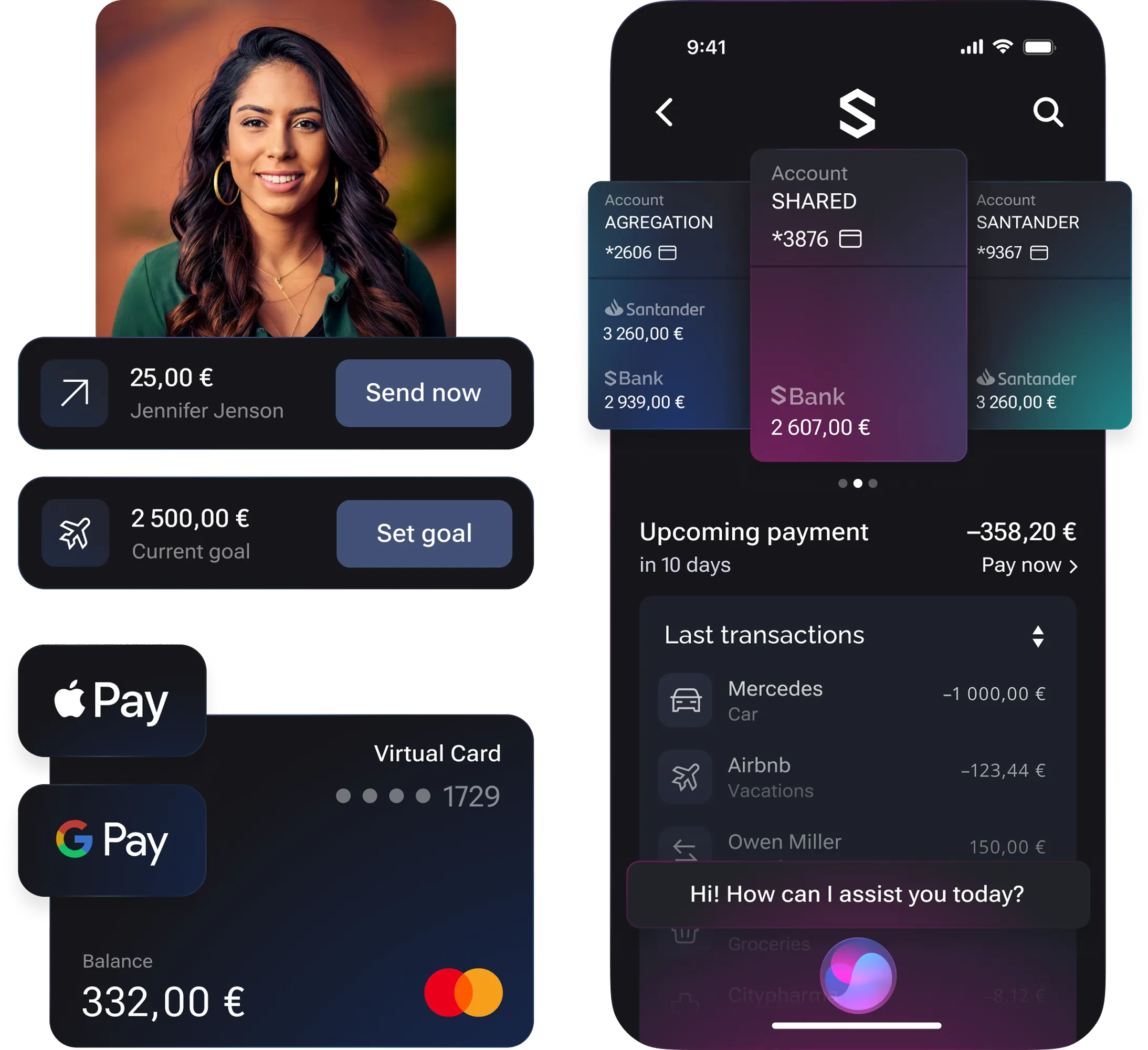

Accounts, depositis & savings, payments & cards

Streamlines account management with advanced tools for deposits, savings, and seamless payment processing. Provides integrated card solutions to enhance customer convenience and enable real-time financial transactions.

Tailored support for microfinance institutions

Serve underbanked communities with dedicated microfinance functionalities supporting deposits, savings, lending, and compliance. We ensure flexibility and scalability to drive financial inclusion while meeting local regulatory requirements.

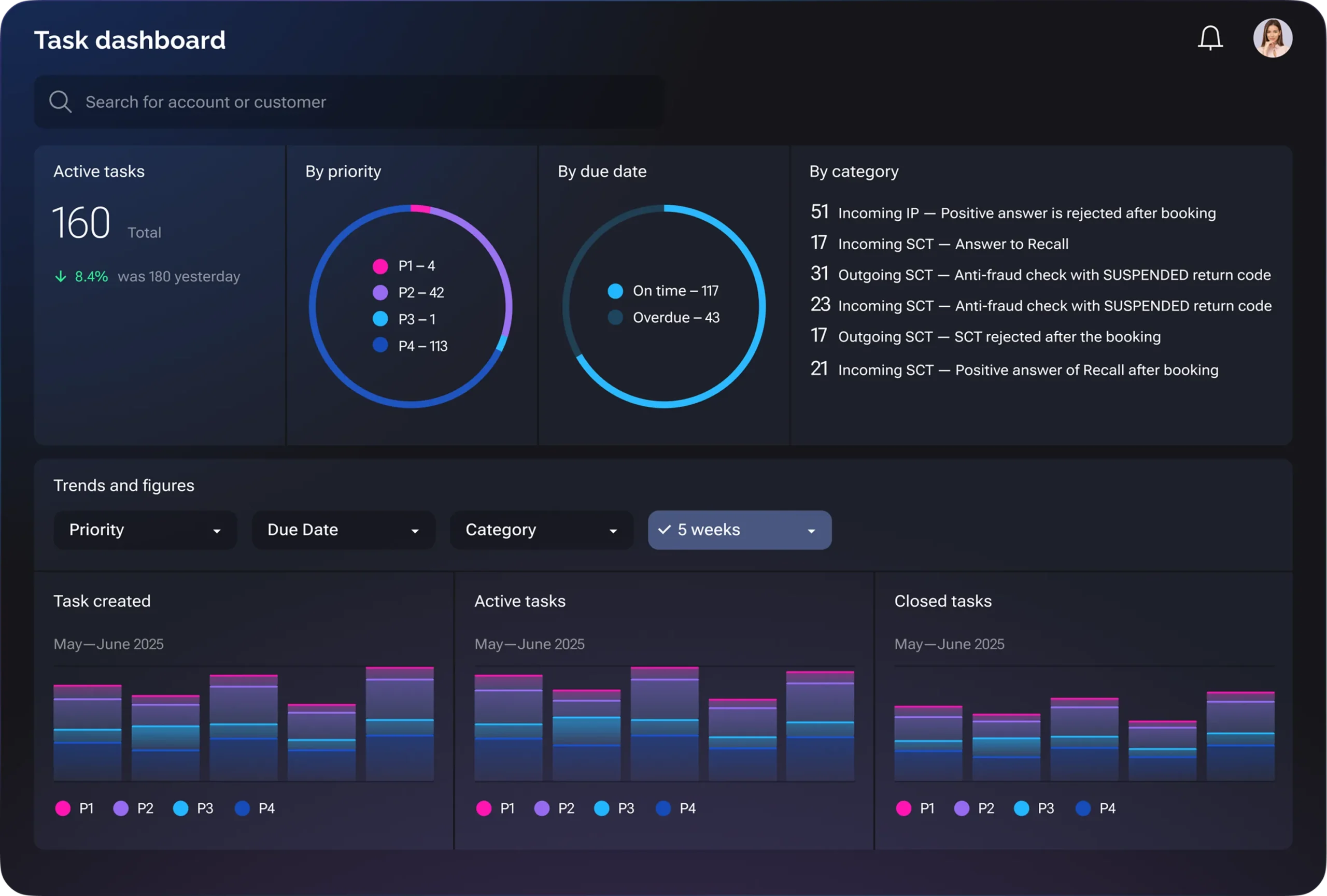

Risk, regulation & reporting

Delivers advanced risk management, regulatory compliance, and automated reporting tools to ensure transparency, accuracy, and alignment with evolving financial regulations.

360° customer management

Provides a unified customer view with personalized insights, empowering banks to deliver tailored services, enhance customer engagement, and foster long-term relationships through data-driven decision-making.