Re-define account management

Deliver personalized, seamless account services to SME and retail customers with our advanced deposits solution. Streamline every step—from account opening to aggregation to servicing to closure—with automated workflows, API-driven architecture, and SaaS delivery. Effortlessly offer a full range of account types customized to diverse customer needs.

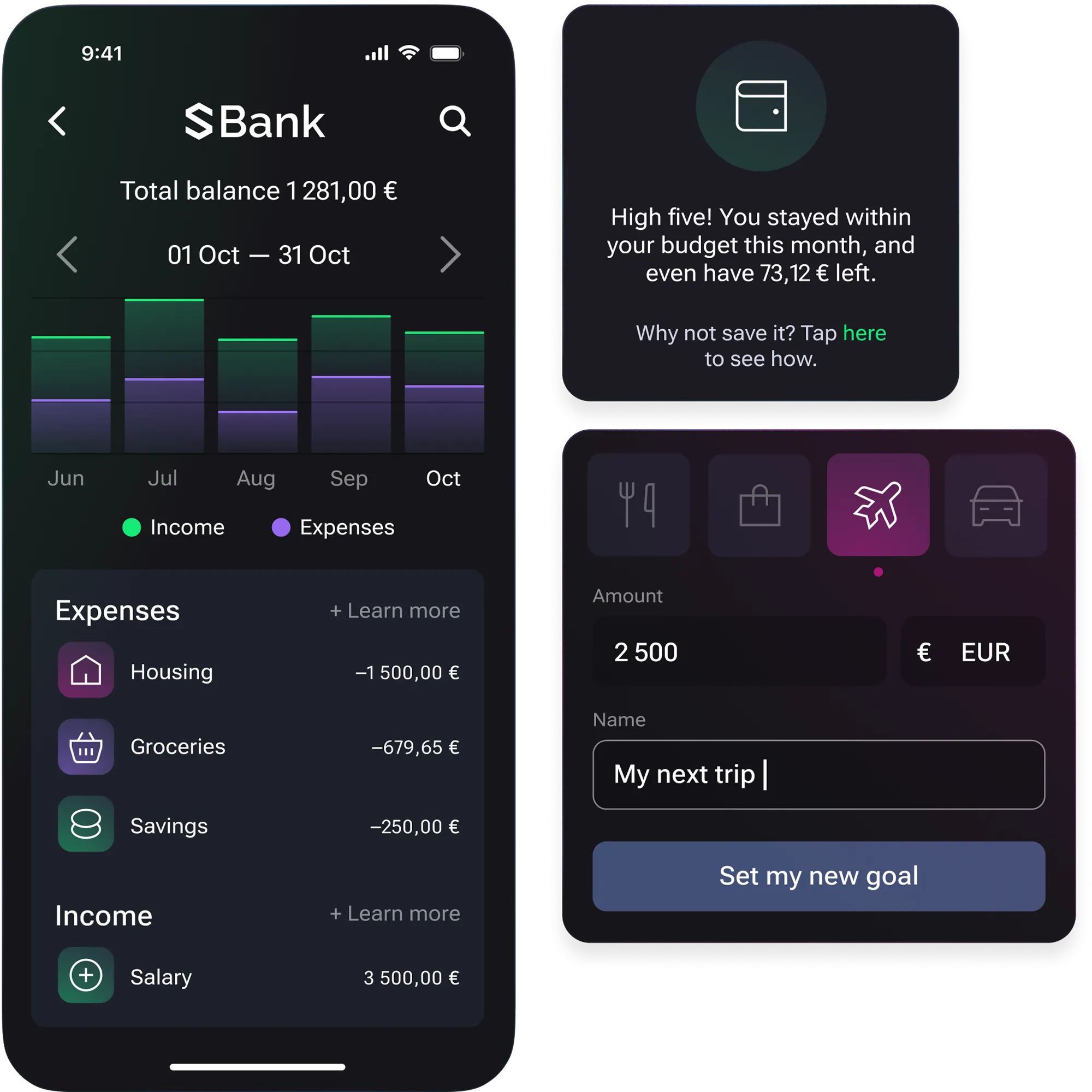

Everyday banking made easier with a next-gen solution

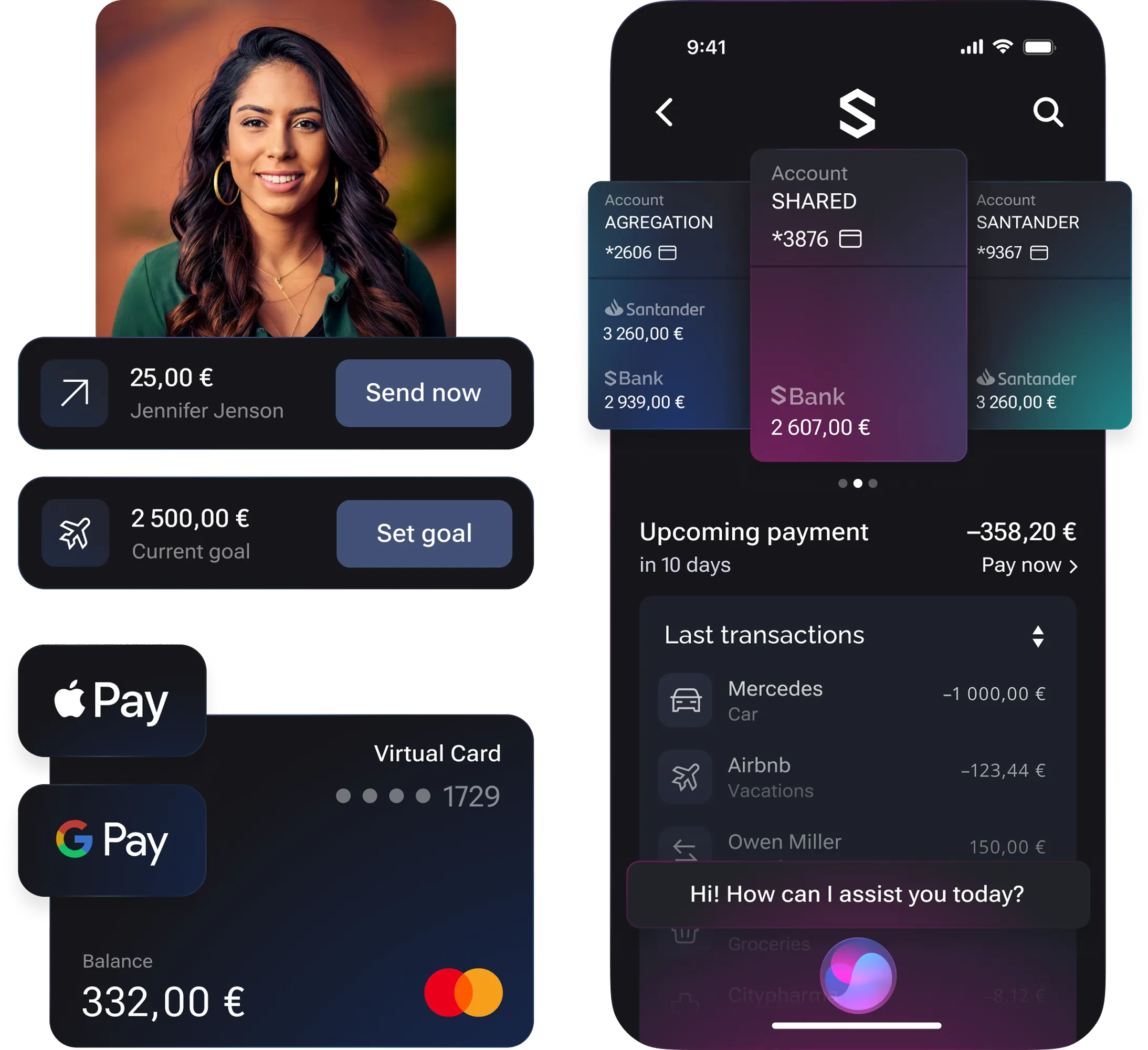

Enhance customer engagement with our advanced deposit management solution. Leverage real-time data to deliver personalized, customer-focused services, while enabling back-office teams to work efficiently through a clean, intuitive interface designed for streamlined operations.

Clients trust us

Our broad client portfolio reflects our technical expertise, exceptional customer support, and deep industry knowledge.

Countries

SBS offers various deposits products globally, complying with local regulations and offering local support to customers.

Clients on SaaS

We are trusted worldwide for our secure and scalable core banking solutions, with more than 100 customers using our SaaS products.

Partners

Unlock the power of an open ecosystem of trusted partners to deliver innovative and dependable solutions across diverse markets.

Benefits

All-in-one deposit solution to engage, retain, and optimize

Deposits management

Harness the power of deep core banking expertise—both European and global—combined with a fully reimagined, next-generation deposits management solution. Rely on our secure, standard SaaS solution and 24/7 local support to deliver agility, and customer-centric innovation at every step.

Product catalog

Define current and savings account products and their related operating conditions, including management rules, possible values, and default values.

Pricing engine

Configure fee structures associated with individual products in a centralized pricing engine, and automatically apply negotiated rates at the contract level.

Event management

Benefit from automated actions such as interest calculations, transfers, payment reminders triggered by events such as account opening, gaining operational efficiency.

Third-party products

Expand your offering portfolio and deliver personalized services to your customers by leveraging seamless connectivity to partners.

Personalized and pre-configured accounts made simple

Design, launch, and manage personalized, pre-configured accounts and support account aggregation. Enable full lifecycle servicing to boost speed, insight, and revenue.

Profile-based accounts

Pre-configured accounts

Account aggregation

Account servicing

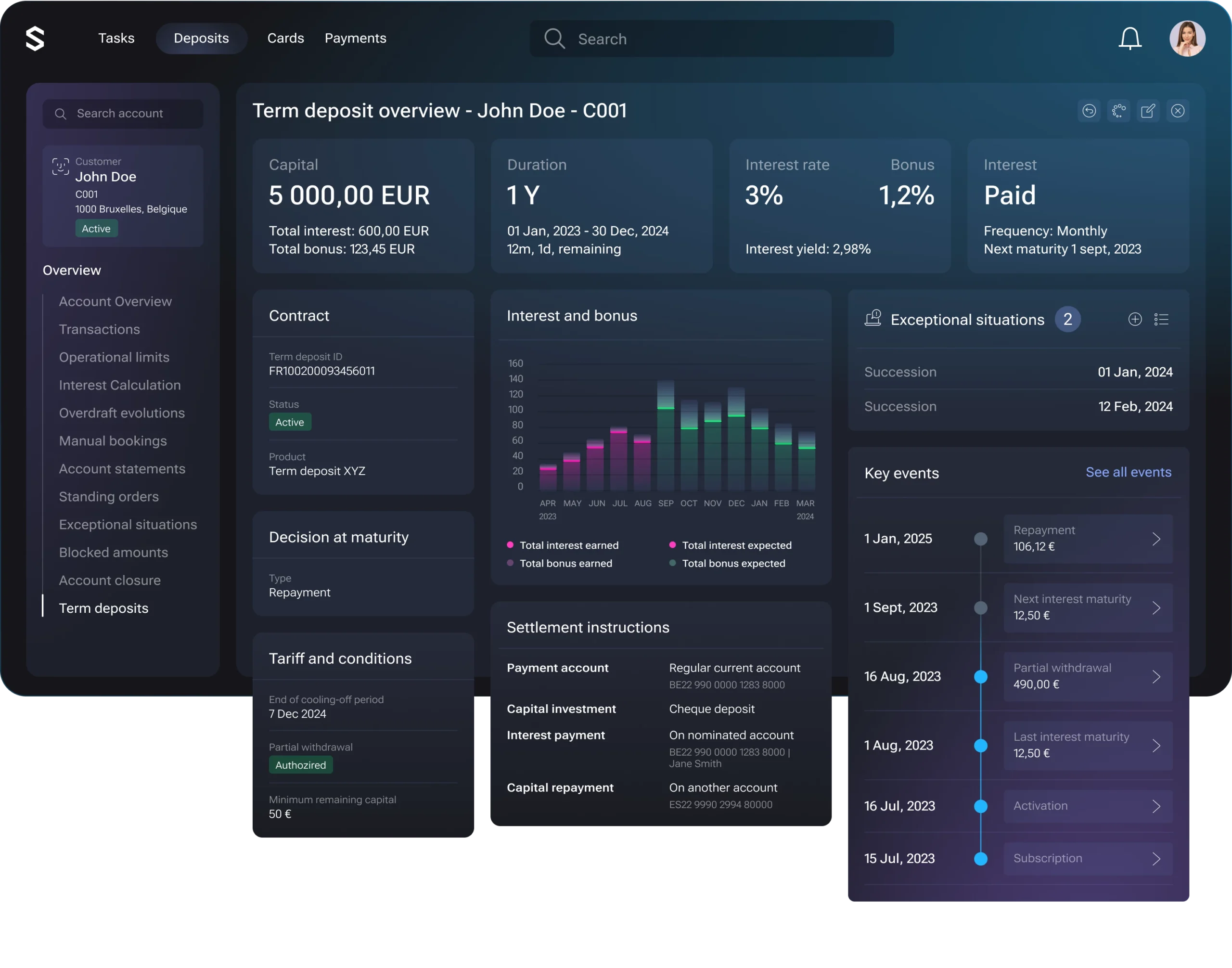

Design, launch and run personalized accounts

Quickly design and launch various account products: current accounts, savings accounts, notice accounts, payment accounts, term deposits, guarantee accounts, bespoke accounts, regulated and non-regulated accounts in the UK and EU.

Quickly launch deposit products

Leverage pre-configured accounts to quickly deliver new products. Define attributes and configure functionalities, operating limits, and more. Differentiate to stay ahead of the market. Address new customer segments to enhance revenue streams.

View all accounts in one place

Help drive engagement by powering fast and easy access to a unified customer account view.

Leverage full visibility of account data for improved services to customers.

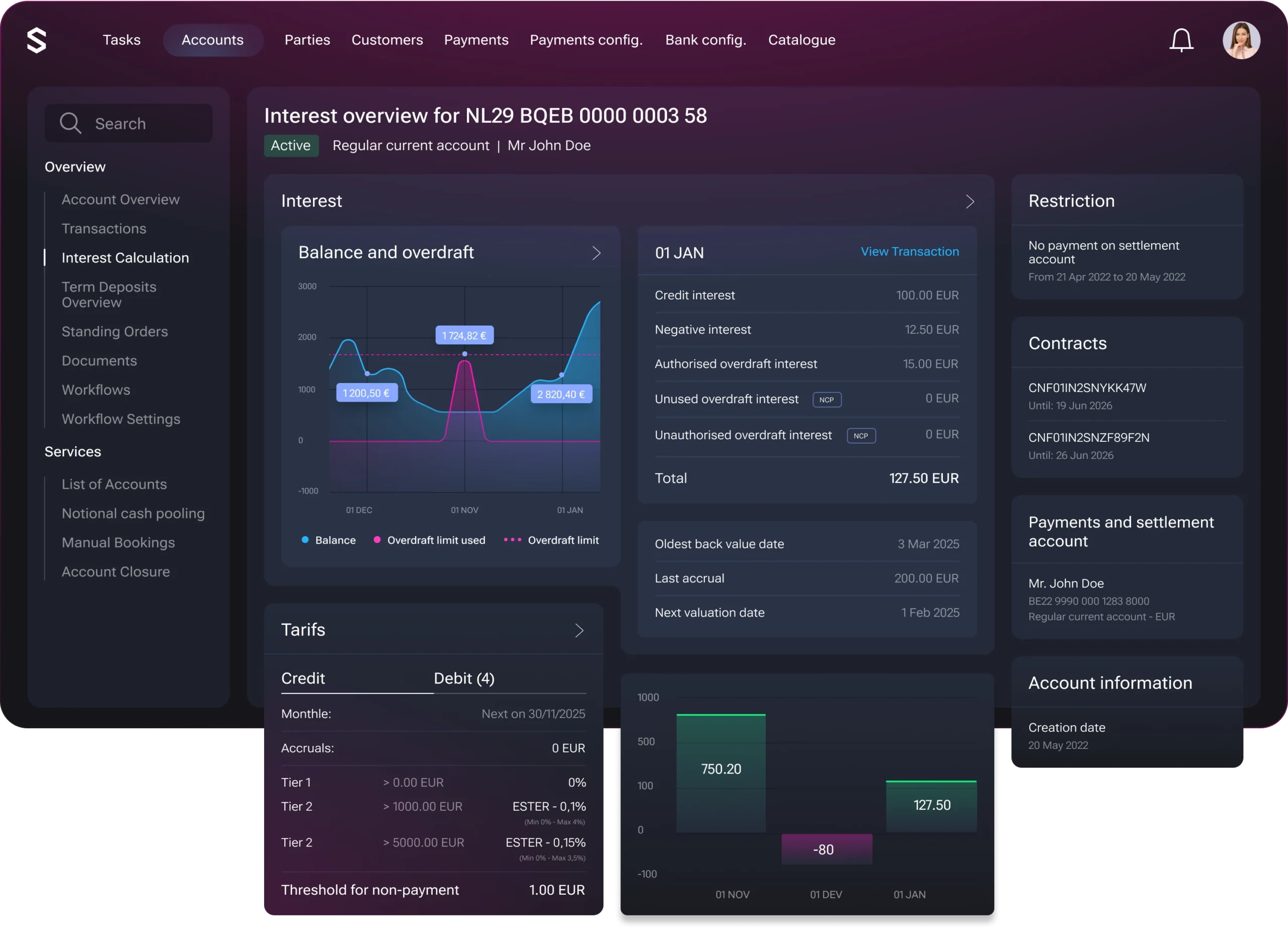

Orchestrate the lifecycle

Benefit from full account servicing after product launch to manage the whole lifecycle of client account contracts, cash account position keeping and accurate interest calculation.

Technology

Advanced deposits solution for a smarter tomorrow

The next-gen deposits solution for all your needs

Explore