In today’s banking industry, the digital front office has become the decisive battleground for customer loyalty. Modernizing the “digital front” is no longer “UI refresh.” It’s building a journey and orchestration layer that works across mobile, web, branch, contact center, and partners; turning every interaction into a personalized journey delivering consistent, compliant, measurable outcome. Bank executives who recognize this shift stand to gain a competitive edge. And those who don’t risk losing their customers to more agile, tech-savvy competitors.

Digital friction: The hidden trillion-dollar threat

Bad experiences don’t just annoy customers; they change behavior. Qualtrics XM Institute estimates that $3.8 trillion of global sales are at risk due to bad customer experiences, and banking is not immune. Many institutions still fall short of rising consumer expectations for speed and ease. When everyday banking tasks become a headache, long login processes, forms that time out, repetitive ID checks, customers simply walk away.

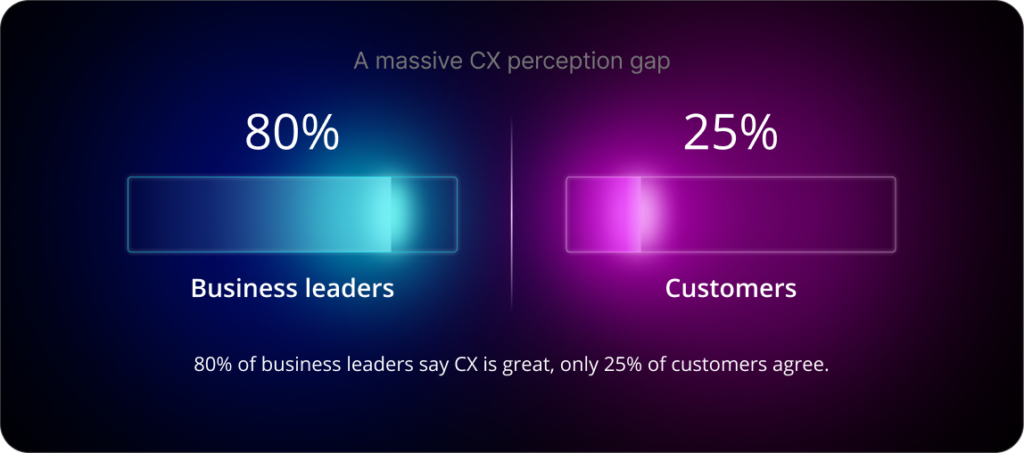

Studies show a massive perception gap: while four out of five business leaders believe they’re providing great customer experience, only a quarter of consumers agree. That disconnect directly translates into lost business.

“Every point of digital friction leaks value, through abandoned onboarding, lower engagement, higher churn and higher cost to serve. Modernization is not transformation theatre, it is value protection.”

Stephane Charbonneau, Head of Sales France at SBS

One of the most glaring pain points is onboarding new clients. Opening a basic account or applying for a loan should be quick and seamless, yet at many banks it remains a source of avoidable friction. The result is blunt: banks lose customers before day one. And the cost goes beyond the immediate lost deposit or fee, it compounds through marketing & acquisition costs, lower lifetime value, higher servicing costs and reputational damage that makes future acquisition harder.

What’s more, switching barriers are lower than many banks assume. Across Europe, top banks’ mobile app ratings are consistently above 4.5 out of 5, with minimal variation by country, which is a strong score but also a signal: a functional digital experience has become table stakes rather than a differentiator. Digital-only players are raising expectations further, setting new benchmarks for convenience and personalization.

Across the Gulf Cooperation Council (GCC) markets of Saudi Arabia, the UAE, Qatar, Kuwait, Bahrain and Oman, customer sentiment reflects the same reality. A recent PwC report found that digital experiences account for close to one in four negative posts, often linked to app crashes, login failures and payment errors. When baseline digital feels interchangeable, customers have fewer reasons to stay loyal and more reasons to move when a competitor offers a smoother, more relevant service. In this context, digital friction does not just frustrate customers, it materially reduces the barriers to switching.

Meanwhile, tech giants and fintech players are swooping in to provide the frictionless experiences that customers crave. Digital-first banks and payment apps are raising the bar by embedding bankings in other digital journeys to make it part of their daily life; effectively making banking almost invisible.

These trends show that consumers will readily embrace new providers when their offerings make financial transactions effortless. For traditional banks, the implication is dire, every instance of digital friction is an opening for someone else to lure your customer away.

From channels to continuous, intelligent experiences

Eliminating digital friction is not as simple as optimizing one channel or tweaking one process. The real challenge is rethinking the digital front as a single, continuous journey rather than a patchwork of channels.

Many banks still operate in channel-specific silos. One team manages the mobile app, another handles online banking, others focus on branches or call centers. Each channel might improve incrementally, but the customer experience as a whole remains fragmented. This channel-by-channel approach creates recurring friction at every handoff:

- Multiple logins and repetitive data entry. Customers often must re-authenticate or re-enter information as they move between channels.

- Inconsistent onboarding and servicing flows. Each channel might present different forms, steps or even decisions, resulting in a disjointed experience.

- Duplicated business logic and controls. Product rules, compliance checks and personalization logic are often duplicated across channels. Not only does this slow down changes, it also leads to inconsistent outcomes.

These pain points reveal a core issue: the bank’s front-office systems are not truly integrated. To fix this, leading banks are shifting to a platform model, replacing monolithic, channel-specific systems with composable, API-driven components. Key front-office capabilities, such as identity verification, onboarding workflows, payments, notifications, consent management and servicing, must be rebuilt as modular services that can be reused across every touchpoint.

In this context, competitive advantage is no longer defined by the sheer number of features a digital channel can offer. What increasingly matters is the ability to recompose customer journeys quickly, adapting flows, rules and touchpoints as customer expectations, regulations or market conditions change.

Banks that can assemble and reassemble journeys using modular capabilities gain a structural edge. They can launch faster, test more freely and respond to change without rebuilding their digital front each time.

To illustrate the shift from siloed channels to a unified experience layer, consider some key differences between the traditional approach and the modern approach:

| Friction in siloed channels | Solution in a continuous engagement platform |

| Repeated logins and data entry for each channel. | Unified identity management (single sign-on) and one-time data capture, reused across all channels. |

| Inconsistent onboarding and service workflows per channel. | Seamless, orchestrated journeys that carry over context and progress as customers switch channels. |

| Duplicated product rules and compliance checks in each system. | Centralized business logic and compliance rules applied uniformly, ensuring a consistent experience everywhere. |

| Channel-specific features developed in isolation. | Modular, API-accessible components (e.g. payments, KYC, notifications) that are shared across mobile, web, branch and beyond. |

Why banks struggle to modernize at scale

If the benefits of a unified, intelligent digital front are so evident, why aren’t all banks doing it already? The reality is that many banks understand the vision, but struggle with execution. The barriers are often structural and cultural, rather than purely technical.

Here are a few of the entrenched challenges holding institutions back:

- Fragmented ownership and silos. Traditionally, different teams or departments own different pieces of the customer experience. The mobile app might be owned by the digital banking team, the website by another, in-branch systems by operations, and so on. The result is a patchwork of solutions that don’t play well together.

- Technology complexity and legacy core tie-ins. In many banks, front-end channels are tightly coupled to legacy core banking systems or old workflows. Making even a small change in the customer interface might require weeks of backend coding and testing because the digital layer isn’t decoupled. Long development cycles discourage experimentation, it’s safer to make minor tweaks to each channel than to attempt a risky overhaul that touches the core.

- Siloed data and decisioning. Customer data often resides in dozens of databases across product lines and channels. One system holds the mortgage info, another has credit cards, another has online banking profiles. This fragmentation means no single source of truth for customer identity or preferences. Likewise, business rules (for credit decisions, offers, fraud flags, etc.) get duplicated and diverge across systems.

- (Often missing) Measurement: banks can’t consistently quantify where friction leaks conversion and cost.

Overcoming these hurdles requires not just new technology, but new ways of working. Banks often need to redesign their operating model to support an integrated digital front. That might mean creating cross-disciplinary teams focused on end-to-end customer journeys rather than individual channels. It certainly means investing in a modern technology architecture that decouples the customer experience layer from legacy systems.

Crucially, it also means a culture shift: embracing agile methods, rapid experimentation and a mindset that puts the customer’s seamless experience above internal silos or traditional product boundaries.

Orchestrating the future: How SBS can help

“AI will not differentiate banks — orchestration will.”

Josselin Joncheray, Head of Sales MEA at SBS

AI will help, but AI alone won’t differentiate banks if the journey underneath remains fragmented. Differentiation comes from orchestration: the ability to carry context across channels, apply consistent rules, introduce “smart friction” only when risk changes, and continuously improve based on real behavior. Successfully modernizing the digital front requires more than point solutions. It requires a platform approach, plus a partner that understands both banking complexity and execution at scale.

Winning banks will adopt a platform model that decouples innovation from the core and orchestrates customer journeys across channels in real time. The SBS Banking Platform is designed to support this shift through a composable, API-first architecture that accelerates time-to-market while reducing long-term complexity and cost.

On top of this, the SBP Digital Banking Suite provides ready-made orchestration for frictionless, intelligent customer journeys. Identity, onboarding, payments, consent and servicing are unified across channels, enabling banks to deliver consistent, personalized experiences without rebuilding core capabilities. Crucially, SBS embeds compliance and security into the platform itself. AI-driven experiences are governed by strict guardrails, ensuring regulatory confidence across markets while allowing banks to focus on growth and differentiation. Modernizing the digital front is no longer optional. It is where banks will compete and where long-term value will be won or lost.

The next five years will reward banks that master orchestration, intelligence and frictionless design. The question is not whether this shift will happen, but who will lead it. Contact SBS today to discover how we can help you deliver the frictionless, intelligent journeys your customers expect, with the compliance certainty you require. It’s time to win on the digital front.

Questions & Answers

Why is the digital front so critical to bank performance? + –

Because it shapes customer experience, loyalty and acquisition at every stage of the relationship. Poor digital experiences directly translate into abandoned journeys and lost revenue.

What does “continuous experience” mean in banking? + –

It means customers can move seamlessly across channels without restarting or losing context. Each interaction builds on the last, regardless of touchpoint.

Why do many digital transformation initiatives stall? + –

Most fail due to fragmented ownership, legacy system constraints and siloed data. Without orchestration, improvements remain incremental.

How does a composable architecture help banks move faster? + –

By decoupling digital innovation from the core, banks can update journeys, integrate partners and launch services without large-scale system changes.

What role does SBS play in digital front modernization? + –

SBS provides a platform and digital suite that enable banks to orchestrate seamless, compliant and scalable customer journeys across channels and ecosystems.