Across Europe, regulation is reshaping the payments industry. From DORA’s operational resilience requirements to the proposed PSD3/PSR framework, policymakers are accelerating efforts to create a competitive, sovereign and consumer-focused financial ecosystem. A key milestone in this transformation is the EU Instant Payments Regulation (IPR), which amends the SEPA Regulation and entered into force on 8 April 2024.

The IPR mandates that all Payment Service Providers (PSPs) – including banks, Payment Institutions (PIs) and E‑money Institutions (EMIs) – offer instant euro credit transfers that settle within roughly 10 seconds, 24/7/365, at no higher cost than regular SEPA transfers. Core obligations include ensuring availability across all customer channels, applying equal pricing between instant and non-instant transfers, implementing Verification of Payee (VoP) to prevent misdirected payments, and performing sanctions screening at least daily or immediately after any amendments to targeted lists.

While much of the conversation around the IPR focuses on these technical and operational requirements, an equally important but often overlooked dimension is the new uniform annual regulatory reporting obligation. By mandating transparent, comparable and actionable data from every PSP in the SEPA area, the IPR aims to turn instant payments into not just a technical standard, but also a measurable benchmark for accessibility, adoption and fairness.

A uniform reporting obligation for all PSPs

From April 2026, all PSPs must submit standardized annual reports to their national competent authorities (NCAs), detailing both the uptake of instant payments and key compliance metrics. The first report is due on 9 April 2026 and will cover the retrospective period from 26 October 2022 to 31 December 2022. After that, reports will cover each full calendar year (e.g., the second report will cover all of 2023, the third all of 2024, etc.) and will be due annually on the same date. Originally, PSPs were expected to report by 9 April 2025, with NCAs forwarding data to the EBA and European Commission by October 2025, but the deadline was extended by 12 months to allow more time for industry alignment.

The legal basis for this reporting obligation is Article 15(3) of the SEPA Regulation, which requires PSPs to report annually on the levels of charges for credit transfers (both instant and non-instant), payment account charges, and the share of rejected transactions due to EU sanctions or targeted financial restrictive measures (TFRMs). To ensure consistency and comparability, the European Banking Authority (EBA) has defined detailed implementing technical standards (ITS), specifying templates, methodology, an XBRL taxonomy and validation rules.

The scope is exhaustive. PSPs must provide data on the number and value of credit transfers, distinguishing between SEPA Instant and classic SEPA, and report on fees applied at both national and EU levels. Reports must also cover rejected instant transfers, with particular attention to those blocked due to sanctions or other compliance checks. Further breakdowns are required by user type (retail vs. corporate), payment initiation channels, payer versus payee perspective and account maintenance versus overall charges, including free versus paid items. This structure ensures that NCAs and the EBA can monitor compliance, compare data across jurisdictions and enforce uniform standards throughout the EU.

Why the format matters

The European Banking Authority (EBA) has set strict templates and a taxonomy for this reporting, requiring all submissions to follow an XBRL-csv format with precise validation rules to ensure data comparability and integrity. There is no deviation permitted: NCAs must adhere entirely to EBA-imposed templates, enabling EU-wide aggregation and oversight.

This standardization is designed to close loopholes. By forcing PSPs to use the same structure, the EBA can compare data across countries, detect breaches such as hidden surcharges or lack of universal access, and enforce sanctions screening obligations uniformly.

Governance, oversight and enforcement

Once submitted, the data will be used by NCAs and the European Commission to monitor compliance with instant payment obligations, detect potential breaches and take enforcement action where necessary. These measures are embedded in the revised SEPA Regulation as amended by the IPR ([EU] 2024/886, Article 15(5)) and apply according to the same phased timeline as the technical compliance rules.

A delayed start and a difficult road ahead

The aforementioned postponement of the first harmonized reporting deadline highlights the scale of the challenge ahead. PSPs need additional time to align on definitions, adopt common templates and implement reporting systems capable of delivering accurate, comparable data. Without this adjustment, inconsistent national approaches and uneven industry readiness would have posed significant risks to the quality and usability of the information collected.

Many PSPs still operate legacy, batch-based infrastructure not designed for 24/7/365 processing, real-time service level agreements (SLAs) or daily sanctions list updates. Integrating these requirements into back-end systems is resource-intensive, both financially and operationally.

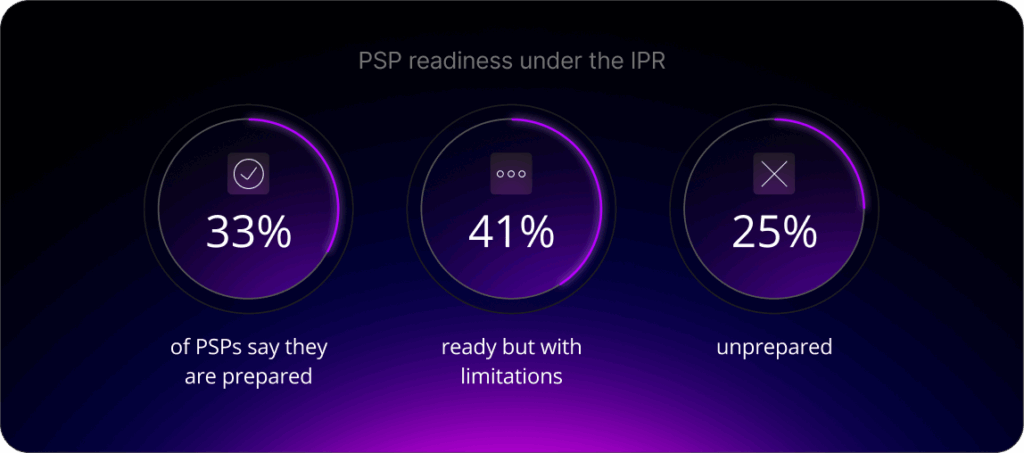

Industry surveys underline the readiness gap. Only 33% of PSPs say they are prepared to meet the EU’s instant payment deadlines. A further 41% say they are “ready but with limitations,” and 25% admit to being entirely unprepared. The top concerns include the complexity of sanctions screening, AML and fraud detection requirements, VoP checks, and meeting the mandated 10-second SLA for all instant transfers.

Key challenges and opportunities under the IPR

The new IPR requirements represent more than a compliance hurdle, they signal a fundamental shift in how transparency, accountability and fairness are enforced across the European payments ecosystem. While meeting these obligations is demanding, it also opens the door to significant operational and strategic benefits.

Challenges

- Data complexity and volume. PSPs must aggregate information across multiple dimensions, including transfer types, customer segments, payment channels and cross-border transactions.

- Template adoption and validation. Implementing the EBA’s XBRL taxonomy and ensuring consistent, high-quality submissions requires technical expertise and careful workflow design.

- Resource strain. Smaller PSPs may struggle with the costs of system upgrades, and overlapping obligations, such as ECB or CESOP reporting, can lead to duplication and operational pressure.

Opportunities

- Operational modernization. Upgrading systems for reporting drives broader digital transformation, enhancing scalability, flexibility and operational resilience.

- Competitive advantage. Institutions that deliver seamless, transparent instant payments and demonstrate regulatory compliance can gain trust and strengthen their market position.

- Data insights. Granular reporting enables deeper analysis of pricing, account usage and adoption trends, supporting smarter business decisions and strategy.

By understanding these challenges and capitalizing on the opportunities, PSPs can transform the IPR requirement from a regulatory obligation into a driver of efficiency, risk mitigation and growth. Those who navigate this landscape successfully will not only comply but also strengthen their long-term operational agility and competitive position.

A clear direction for European payments

The IPR is a significant marker set down by the EU that is indicative of where European payments are heading: towards transparency, uniform oversight and measurable performance. For PSPs and banks, the challenge now is not only to meet the letter of the law, but to consider how this unprecedented visibility will reshape customer expectations, competitive dynamics and even the economics of payments.

In a wider sense, the IPR signals a transformation in the payments ecosystem’s governance. It demands a recalibration of trust between providers, regulators and end users, making accountability and data integrity foundational pillars.

But it also has a major impact on individual organizations. PSPs, who must now evolve their organizational cultures and systems to operate under constant scrutiny, where every transaction can be measured and assessed. The ripple effects will be felt in how services are designed, how risks are managed and, ultimately, how the European payments market maintains its credibility and stability in an increasingly interconnected world.

If you’re looking for an experienced and industry-recognized partner to help guide you through the challenges of regulatory and reporting compliance, get in touch with a member of our team today. We can provide tailored advice and solutions to help you navigate evolving requirements smoothly and ensure your reporting processes are robust, accurate and future-proof.