Given the current economic climate, easy and quick access to credit is as necessary now as it’s ever been. However, millions of individuals and small businesses still fall victim to financial exclusion and are unable to receive the lending solutions they need. Open banking, its next iteration open finance, and emerging technologies like artificial intelligence (AI) are poised to transform this landscape, offering more inclusive, accurate and secure lending solutions.

These advances also allow banks to enhance their risk assessment processes, reducing the percentage of non-performing loans by providing a clearer picture of a client’s real financial situation. For lenders, this is an opportunity to not only reach out to a new pool of creditworthy borrowers, but also to help bridge the gap and create fairer financial opportunities for all.

Financial exclusion in the EU and UK

Despite efforts to tackle problems around financial exclusion, there remains a significant number of individuals underserved by traditional financial services systems. In the UK, for instance, over 5 million people are classified as “credit invisible” – many of whom are young adults without sufficient credit history to access traditional financial services. And in Europe, 24.5% of young Europeans aged 15-29 are at risk of poverty or social exclusion.

These financially excluded individuals are often those who fall outside of traditional credit systems. For instance:

- Young people who haven’t yet had the opportunity to build credit history

- Immigrants who are new to a country and struggling with not having local credit scores

- People who live far from brick-and-mortar banks and don’t use online or mobile banking

- Self-employed people without a regular, consistent or steady source of income

SMEs, vital to economic growth, also frequently struggle to access loans. Unlike large corporations, they often lack consistent financial records, making it difficult to secure credit through traditional methods. Indeed, almost half of European SMEs consider bank loans to be inaccessible.

Why lenders are overlooking potential borrowers

So why is it that lenders are failing such a large number of potential borrowers, whether they be individuals or SMEs?

In part, it’s down to traditional credit scoring methods that fail to account for non-traditional financial behaviors, leading to inaccurate risk assessments. These methods rely heavily on historical financial data, which may not fully reflect the borrower’s current financial health. Moreover, the way this data is shared – often through insecure means such as PDFs or pay stubs – opens the door to fraud and doesn’t account for a customer’s real expenses.

This challenge highlights the need for a new approach to credit risk assessment – one that embraces emerging technologies like open banking. Open banking not only leverages more inclusive data sources but also ensures that the data is shared securely, through transparent APIs that protect customer information from being exposed to unauthorized parties.

Open finance and FIDA: The next iteration of open banking in Europe

Open banking is helping to bridge these gaps by providing more accurate, real-time financial data to lenders, enabling better access to credit for both individuals and SMEs. Open banking has been at the forefront of the banking sector since 2018, following the introduction of the Open Banking Implementation Entity (OBIE) in the UK and the Revised Payment Services Directive (PSD2) in Europe. These frameworks require banks to securely share financial data with third-party providers, with customer consent, via APIs, fostering greater transparency and innovation.

With the transition to PSD3 and PSR regulations – a new set of EU rules that builds on PSD2 – there is a growing emphasis on further enhancing security, transparency and the integration of open banking with broader financial ecosystems, while also addressing key obstacles to a seamless user experience (UX) and customer journey.

Furthermore, the Financial Data Access (FIDA) framework, introduced in 2023, supports the expansion of open finance, moving beyond just bank accounts to include data from savings, investments, pensions and insurance. This broadened scope allows lenders to access a wider range of financial behaviors, improving the accuracy and fairness of credit assessments and decision-making, even if the framework is still under discussion by the EU lawmakers.

Together, these regulatory changes enable open banking connectivity, empowering banks to enhance their credit insights, offer more inclusive financial products, and provide a more accurate assessment of creditworthiness for individuals and SMEs.

AI and data-driven lending

At the heart of open banking and open finance is a vast ocean of customer data. This data allows lending institutions to ensure that borrowers’ creditworthiness is assessed using the most up-to-date analysis possible. However, analyzing this data is no easy feat. It requires advanced machine learning (ML) and AI technology.

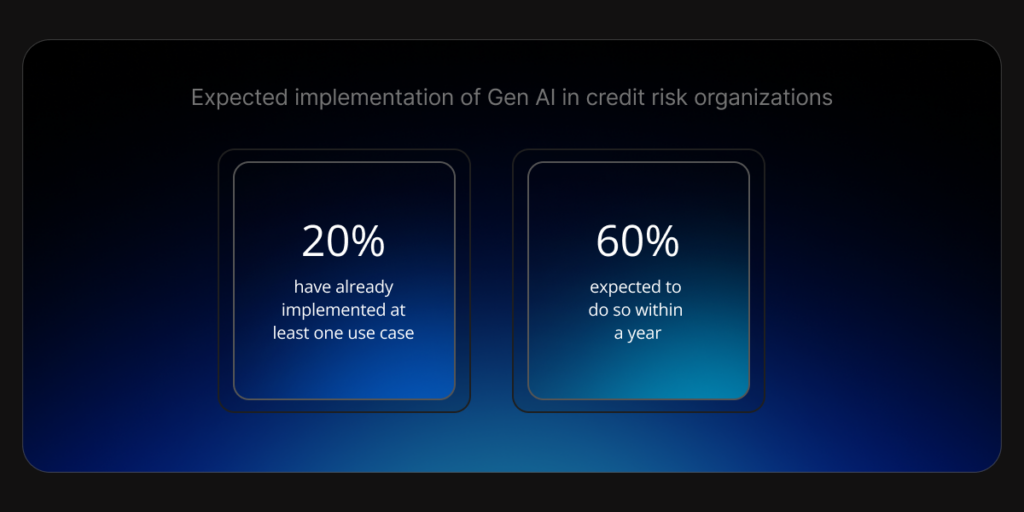

Per research conducted by McKinsey, many financial institutions are already leveraging this technology. In 2023, at the time when the study was conducted, 20% of senior credit risk executives had already implemented at least one gen AI use case in their organizations, and a further 60% expected to do so within a year. Legacy financial institutions and new industry entrants are successfully leveraging AI technology for risk assessment and credit scoring.

Barclays, for instance, has integrated AI-driven solutions to assess the creditworthiness of small businesses and individuals. By analyzing a broader range of customer data, including real-time financial data, rather than relying solely on traditional credit scores, Barclays offers more personalized credit products to underserved SMEs and individuals with limited credit histories.

Revolut uses AI to offer personalized lending products to its customers, developing dynamic credit scoring models that take into account real-time data such as transaction history and spending patterns. This enables more inclusive credit assessments for users with limited or no traditional credit history.

Technologies such as AI and ML enable institutions to make faster, more accurate decisions, reducing reliance on outdated models and expanding access to credit for a broader range of individuals and businesses. With technology and open banking working in tandem, the financial sector is poised to redefine how credit is assessed, ensuring that lending is based on a deeper understanding of each borrower’s true financial situation.

How SBS can help

To navigate this increasingly complex and challenging environment, it’s essential for financial institutions to work with experienced partners who can help them leverage the latest technologies while also remaining compliant and secure. The SBP Open Banking Platform ensures compliance with the latest industry standards and regulations, with best-in-class security measures so you can have peace of mind knowing your customers’ data is handled with the utmost care.

Thanks to our strong integration capabilities, you can now unleash the power of open finance by making it easier to innovate and connect to the ecosystem. Maximize lending efficiency and offer seamless onboarding, faster fund disbursement, account checks, income verification and robust credit assessments. With our help, you can offer a faster, more accurate way of assessing a customer’s creditworthiness, leading to more efficient, user-friendly, data-driven decisions for delightful customer experiences with minimal defaults.

Contact a member of our team today and learn how we can help you provide your customers with affordable, fair and tailored lending solutions.