The banking sector has gone through an irrevocable shift in recent years. Advances in technology and increased competition have created a landscape where banking customers not only expect, but demand, a completely different digital and service experience.

To meet this demand, banks need a core banking system capable of leveraging technologies that are constantly growing in scope and power, integrating with a larger ecosystem of companies from outside the banking sector, all the while remaining secure and compliant. Those that can adapt stand to make great gains in both brand value, NPS ratings and market share. And those that can’t are likely to find themselves left behind.

Customer-centric banking in 2025

Customer experience (CX) matters just as much as a company’s products and services for 90% of consumers, per Salesforce research. And banking customers are no different. Their expectations are shaped not only by other financial institutions but also leading players in other industries, such as e-commerce and entertainment, and other digital services. As such, they now expect the same level of convenience, speed and personalization from their banks.

Below are some of the top drivers of customer-centric banking in 2025.

Hyper-personalization

For years now, customers have expected more than off-the-shelf financial products. A 2024 survey by Q2 Holdings found that 74% of consumers across all generations seek more personalized experiences from their banks. Banks, however, have been slow to catch up.

With access to real-time data, banks now have the potential to deliver hyper-personalized CX – and consumers are open to it. 66% are comfortable with their financial institution using their data to personalize their experiences.

Multi-platform experience

Banking customers increasingly expect convenience, not just within their bank’s ecosystem but across the digital services they use daily. To meet this need, financial services must integrate effortlessly with non-banking platforms, such as e-commerce sites and personal finance management tools.

Instant customer engagement and support

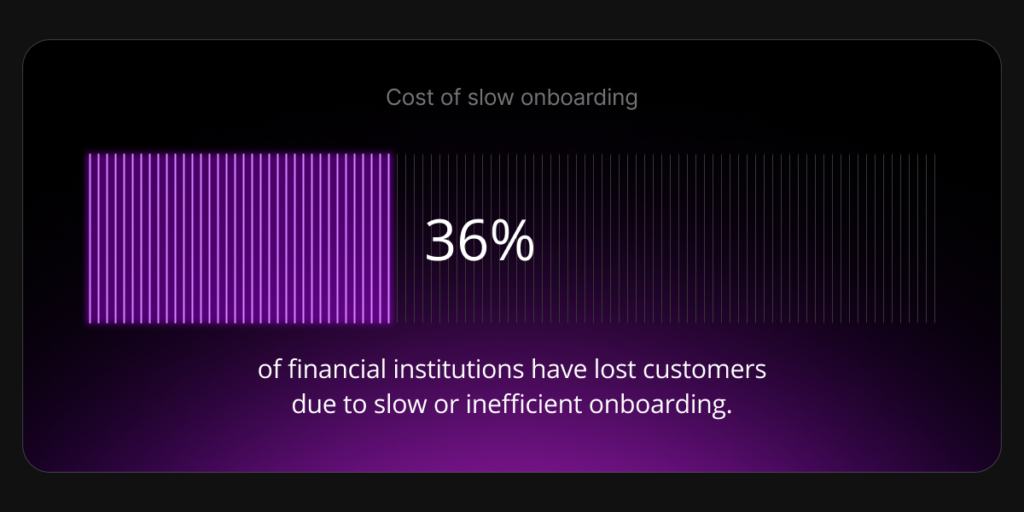

Customer engagement and support also needs to be instantaneous, with 64% of consumers wanting real-time interaction. This applies not just to AI-powered chatbots and customer support, but also accessing banking services seamlessly – whether that’s opening an account, transferring funds or getting a loan approved instantaneously at the point when the customer most needs it. In fact, 36% of financial institutions have lost customers because of inefficient or slow onboarding.

Trust

Thanks in part to its rigorous security standards, banking enjoys a good level of trust among customers compared to other sectors. This trust is fundamental to long-term customer loyalty and a strong CX. Any lapse in security – a customer data breach, for instance – could cause a bank irreparable reputational damage that could take years to recover from.

The next-generation of core banking

For banks to be able to provide these products and services and meet their customers’ needs, they need a robust technological infrastructure. One that can support powerful algorithms and data models, as well as an open ecosystem to integrate with third-party applications.

Problematically, many banks still rely on legacy core banking systems – back-end software which is often decades-old, on-premise and mainframe-based. The nature of these systems means it’s difficult to interface with partners and their platforms, ultimately restricting banks from offering state-of-the-art digital products. As many as 95% of senior banking executives believe “outdated legacy systems and core banking modules inhibit efforts to optimize data and customer-centric growth strategies.

Worse still, outdated systems have been at the heart of major service failures and outages in recent years, leading to customer frustration and reputational damage. The alternative to these legacy systems is a modern, next-generation infrastructure. Below are some of the key characteristics that make up such a system, as well as capabilities they can bring to helping a bank enhance its CX.

Cloud-native scalability

A cloud-based architecture is crucial for banks wishing to scale operations and deploy products & services at speed. The flexibility of cloud computing allows banks to expand their operations without being limited by the physical infrastructure of traditional on-premise solutions.

API-first architecture

With open APIs, banks can leverage services from third-party providers. This approach to ecosystem banking enables banks to quickly integrate services into their own systems to offer higher quality, more personalized and richer products.

AI-driven automation

From hyper-personalization to highly sophisticated fraud detection, AI technology doesn’t just empower banks to meet the needs of their customers – it also allows them to anticipate their needs, helping banks integrate user experience into their long-term strategy.

Real-time processing

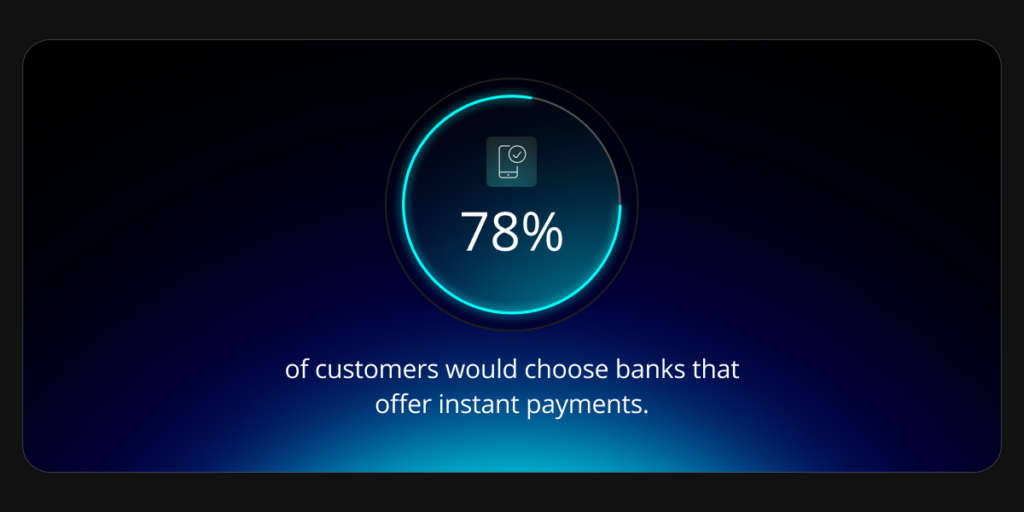

Per a 2024 report on consumer banking, 78% of customers would choose banks that offer instant payments. Instant transactions, payments and customer service are all expected by today’s banking customer, making real-time functioning of back-end processes crucial.

Efficient product catalog

Rapid rollout of new products and services is essential for today’s modern bank. Beyond simply speeding up development cycles, it’s about making financial products available to customers exactly when they need them. Whether it’s offering a loan at the point of sale or enabling instant account openings, banks equipped with next-gen core banking technology can quickly build, price and deploy products – sometimes in as little as a single day.

Modular and composable design

Instead of being stuck with a monolithic system, a modular and composable design allows banks to integrate systems based on what they need and when, meaning they’re better prepared to meet the changing nature of today’s banking customer and regulations, while optimizing their investments.

Security and compliance by design

79% of financial institutions cite cyberattack vulnerability as a primary concern affecting their transformation plans. And the majority of European banks are concerned that regulations will necessitate modifications or upgrades to their infrastructure. The latest security and regulatory measures are built into a modern core banking system so, with ongoing management and monitoring, customer data is always protected.

How SBS can help

Transitioning from legacy core banking systems to a modern cloud-native, API-first approach is essential for achieving best-in-class CX. But it’s far from straightforward. In fact, only 30% of core banking transformations are successfully carried out. The process can be costly and time-consuming, while also presenting problems around operational risk, data inconsistency and service downtime.

It’s vitally important for banks considering such a transition to choose the right partner to help them.

SBS combines a far-reaching knowledge of European banking with a completely rewritten next-generation core banking platform that leverages the latest technology in core banking. Trusted by over 300 customers, our core banking offer is scalable, secure, fully cloud native and highly intuitive for ease of use by back-office users. And because of our team of experts, composable architecture and model bank (business processes) transitioning to a modern core banking system geared for the digital age has never been easier, allowing progressive transformation without affecting your daily operations.

Best of all, our core banking solution, SBP Digital Core, is capable of leveraging the latest in data and AI use cases, providing our customers with a future-proof roster of banking products that can be created in as little as one day. This means that you’ll be ready to meet your customers’ digital banking expectations in the short-, medium and long term.

Find out more. Request a demo today and see how SBS can help you to upgrade your core banking and offer a smooth experience to your back-office users and end-customers