Digitize your portfolio management

SBS Portfolio Management is a credit risk solution that supports organizations to streamline customer onboarding for lenders. It enhances portfolio management by digitizing processes for new customer acquisition, portfolio expansion, and real-time risk management.

Boost your productivity: minimize latency, maximize results

SBS Portfolio Management, built on Salesforce, enables swift customer onboarding, sleek integration for new dealers in your network and service delivery. This helps organizations to enhance overall customer satisfaction through a clean user journey, whilst maintaining the accuracy of credit decisioning.

Product implementations

A diverse customer and asset base gives us the experience to deal with almost any business case in wholesale finance.

Billion AUM with clients

We’re a trusted partner, with highly reliable systems keeping our customers in business.

Industry leading clients

From cars to boats to cranes, our software enables almost any asset to be financed.

Countries SBS is live in

We specialize in delivering multi-territory solutions, adhering to currency, tax, and legal requirements.

Benefits

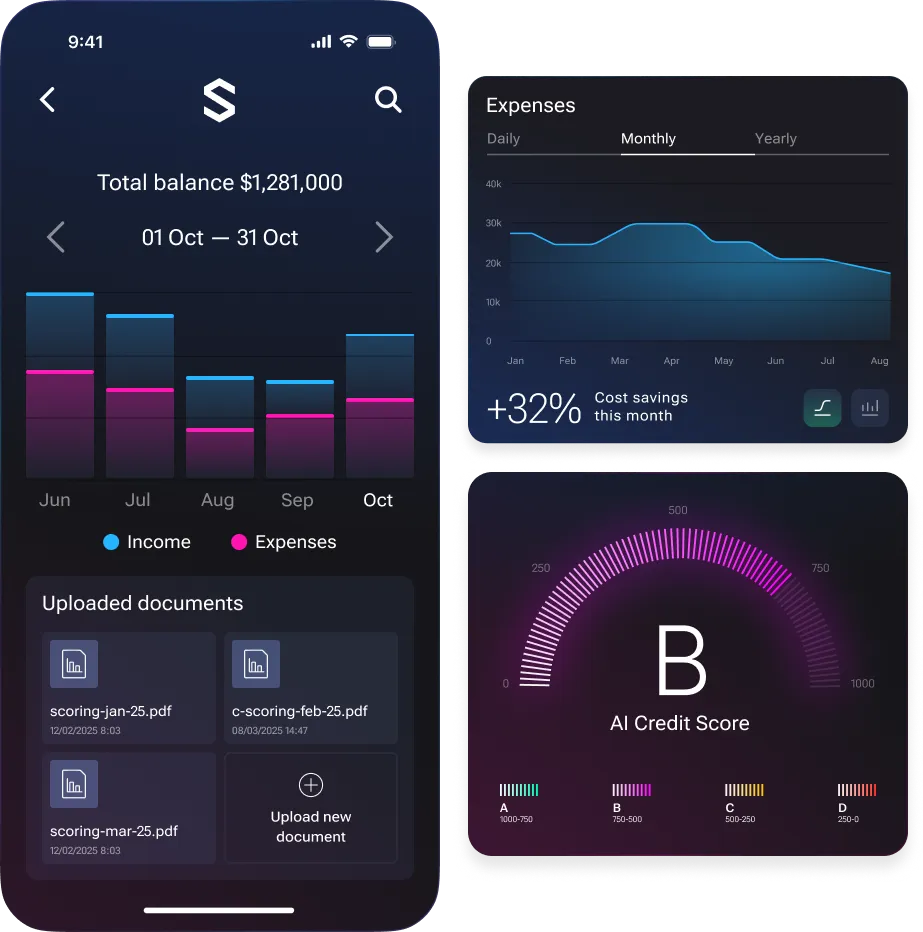

Unlock a 360° view of your customer’s experience

Replace manual controls and accelerate time to funding

Spend less time evaluating data by streamlining the analysis of financial statements, bank records, and tax returns. Portfolio management software replaces manual controls and processes, empowering you to make precise and customized value-added credit decisions efficiently.

Efficient processes

Spend less time analyzing financial and bank statements and tax returns.

Paperless operations

All documents related to the dealer account are stored digitally.

Reduce risk exposure

Reduction of risk related to downtime or service interruption for maintenance.

Liability awareness

Elevated risk awareness from integrated and digitized risk indicator feeds.

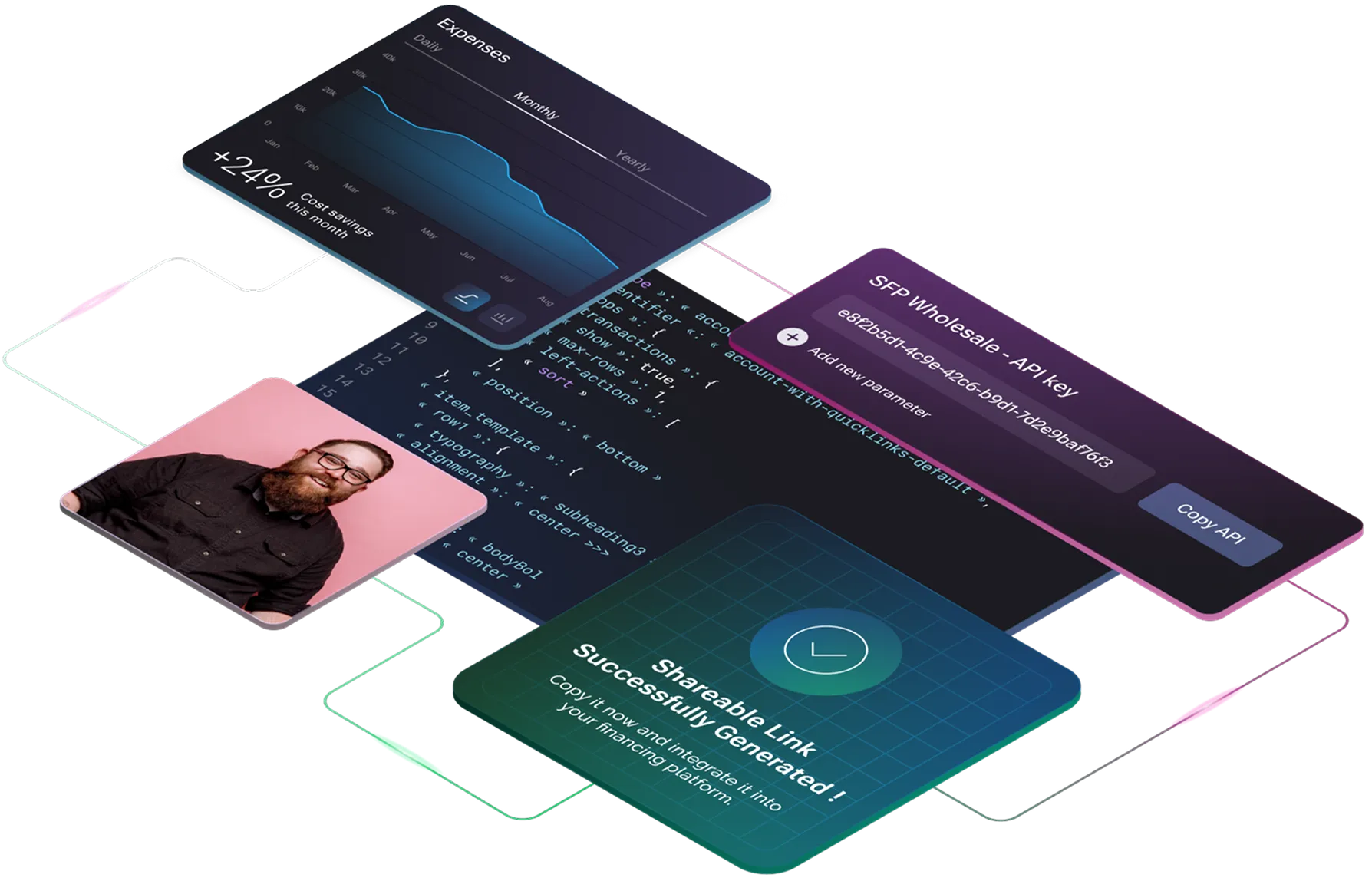

Optimize financial decision-making with strategic integrations

Benefit from a range of strategic integrations available through a reliable partner ecosystem, ensuring turnkey solutions can be rapidly delivered

Open banking

Onboarding portal

Smart credit decisioning

Integration

Accelerate your credit decisioning

Integrations with multiple open banking vendors facilitates speedy credit decisioning with the added benefit of an ongoing risk assessment.

Fast & effortless client onboarding

Advance operations with a high-quality, customizable web interface that enables customers to submit data and perform onboarding tasks with ease.

First class data analytics tools

Feed open banking and even PDF-based financial data in to smart analysis tool that enabling faster, more accurate decisions.

Straightforward system connectivity

Push new customers live with just one click. Then use portfolio, payment and other data to actively monitor risk of assets.

Technology

Plug and play from front to back-end

The next-gen solution for all your asset finance needs

Explore